The global grease market is navigating the challenging grounds of high raw material prices, technological changes and sustainability requirements. At the same time, the global demand for grease continues to grow driven by the growth in automotive parc and industrial applications. In the next decade the demand for grease is estimated to see a compound annual growth rate of between 1% to 1.5%, as the sector anticipates an important transition in grease formulation mix and customer needs.

The grease manufacturing industry is currently experiencing significant volatility in the price of raw materials, such as lithium, which is used for making greases. The cost of lithium increased suddenly and dramatically between mid-2021 and continued into the end of 2023, when the prices of lithium spiked by as much as 80% to 120%. This spike was largely caused by an exponential demand for the metal in electric vehicles (EVs), which run on lithium-based batteries. The prices have come down in 2024 but still remain above their 2021 levels.

Price volatility in lithium grease has inadvertently helped to break the ice for alternative, and at times, better performing grease types amongst end-users. Due to the high prices of lithium-based EP2 and EP3 greases, the adoption of calcium sulfonate and polyurea-thickened greases increased in the last couple of years. Calcium sulfonate greases, which offer superior performance compared to lithium greases, are now offered at lower or comparable prices to lithium greases. Thus, the industry is seeing a growing demand for calcium greases, especially in commercial off-highway applications where these greases offer high performance and water resistance. Similarly, polyurea greases are seeing a growing demand from the automotive segment, especially in select vehicles, as they run very quietly, and they tend to bleed less than lithium greases.

