KEY CONCEPTS

•

Industrywide consensus on what factors constitute sustainable metalworking fluids remains a work in progress.

•

Various factors that contribute to metalworking fluid sustainability can work at odds with each other.

•

The diversity of metalworking operational requirements and priorities requires metalworking fluid formulators and manufacturers to offer large product portfolios and customization services.

“Everybody wants sustainability,” says STLE member Jennifer Lunn, product manager with Fuchs Lubricants. “But the actual people using metalworking fluids (MWFs) won’t change unless there’s some sort of regulation. So it’s nice to have, but if it’s not cheaper, if it doesn’t work as well or better—or if they don’t have another reason to change, then it’s not enough just to say it’s sustainable.”

Sustainability means different things to different people, says STLE member Andy Dudelston, product application manager for Quaker Houghton. For some, it might mean a completely biobased fluid. For others, it might be a recyclable fluid or a fluid with a longer service life. He sees the MWF industry trending toward biobased fluids, but not very rapidly. He also notes that the adoption rate for biobased fluids differs by region: North America, Europe, Asia and other parts of the world.

Chemical management—waste minimization and MWF performance optimization—as a money-saving strategy has been in use for decades, he continues. These can be considered sustainability measures because they reduce the amounts of materials used. Dudelston notes that at present, however, there is not an industry-wide consensus on what “sustainability” entails. The matrix of interconnected factors is not simple, he says.

Complicating things still further are factors like worker health, transportation of feedstocks to the factory and products from the factory to the customer and CO

2 offsets. Here, we look at several of the interacting factors that contribute to sustainability efforts in the field of MWFs.

Pros, cons and tradeoffs

“The metalworking industry is one of those industries that people never think about—it’s just there. It’s behind the scenes, but it’s so important,” Dudelston says. An ordinary kitchen has metal light fixtures, metal cabinet hardware, housings and mechanical parts for all the appliances, a stainless-steel sink and not to mention the nuts and bolts that hold everything together. MWFs lubricated and cooled the machines in the metal shops where each of these parts was made. For high-stakes applications in industries like aircraft manufacturing, he adds, metal part specifications are especially critical, and the MWFs for these applications must not contribute to corrosion or metal fatigue (e.g., from cutting threads on a bolt).

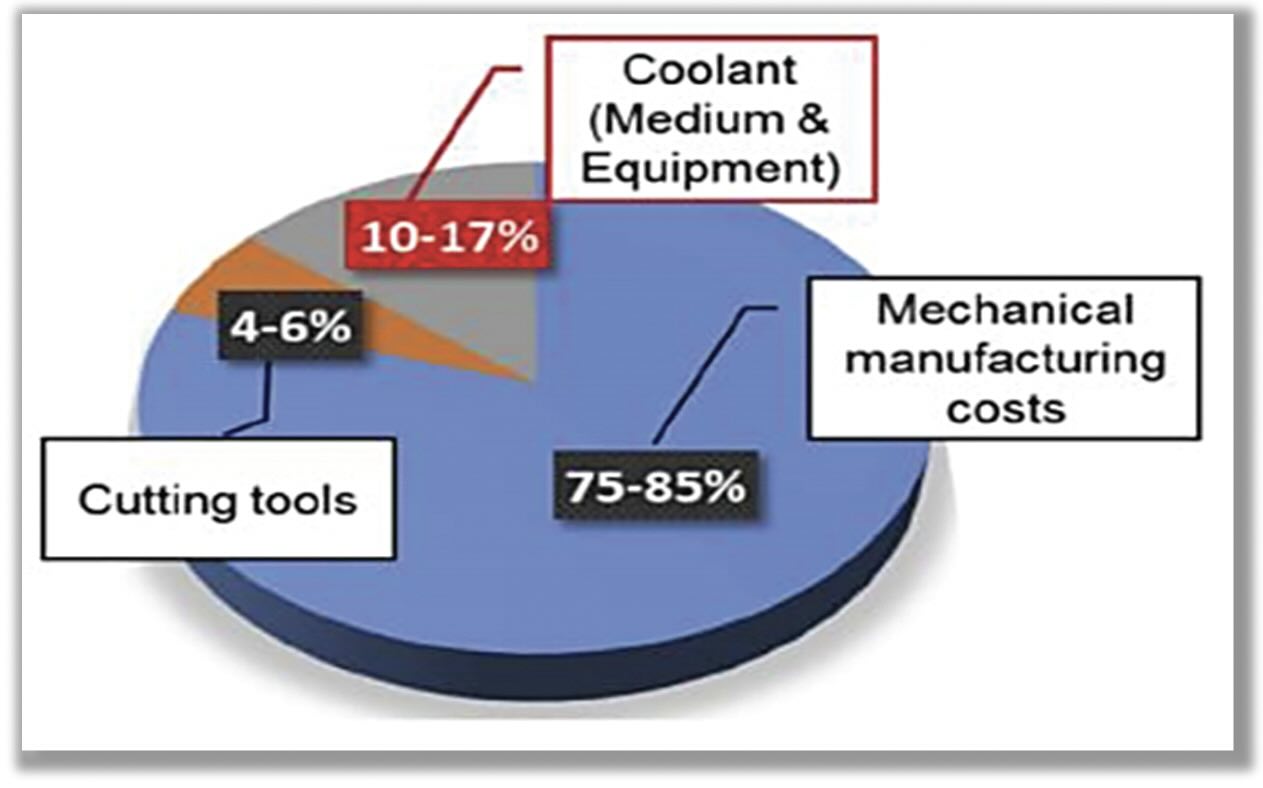

One estimate states that MWF usage accounts for 15%-20% of the overall costs of machining processes and 10%-17% of total manufacturing costs

1 (see Figure 1). Another study found that even though MWFs represent less than 5% of total plant expenditures, they can affect more than 40% of the plant’s operational budget (presumably by affecting tool life, quality of the manufactured parts, worker health and safety, disposal costs and downtime).

2

Figure 1. One estimate of the cost breakdown for metal manufacturing operations. Figure courtesy of Ref. 1, Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Figure 1. One estimate of the cost breakdown for metal manufacturing operations. Figure courtesy of Ref. 1, Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Sustainable manufacturing processes encompass a range of factors, some of which are at odds with each other (e.g., reducing fluid usage versus prolonging tool life). Agricultural land devoted to sustainable feedstocks like plant-based oils can reduce the amount of land available for food crops, and transportation costs for base oil and additive feedstocks can increase the environmental and monetary costs of the resulting MWF formulation.

1,2

A move away from petroleum products has focused attention on biobased MWFs, which typically use base oils from vegetable sources. These MWFs offer a number of advantages. Newer formulations perform as well as (or in some cases, better than) mineral oil-based fluids, and they do not contain many of the toxic additives and petroleum compounds that endanger worker safety and the environment. Also, petroleum-derived base oils are a major cause of moisture and oil smoke generated during machining. In contrast, vegetable oils break down into environmentally benign substances, and they present less of a toxicity or irritant hazard to workers. The additives used in vegetable-based MWFs also produce fewer harmful environmental impacts than those used with mineral oils.

1

Vegetable oils have a high natural viscosity, and they maintain this viscosity better over a wider temperature range than conventional MWF base oils. The polar nature of biobased oils attracts them to metal surfaces and helps them form corrosion-protective, lubricating coatings on metal surfaces that resist being wiped off. Moreover, the flash points for biobased MWFs run about 200 degrees higher than those for conventional fluids, which increases safety in enclosed workspaces or operations near open flames.

2

However, biobased oils tend to oxidize more easily than mineral oils, which can accelerate tool wear. Maintaining oxidative stability is important for preserving additive solubility and compatibility, as well as overall fluid performance. This can be less of a problem in MWF applications because the MWF is carried away on metal chips or cleaned off of the part in preparation for painting, staying on a machined part for a much shorter time than is typical for gear oils and hydraulic oils. On the other hand, MWF sumps are more likely to be open to the ambient environment than bearings, gears or hydraulic systems, which are generally enclosed.

2

Biobased oils can perform less effectively in humid or warm environments than mineral oils because the oxygen-containing ester or fatty acid components in biobased oils are more prone to hydrolysis. Genetically modified plants may provide more oxidatively stable oils, and additives and chemical modification can also provide stability. Esters and fatty acids are also ideal nutrients for microbes. Ideally, microbial degradation occurs in the environment after the oil has been disposed of, but biocides are needed to prevent premature degradation while the oil is still in use.

2

Vegetable-based MWF products have been on the market for at least 20 years, Dudelston says. However, he adds, the customer uptake for these products hasn’t been as good as the sustainability advocates hoped for. There are renewable alternatives that are not vegetable-based, he says, but the formulas and feedstocks are largely proprietary. Again, customer demand drives the need for appropriate base stocks.