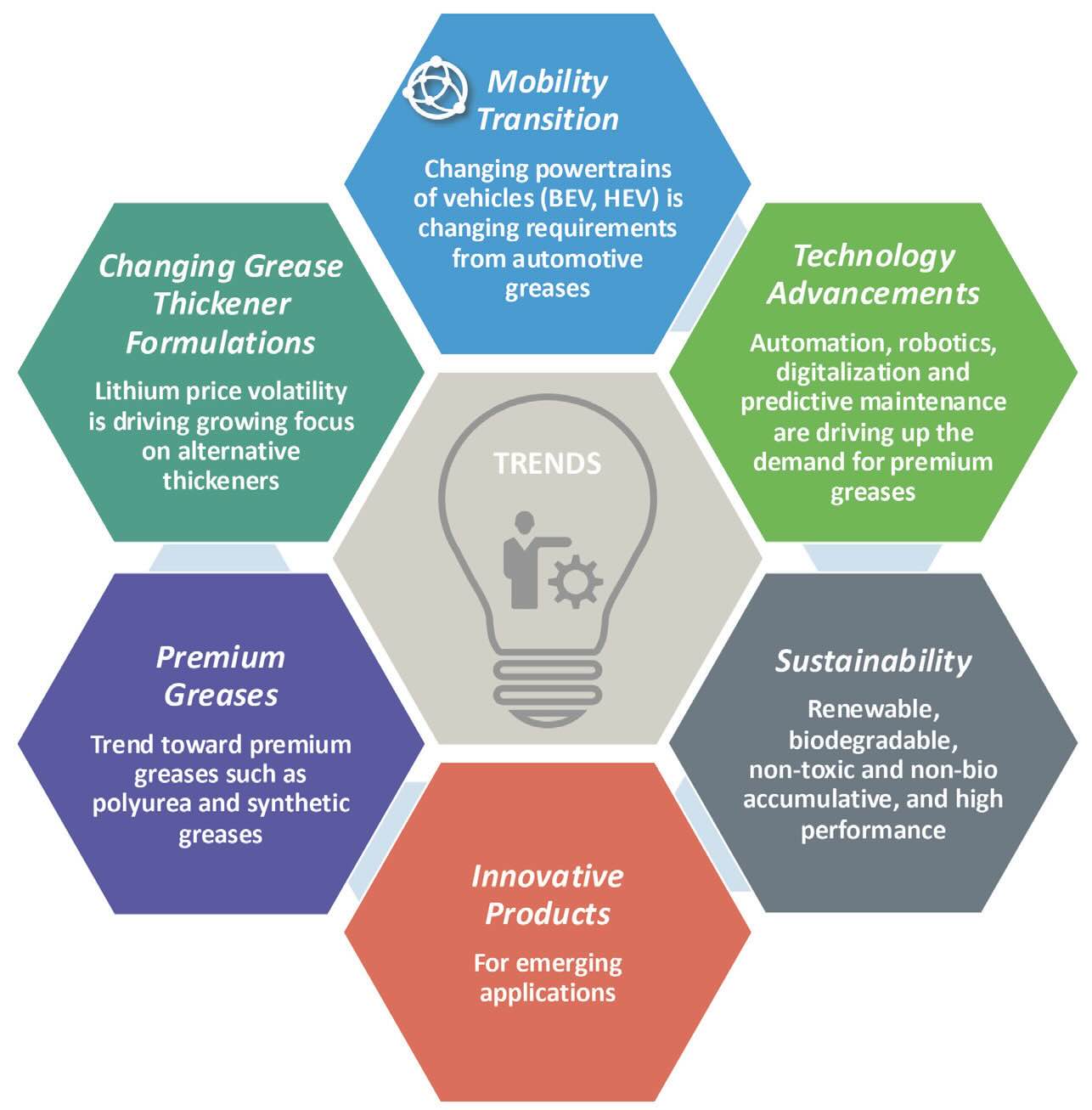

The challenges in the grease market are further compounded with ongoing global megatrends, such as mobility transition and technology advancements

(see Figure 1). The changing powertrains of vehicles, moving away from conventional internal combustion engines (ICEs) toward battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), are generating the need for premium filled-for-life greases. Equipment hardware and changes in bearing technology for EVs are the current subjects of innovation and development, primarily driven by energy efficiency, downsizing trends, extended life and maintenance intervals.

Figure 1. The challenges in the grease market are further compounded with ongoing global megatrends.

Figure 1. The challenges in the grease market are further compounded with ongoing global megatrends.

Technological advancements such as equipment automation, robotics, digitalization and predictive maintenance are driving up the demand for premium greases. Growing use of automated greasing systems, which can be monitored online and perhaps be controlled in the future (through 3P), are being increasingly adopted. One glaring example of this is the rising trend toward the automated greasing systems in vehicles in the construction industry. These automated systems help in reducing the downtime, resources and compatibility issues in construction vehicles.

Amidst the ongoing technological advancements, the need also has arisen for greases to step up and meet increasing sustainability requirements. Interestingly, where earlier sustainable fluids were defined as renewable, biodegradable, non-toxic and non-bio accumulative, the definition of sustainable fluids has been evolving over the years. These fluids are now coming under increasing scrutiny for performance, including their contribution in increasing equipment efficiency and in reducing overall energy consumption.

Similarly, greases are now increasingly being evaluated from the lens of their performance benefits and contribution to energy efficiency rather than just having a green label or being biodegradable