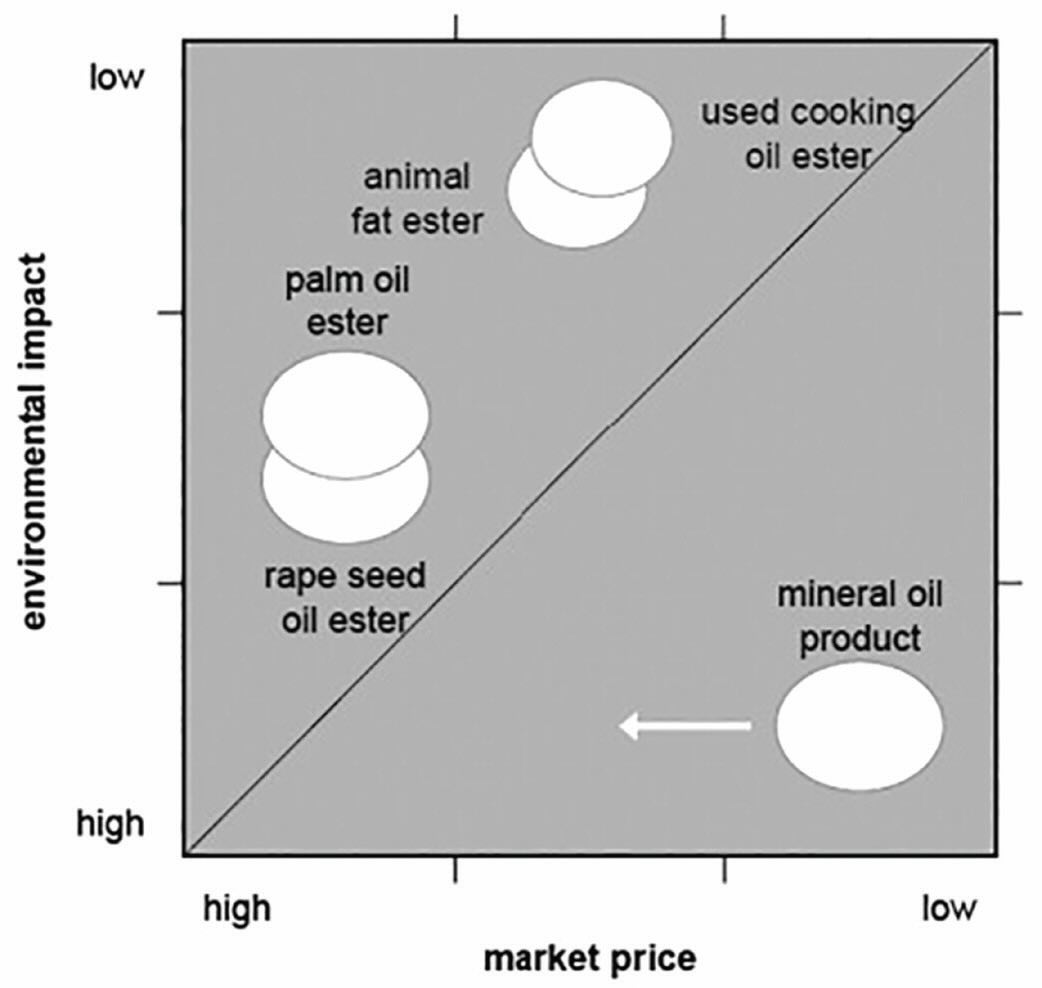

Manufacturers’ warranties are an obstacle to more widespread adoption of biobased MWFs. The U.S. Department of Agriculture (USDA) has been working with OEMs to encourage the incorporation of biobased products in their maintenance warranties, so this is becoming less of an issue. Price can be another obstacle, depending on the relative cost of biobased MWFs compared to their mineral oil counterparts. The cost comparison varies with petroleum prices, import and transportation costs of plant feedstocks, and the relative performance of these fluids over their service lifetime

2 (see Figure 2).

Figure 2. The economic and environmental impact of vegetable oil-based MWFs compared with their mineral oil counterparts. Figure courtesy of Ref. 1, Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Figure 2. The economic and environmental impact of vegetable oil-based MWFs compared with their mineral oil counterparts. Figure courtesy of Ref. 1, Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Slow progress for formulations

Environmental and sustainability concerns added impetus to the development of vegetable-based MWFs in the early 2000s. However, the economic crash in 2008 and the economic effects of the COVID-19 pandemic in 2020 halted many experimental projects for next-generation MWFs. Supply chain disruptions and economic uncertainty caused fluid formulators and suppliers, as well as their customers, to retreat to the certainty of tried-and-true products.

3

On the other hand, supply chain disruption during the COVID-19 pandemic also drove a lot of innovation and made several new additives more competitive, Lunn says, because the usual MWF components were simply not available. Even without the pandemic-driven supply chain disruptions, availability of raw materials remains a significant obstacle to developing new chemistries and introducing them to the marketplace. Single-sourced components present a real risk to product suppliers, and critical components must be produced at a scale that the market demands. “It could be the coolest chemistry in the world,” Lunn says, “but if you can’t make it to sell at the levels that you need to sell to be successful, it’ll go nowhere.”

Vegetable oil-based MWFs can help to decrease overall cutting temperatures, cutting forces and surface roughness compared with mineral oils, as well as being more environmentally benign. However, little research has been done on their performance with nonferrous metals like copper, brass, aluminum and the newer superalloys. More research also needs to be done on the oxidative and thermal stabilities of vegetable oil formulations.

1

Interestingly, the European MWF market relies very heavily on oil-based products, unlike in the U.S., where water-dilutable products are more common, Lunn says. She notes that oil-based products generate more disposal volume per drum because, unlike water-dilutable fluids, they are used as delivered. A water-dilutable MWF concentrate might be used at only 5% of the fluid in the sump, depending on the application, so one drum of concentrate could yield as much as 20 times that amount of fluid in circulation.

As of 2021, there were no usage requirements for MWF formulations under the European Union’s (EU’s) Ecolabel or the U.S. BioPreferred programs. However, plant-based biodegradable components are attracting increasing interest for reducing the carbon footprint and increasing the overall sustainability of MWF formulas. Even in the absence of formal requirements, biodegradable MWFs must meet certain criteria in order for customers to accept them. Boundary lubricity additives, for example, must be soluble in the water or oil base fluid and compatible with the other components in the formulation. These additives must be stable at the temperatures they will encounter, and of course, they must provide sufficient lubricity for the types of metals, tool speeds and feed rates and other conditions of their intended operations.

4

The amount and expense of cleaning metal parts after they are formed also factors into the sustainability equation, Lunn says. Disposal involves used fluid in the sump that has reached the end of its service life, she explains, but it also involves drag-off, the fluid that remains on the part that must be cleaned off afterward.

A lot of work is being done on using re-refined base oils, Lunn says, adding that for the manufacturing plant operator, the biggest concerns are performance and cost. Her customers want to minimize costs, but they also want to minimize scrap parts and downtime. They want to know the condition of a re-refined base oil and how much the refining process adds to the cost of the oil before they will consider switching over.

It should be noted, however, that the use of re-refined oils for MWFs has been steadily growing for years, and that these oils must satisfy the same technical specifications as primary raw materials.

5,6 The trend away from API Group I oils toward the more highly refined Group II oils has produced more benefits than drawbacks to using re-refined base oils, says STLE member Rick Butler, MWF customer applications specialist with Advancion. He adds that these oils are more available now, their cost premium is currently very small and that re-refining and reusing mineral oils represents an opportunity to increase their sustainability.

Vegetable-derived base oils are an active area of investigation, Lunn says. Because vegetable oils are more polar than mineral oils, they provide excellent lubricity. Users can get the same results as a mineral oil product with a smaller amount of a vegetable oil, she says. Like water-dilutable fluids, MWFs using biodegradable oils can attract microbes. However, a balanced formulation will keep the formulation at conditions that are inhospitable to microbes, extending the life of the fluid. More recently, vegetable oils are available that have a higher oleic acid content. This reduces the tendency of the fluid to break down and go rancid, which also increases the in-use life of the fluid, she says.

Nonferrous metals are another area of interest, Lunn says. Automotive companies have switched from steel to aluminum where practical, in an effort to reduce weight in their vehicles. One advantage to using aluminum, from a fabrication perspective, is that aluminum doesn’t react with traditional extreme pressure (EP) additives like steel does. With steel, EP additives containing chlorine, sulfur or phosphorus react with the metal surface to produce a sacrificial film, but aluminum does not form these coatings. Thus, it is important to use vegetable-derived fatty acids or esters, which form an electrostatic attraction to the metal surface to provide a protective barrier. Steel also requires rust preventive additives, unlike aluminum, she continues. She adds that aluminum is prone to staining at the higher pH values typically seen with traditional MWFs, so it is imperative to evaluate compatibility, and it may be necessary to use metal deactivators to protect the surface.

The basic formulation structure of MWFs, including the four main types (straight oil, emulsifiable oil, semisynthetic and synthetic), has remained unchanged over the years, says STLE Fellow Neil Canter, president of Chemical Solutions. Regulatory restrictions, the introduction of some new raw materials and additives and formulators switching to specific MWF types has led to product improvements. Better fluid monitoring by end-users has also been a great contributor to MWFs operating at optimum performance levels for longer time periods, he adds.

Neat oils, which are petroleum-based, have their place in the industry, and cost is always a factor, Dudelston says. From a machining standpoint, some operations are very difficult to perform using water-based fluids, he says. “If a manufacturer can get a better part, better throughput and better tool life, with a neat oil than they can with a water-soluble oil, if it makes economic sense to do it, they’ll do it.” He adds that many sustainability efforts run into difficulties when costs begin to add up, especially during inflationary economic times. However, neat cutting oils can be made using biodegradable feedstocks. In addition to using renewable resources, these formulations reduce oil misting and fire risk.

7

Emerging alternative methods are currently under development, including minimum quantity lubrication (MQL) and MQL nanofluids, which incorporate nanosized solid particles in a liquid to improve heat transfer and tribological properties. Other methods, including dry machining and high-pressure coolants, have shown promise. Some synthetic formulations outperform both mineral- and vegetable-based oils, including in MQL operations.

1

Nanofluids perform well for decreasing interface temperatures, reducing cutting forces and power consumption and providing a good surface finish. More needs to be known about the effects of different sizes and shapes of nanoparticles, as well as optimizing their volumetric concentration and usage conditions (e.g., spray nozzle angles) and minimizing their environmental impact. Cost effectiveness continues to be an issue for biodegradable fluids, nanofluids and other alternatives to mineral oil fluids.

1

A changing regulatory environment

Chlorinated paraffins and biocides, and the lack of practical substitutes for them, come up frequently in discussions of the regulatory pressures facing MWF formulators. “There are at least 13 MWF additive categories, and some are status quo, and some are tightening,” says Canter, referring to the changing regulations for MWF additives. Under the status quo category (at least for now), he explains, are the chlorinated paraffins.

Short-chain chlorinated paraffins, where chlorine represents a bigger percentage of the molecular weight, have been banned in the U.S., Canada and the EU, and China banned them at the beginning of 2024. These compounds are persistent, bioaccumulative and toxic to aquatic organisms, and they can pose significant risks to human health and the environment.

Some efforts have been made to ban medium-chain chlorinated paraffins, but the lack of a practical substitute is a significant hurdle to implementing such a ban. Some plant operations that switched to non-chlorinated MWFs have seen their fluid usage increase by a factor of 10 to 20 because the new fluid has a significantly shorter service life.

8,9 A 2009 report from the UK’s Environment Agency stated that although long-chain and very-long-chain chlorinated paraffins persist in the environment, they are not considered to be bioaccumulative in marine life (there are no definitive overall studies or standards, however), and they are not considered toxic to aquatic organisms at concentrations as high as their water solubility limit.10

Another obstacle to replacing chlorinated paraffins with other EP additives is the added complexity of non-chlorinated formulations. “You get it all with a chlorinated paraffin,” Lunn says. The chlorine molecular head bonds with the metal surface and the paraffin tail provides the lubricity. Using other EP additives instead of chlorinated paraffins requires combinations of fats and compounds containing phosphorus and sulfur. Neither phosphorus compounds nor sulfur compounds by themselves provide protection over the same temperature band that chlorine compounds do. Thus, a combination of multiple additives is needed to provide the same performance as a chlorinated paraffin by itself, she says.