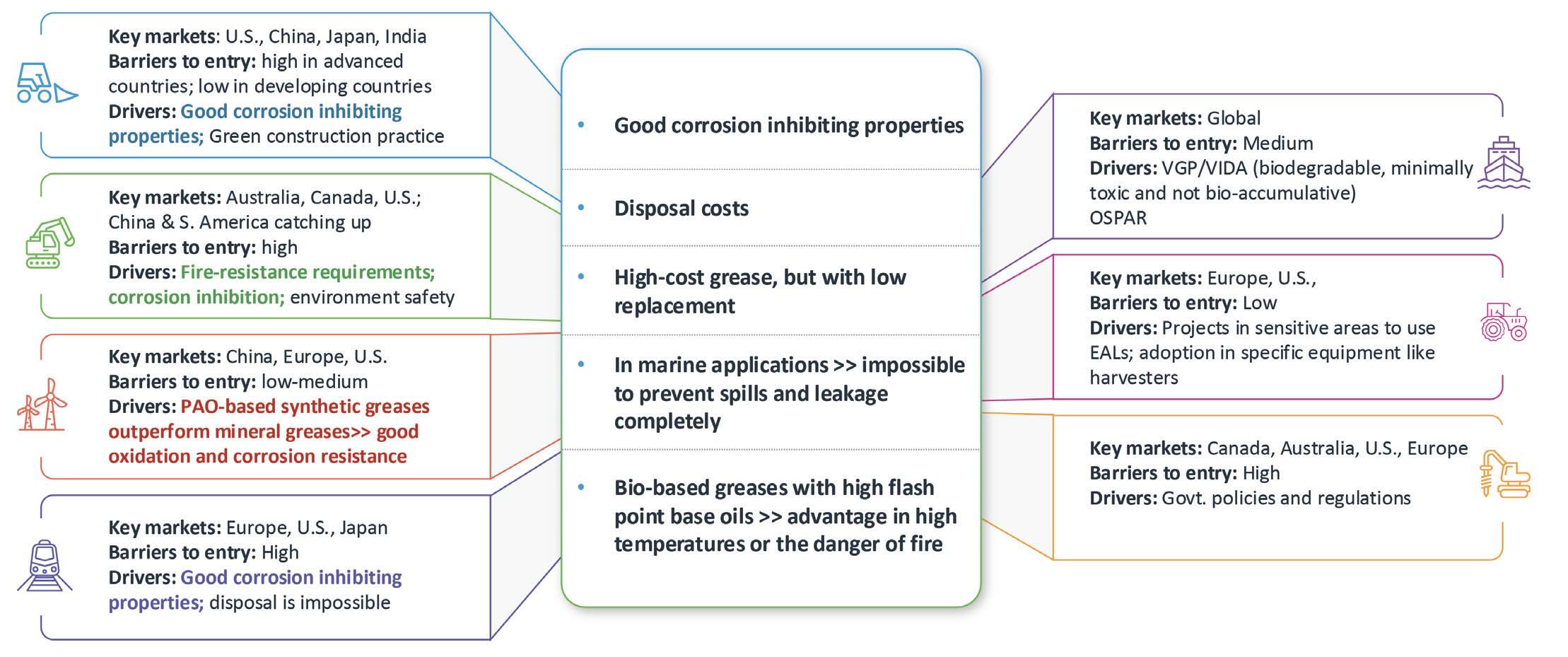

(see Figure 2). Traditionally, sustainable greases have penetrated end-use applications in marine, agriculture, oil and gas and mining sectors, where the risk of the grease coming into contact with water bodies or the risk of grease seeping into the ground is high. In such applications biodegradable and non-bio-accumulative greases have been the product of choice. However, now the outlook for greases is changing amongst end-users.

Figure 2. Demand for sustainable grease is now driven by performance benefits; safety against fire hazards; legislation; and corporate social responsibility (CSR)/health, safety and environmental (HSE).

Figure 2. Demand for sustainable grease is now driven by performance benefits; safety against fire hazards; legislation; and corporate social responsibility (CSR)/health, safety and environmental (HSE).

With tightening carbon neutrality goals for end-use industries, such as mining, construction and railways, the demand on greases is shifting from just being biodegradable or non-bio accumulative toward being efficiency enhancers that can contribute to reducing overall energy consumption. In this new light, synthetic greases, particularly those based on synthetic esters, are shining bright

(see Figure 3).

Figure 3. Synthetic greases, which also offer biodegradability, are high in demand due to their fire resistance and good corrosion inhibition properties in construction and mining applications.

Synthetic ester-based greases are particularly seeing growing interest in construction and mining applications where their fire-resistance and good corrosion inhibition are now driving up their demand, rather than just their biodegradability. Railway curve greases is another application where synthetic greases are growing due to their better pumpability in automated greases systems.

Another emerging application is wind energy generation where polyalphaolefin (PAO)-based greases are finding increasing demand. Wind turbine installations are either placed in offshore or in remote onshore areas and on 80 meter- to 120 meter-high towers. In such installations regular maintenance of turbines becomes challenging. This generates the need for greases that can offer extended performance life, good oxidation stability, corrosion resistance and are biodegradable/non-bio-accumulative. Premium PAO-based lithium complex or polyurea greases are especially preferred in such applications as they are able to offer these performance aspects.

These emerging trends and customer requirements coupled with raw material price volatility are driving the grease market toward premium or synthetic greases and thickeners other than mainstream lithium. These factors have prompted a significant shift in the grease market where the shares of conventional lithium-thickened greases in the global market have reduced from 50% in 2019 to 43% in 2023, while premium lithium complex, calcium, aluminium and sodium-thickened greases continue to strengthen.

Reflecting on the changes taking place in the grease market globally, it is evident that this market is shifting ground. Though mineral oil-based conventional lithium greases will continue to hold a significant share in this market, premium and synthetic grease will be the key value creation products for grease manufacturers. The demand for high value premium greases will be driven by increasing performance needs, tightening regulations, stiffening carbon neutrality goals in end-use industries and extending performance life requirements, especially in emerging applications such as BEVs and wind.

Pooja Sharma is a Project Manager at Kline + Company in the Energy practice. You can reach her at pooja.sharma@klinegroup.com.

Kline + Company is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.