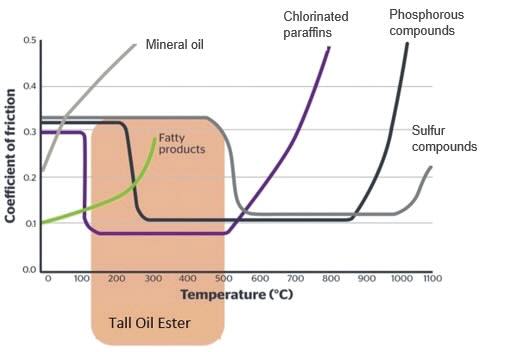

Various metalforming processes involve different temperatures, but friction always raises the temperature as the piece is being worked. Chlorine activates over a wide range of temperatures, in contrast with phosphorus, which activates at high temperatures, and the oil itself, which lubricates at lower temperatures. Sulfur-containing fatty acids function in a similar manner to chlorinated compounds, but the active range for sulfur-containing additives depends on the type of compound (active or inactive sulfur). Esters activate at a higher temperature than oils, but they are electrostatically attracted to the metal surface rather than forming the strong chemical bonds that chlorine does

(see Figure 3).

Figure 3. Various types of MWF boundary lubricity additives are effective over different temperature ranges. Tall oil esters (orange shaded region) bridge the region between fatty oils and esters (active at lower temperatures) and EP agents (active at higher temperatures).4

Figure 3. Various types of MWF boundary lubricity additives are effective over different temperature ranges. Tall oil esters (orange shaded region) bridge the region between fatty oils and esters (active at lower temperatures) and EP agents (active at higher temperatures).4

Biocides used with non-petroleum MWFs pose an interesting issue. Although moving away from petroleum products is widely accepted as a move toward more sustainable sources, the biocides needed to keep microbes away from biobased fluids are coming under increasingly stringent regulations. “What I see is biocide restriction, particularly if the U.S. Environmental Protection Agency (EPA) and the European authorities decide to restrict the use of formaldehyde-releasing biocides, which is the main type of biocide used in the MWF market,” Canter says. This restriction, he says, will prove problematic in the MWF market because there aren’t enough approved alternatives that can serve as replacements.

Vegetable-based oils used in water-dilutable MWFs have been touted as more sustainable than mineral oils, Canter says. However, vegetable oils are also more vulnerable to microbial contamination. This makes MWFs formulated with these oils more susceptible to contamination, degradation and failure, he adds.

Formaldehyde-releasing biocides are still in use because the alternatives either don’t work as well or they are more expensive. Testing and certifying new biocide compounds presents a large barrier to entry, so the move away from existing biocides is at a standstill, Lunn says. Doing away with biocides, especially for water-based or biodegradable fluids, is not an option—the toxins that microbes release present a bigger hazard to workers than the amounts of formaldehyde that the biocides release.

Formulators must work with a toolbox of additives that are currently approved for use, Canter says. Stricter regulations will reduce the number of additives available in that toolbox. If formaldehyde-releasing biocides can no longer be used at an effective treat rate in MWFs, then formulators will need to use other additives that contain chemistries that are not conducive to microbial growth. “The problem is finding them,” he says. To succeed in the market, additives must not only be effective, but they must also be attractively priced and reliably sourced, and they must meet regulatory restrictions in various markets around the world.

Restrictions on formaldehyde-releasing biocides, Canter says, are driven by concerns over formaldehyde’s toxicity effects. However, in his decades of experience as a consultant working with metalworking operations, he has not heard of any incidents of workers experiencing toxic effects from the use of formaldehyde-releasing biocides. To a large extent, he explains, this is because, when used according to directions, the formaldehyde released is very effective against microbes at very small concentrations that have not affected workers.

“There are ways to make fluids more biostable and more resistant to microbes, but biocides are still needed,” Canter says. Water-dilutable MWFs contain a cocktail of organic components that can accelerate the growth of microbes, leading to premature MWF degradation that can shorten service life and also cause unsafe working conditions. Both of these issues reduce the sustainability of MWFs because they can also lead to a loss of efficiency and productivity and an increase in waste generation.

Harmful effects to workers from exposure to MWF biocides do not appear to be widespread, mostly because of the small amounts used, Dudelston concurs. However, he adds, there have been reports of negative effects indirectly related to biocide usage. For example, a 2010 research paper reported the discovery that hypersensitivity pneumonitis affecting workers in one particular manufacturing plant could be attributed to a new, slow-growing bacterial taxon related to

Mycobacterium chelonae/abscessus.11 These bacteria had developed thick cell membranes that allowed them to “wait out” the biocide in the MWF and proliferate after other types of microbes were eliminated.

Although some major U.S. manufacturers have banned triazines and other formaldehyde-releasing biocides, European countries face even stricter “broad-brush” bans, Dudelston says. He adds that regulations are a moving target for MWF formulators. New data are constantly coming out and there are new classifications for raw materials, so safety data sheets must be updated repeatedly. “It makes it very difficult to bring new products to market and keep them there in the long term because you don’t know what new data is going to come out in the future.”

Fluid maintenance, efficient usage and disposal

Sustainable disposal of biobased MWFs, like their mineral oil-based counterparts, can present challenges. Fluids marked for disposal have reached the end of their service life, and as such, they are not the same as they were when they were fresh out of the drum. Used MWFs contain metal fines, tramp oil and anything else that may be in the sump, circulating through the system or clinging to the surfaces of the tools, workpieces and tanks.

3

Recirculating an MWF can contribute significantly to sustainability by reducing fluid usage and disposal costs. Some metal cutting and grinding operations can recirculate their fluids, but this is not as common in stamping or forming operations, Lunn says. Further, every time a water-dilutable oil product is changed out, the system must be cleaned, the water and oil components must be separated, and the oil component must be disposed of properly. Water-dilutable formulations can be reused, and if they have been formulated and maintained well, they can last a long time, she says. Extending drain intervals saves money, time and energy, she adds, increasing sustainability even without making other changes.

Properly maintaining MWFs, including keeping sumps clean and regularly monitoring pH levels, can prevent microbes from getting out of hand, Lunn adds. This not only makes a healthier working environment, but it also helps prevent microbes from degrading fluids (e.g., splitting emulsions) and releasing acidic metabolic products that can cause corrosion, reducing costs all around.

Running operations in a way that requires less metal cleaner also contributes to sustainability, Lunn says. Using a metal cleaner formulation (e.g., with stronger surfactants) that is effective at lower temperatures saves energy by not requiring heated cleaner baths.

Proper fluid monitoring and maintenance goes a long way toward making MWFs more sustainable. This works on several fronts, including extending fluid life, making the workplace safer and improving operating efficiency and productivity, Canter says. Safe, well-functioning operations also contribute to happier, more motivated workers. “It’s not just the fluid itself,” he adds.

However, he continues, persuading end-users to take this kind of long-term approach can be challenging, particularly in smaller operations that generate smaller profit margins. Some end-users consider monitoring and maintenance as taking time away from manufacturing parts and increasing initial costs. But over the long run, Canter says, these efforts are helping end-users understand that proper maintenance improves manufacturing efficiency, cuts costs and raises profits. This is the important aspect in improving the sustainability of MWFs and the systems used in operating them, he explains. “Dumping a MWF is the last resort, but unless you maintain it properly, you’re going to be dumping it more frequently.”

MWF manufacturers and fluid managers are probably in the best position to educate their customers on practices that prolong fluid life, Canter says. This might reduce their sales, he adds, but it would add to the value of the MWFs. For many operations, a purchasing manager makes the decision on which fluid to buy, he explains, and the challenge is to persuade this individual that the higher initial cost of the MWF is more than made up for in terms of better performance and longer fluid life.

Dudelston notes that some metal shops are using automated fluid condition monitoring, where sensors continuously monitor machinery and fluid characteristics and alert workers to potential problems in the early stages. At present, he says, these systems work with most water-based fluids, but they are not yet designed for use with neat oils. However, neat oils pose fewer problems, he adds, largely because they are not conducive to microbial growth.

Sump maintenance is important from several standpoints, not just sustainability. Keeping tramp oil, particulates and other contaminants out of the MWF extends fluid life and helps prevent a host of other problems. Likewise for fluid maintenance—cleanliness, additive replenishment and condition monitoring all contribute to efficiency and waste reduction. It’s difficult to know if a customer is keeping up with these things for reducing costs and downtime, if they are seeking to reduce waste or a combination of these things, Dudelston says. Regardless of the motivation, he adds, the result is less waste.

Shipping, storage and sustainability

Environmental impact is another important factor in the push toward sustainability—sustainable protective coatings must not damage the environments with which they come into contact. For example, parts that will be stored for lengthy periods or exposed to salt spray when they are shipped overseas may require wax-based calcium sulfonate or petrolatum coatings. Automotive underbody coatings, used to protect the finished vehicles from road salt and other corrosives during use, face especially strict environmental regulations, Lunn says. Natural products like lanolin, a byproduct of sheep shearing, provide good protection and any runoff will not harm the environment.

Globalization plays a role in sustainability as well, Lunn says. For example, parts manufactured in the cold weather in Cleveland, put into bags, then shipped to warmer weather in Mexico for assembly might require a rust preventive coating to guard against water condensation during transport. Recently, she has seen some movement toward bringing more operations into the same facility. Rather than shipping individual parts to distant factories for subassembly, some companies assemble several parts into modular units before shipping them to the plants that do the final assembly. This cuts down not only on transportation costs but also limits exposure of the parts to environmental damage and exposure of the environment to MWFs and coatings applied to the parts.

Diverse processes, customized fluids

Another challenge to sustainable formulations and usage, Lunn says, is that the metalworking industry encompasses so many different processes. Each process requires its own multi-component formulation, so producing commodity amounts of only a few formulations is not effective. Formulators and suppliers must interact with specific customers to determine their needs, which presents a high barrier to entry for new additive suppliers and fluid vendors.

This customized approach is very different from that taken by oil formulators who make high-margin gear oils or vendors that sell commodity quantities of vehicle lubricants. The result is a very fragmented MWF industry, with relatively lower profit margins. “You have to go in, you have to make friends, you have to look at the whole plant,” Lunn says. “You have to look at the whole process, and you have to understand and talk to them and say, ‘Well, why do you like this? And why don’t you like that?’ It’s a very personal sell, as opposed to being able to go and say, ‘I have the latest gear specification with my product—you have to buy it.’”

This diversity of applications also means that there are no overall product specifications like those that vehicle lubricants must meet. Two machines in the same plant can run differently, Lunn says. Even the machine operator’s personal preferences can make a difference, she adds. It’s not unusual for one machine shop to make small quantities of several kinds of parts or to perform several processes on any given part. OEMs, especially the larger manufacturers, Lunn says, can set part specifications and to some extent fluid specifications, for such things as lubricant compatibility with adhesives or paint, but smaller shops take a more customized approach.

European OEMs in particular are pushing toward net-zero carbon emissions, Lunn says. However, calculating a carbon footprint for any specific part of the fluid formulation and manufacturing process is not easy. MWF companies have very little control over what carbon emissions are involved in producing the feedstocks they buy or what happens to their products once they go out the door.

Although the science involved in developing MWF formulations has progressed over the years, “there’s also a lot of art involved in formulating because MWF formulations are very complex and formulators need to develop a feel for how the components used interact with each other,” Canter says. Specific applications require adjustments for optimizing performance. “You may run two identical machines in the same application. One machine may work well with one set of formulations, and the machine next to it may not. The formulator is used to [making adjustments]. That’s why many MWF companies have large product portfolios. They have to because of the uniqueness of many of these applications.”

For large operations, fluid customization is done on a plant-by-plant basis. These plants often have central systems with large reservoirs of fluid, containing thousands of liters, which supply many machines in the plant. However, other operations have standalone machines with individual sumps containing the MWF. In the U.S., Canter says, most machine shops operate with standalone machines. A fluid vendor will typically recommend a particular formulation, and if the performance is not up to the customer’s standards or if a problem arises, the customer often tries other fluids (often from other vendors) to see which one works best.

Large corporate manufacturers have their own internal specifications, but there are no industry-wide standards for MWFs, Canter says. This is very different from automotive engine oils, which must pass a sequence of tests to qualify for use and can be bought off-the-shelf in retail outlets. Efficiency and cost are driving factors in MWF selection. “It’s done uniquely by each company, to meet their individual operating requirements,” he adds.

“If a company had created the perfect fluid for every application, none of the rest of us would be in business,” Dudelston says. He notes that there are some very effective, tried-and-true products on the market, but processes and equipment vary so widely from one operation to another that customization is a necessity. Different customers using the same type of machining center but different feeds, speeds and alloys require MWFs with different characteristics. Vendors with a good historical knowledge of the unusual situations that can arise are at an advantage, he adds.

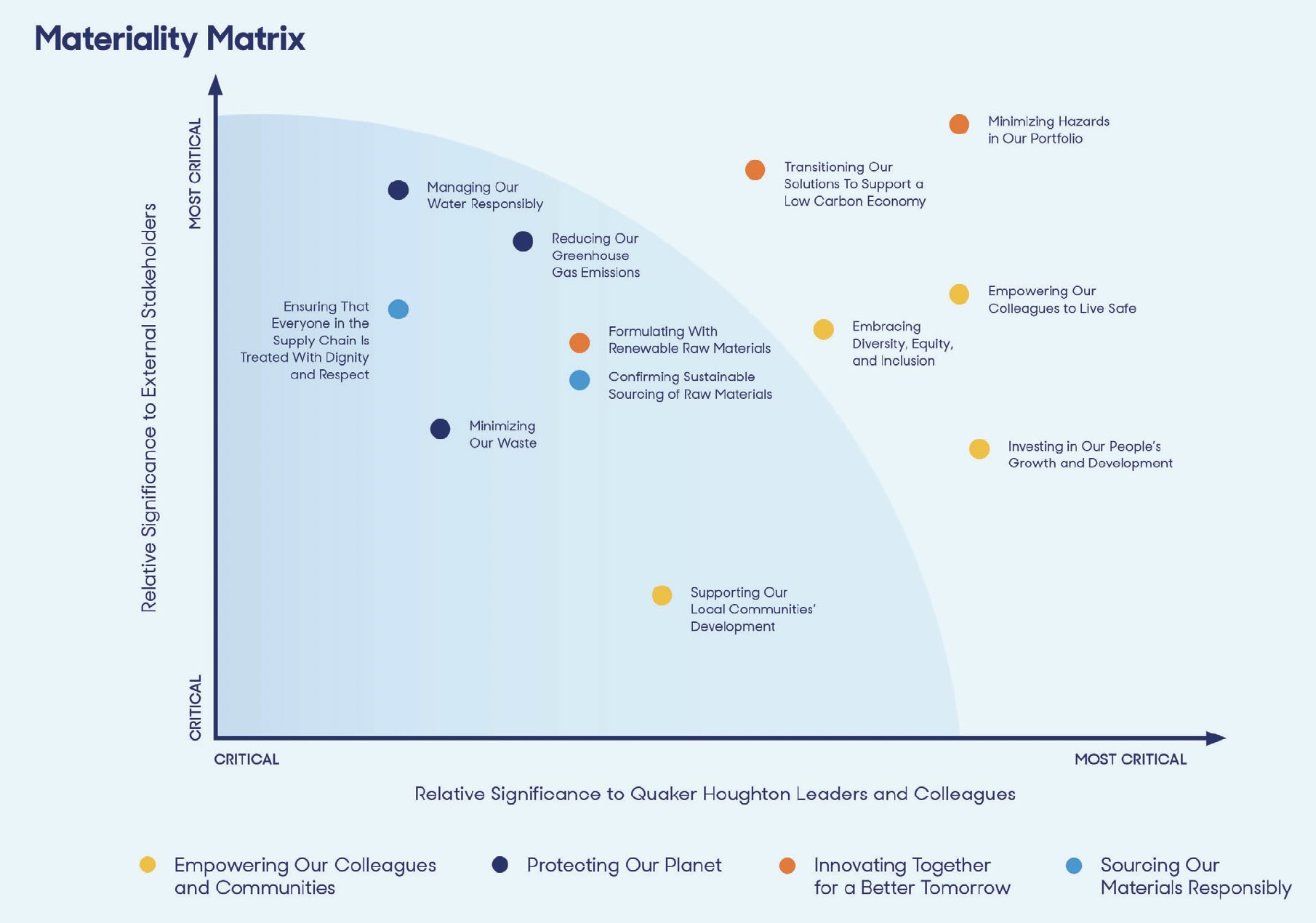

If a customer requires a formulation that avoids specific components, an MWF formulator can generally find a workaround, although there may be some tradeoffs involved, Dudelston says. He notes that this type of specificity isn’t related to the size of the customer’s operation; small and large shops alike have preferences and performance requirements that require varying degrees of customization. The wide range of customer requirements results in MWF manufacturers needing a large portfolio of products at various price points

(see Figure 4).

Figure 4. Corporate sustainability efforts require finding common ground between priorities for external stakeholders and company leaders and their colleagues. Figure courtesy of Quaker Houghton.7

Figure 4. Corporate sustainability efforts require finding common ground between priorities for external stakeholders and company leaders and their colleagues. Figure courtesy of Quaker Houghton.7

Putting sustainability into practice

Dudelston notes that many corporations are mounting large, well-publicized efforts toward sustainability, but their criteria for sustainability goals differ and it’s not clear how far into the manufacturing plant these efforts extend. For example, a manufacturer of MWFs or fluid components could compile a list of preferred raw materials for use in formulations research and development.

7 This list might incorporate sustainable sources like non-food agricultural products, workplace environment factors like low volatiles emissions, low environmental impact or a host of other factors. The balance between cost, product quality, worker safety and sustainability varies considerably even within the same plant. “Nothing’s easy in this industry,” he says.

“Many people consider MWFs to be commodities, especially when you get into purchasing segments,” Dudelston says. “All they know is, it’s a coolant, so coolant A is equivalent to coolant B. If coolant A is cheaper than coolant B, we’re going with coolant A, but they don’t ever figure in all of the other aspects of what the coolant’s designed to do—longevity, total cost of ownership.” He notes that many large manufacturers have separate purchasing managers for fluids and for machines and tools, and that these people might not be in the same physical location or have any contact with each other. Thus, the fluid buyer might not consider the effect of a less expensive fluid on tool life, quality control or drain intervals. Other operations are aware of the advantages of a better-quality fluid, but the nature of the workpiece (e.g., cup-shaped parts) is such that fluid carry-off loss is unavoidable, which requires them to buy more fluids. Everyone is familiar with the concept of total cost of ownership, he says, but personnel in various roles are evaluated on differing criteria. Fluid manufacturers need to supply what their customers want, he adds.

Dudelston reiterates that many people have an interest in sustainability, and they have many different definitions of what that entails. “If we can do something that is better for the environment, if your fluids are going to last longer, if it’s better for us as a human species, I am all for it,” he says.

REFERENCES

1.

Khan, M.A.A., Hussain, M., Lodhi, S.K., Zazoum, B., Asad, M. and Afzal, A. (2022), “Green metalworking fluids for sustainable machining operations and other sustainable systems: a review,”

Metals, 12, 1466,

https://doi.org/10.3390/met12091466.

2.

Van Rensselar, J. (2012), “The growth of biobased metalworking fluids,” TLT,

68 (8), pp. 27-33. Available at

www.stle.org/files/TLTArchives/2012/08_August/Cover_Story.aspx.

3.

McGuire, N. (2022), “The long road toward oil-free metalworking fluids. TLT,

78 (8), pp. 30-35. Available at

www.stle.org/files/TLTArchives/2022/08_August/Cover_Story.aspx.

4.

Canter, N. (2021), “Metalworking fluids: update on boundary lubricity additives,” TLT,

77 (3), pp. 42-52. Available at

www.stle.org/files/TLTArchives/2021/03_March/Feature.aspx.

5.

OSHWIKI, European Agency for Safety and Health at Work (2013), “Metalworking fluids,” updated 02/07/2019. Available at

https://oshwiki.osha.europa.eu/en/themes/metalworking-fluids.

6.

Wilson, A. and Garett, J. (2024), “Rethink, Redefine, Re-refine: Formulating Solutions for the Future,” TLT,

80 (11), pp. 54-57. Available at

www.stle.org/files/TLTArchives/2024/11_November/Afton_Chemical_Corporation.aspx.

7.

Quaker Houghton, See Beyond™, “2023 Sustainability Report.” Available at

https://home.quakerhoughton.com/sustainability/2023-sustainability-report/.

8.

Jaques, A. (2024), Chlorinated Paraffins Industry Association, “Chlorinated Paraffin Update for the ILMA MWF Committee.”

9.

Pearce, M. (2024), “Chlorinated Paraffins in Metalworking Fluids: An Industry Perspective.” ILMA 6th International Metalworking Fluids Conference.

10.

Environment Agency (UK) report Science report SCHO0109BPGR-E-E (January 2009), “Environmental risk assessment: long-chain chlorinated paraffins.” Available at

https://assets.publishing.service.gov.uk/media/5a75b9e3ed915d506ee81070/scho0109bpgr-e-e.pdf.

11.

Moore J.S., Christensen, M., Wilson, R.W., Wallace, R.J., Zhang, Y., Nash, D.R., Shelton, B. (2000), “Mycobacterial contamination of metalworking fluids: Involvement of a possible new taxon of rapidly growing mycobacteria,”

American Industrial Hygiene Association Journal, 61, (2), pp. 205-213,

https://doi.org/10.1080/15298660008984529.

Nancy McGuire is a freelance writer based in Albuquerque, N.M. You can contact her at nmcguire@wordchemist.com.