How are lubricant additive formulators keeping pace with the transition toward electric vehicles?

By David Tsui, Kline + Company | TLT Market Trends September 2024

There’s greater pressure on the lubricant additives designed to prevent wear.

A predominate view is that electric vehicles (EVs) will be the inevitable replacement for internal combustion engine (ICE) vehicles, which will then forecast the end for engine oil demand. But if that is the case, why is it that engine oil specification groups are working furiously to launch new specifications, and OEMs also are pushing hard for revisions and changes to those specifications?

EV lubricants are center stage right now as EVs demand their own unique set of requirements that traditional ICE lubricants may not meet. However, despite the investment from lubricant companies into these fluids, there is still a lot more to be done on traditional ICE lubricants.

For one, emissions mandates like those from the Environmental Protection Agency (EPA) will force OEMs to advance engine and emissions technology further to meet new targets. This means OEMs also need the lubricants to deliver greater efficiency and protection for those complicated engines and exhaust after-treatment devices, all the while offering the consumers longer oil life.

The new ILSAC GF-7 specification is being planned for March 31, 2025, first license date. The new specification intends to improve better pre-ignition protection. While limits currently are not changed there is potential to seek better protection, which helps ensure magnesium-based detergents find greater use in formulations. While the industry has already shifted since the Sequence IX pre-ignition test was developed for API SN Plus, the drive for greater engine efficiency could push these small, turbocharged engines into an area where low-speed pre-ignition (LSPI) becomes a greater concern.

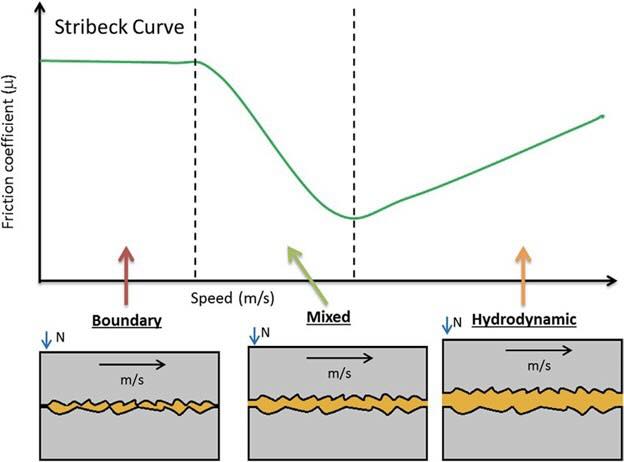

Improved fuel economy is required, and while the shift to 0W-12 and 0W-8 seems to have slowed, the 0W-16 and 0W-20 grades are seeing the greatest level of adoption by nearly all OEMs, even for turbocharged engines. This can be a challenging task for formulators as lower viscosities push the lubricants further down the Stribeck curve into the mixed or boundary friction regimes where metal-on-metal contact can occur

(see Figure 1). This puts greater pressure on the lubricant additives designed to prevent wear, which goes counter to the drive for less friction and improved fuel economy. Friction modifiers, for example, can be used to reduce friction in these lubrication regimes; however they compete for surface space with the antiwear additives such as zinc dialkyldithiophosphates (ZDDP). This will drive a delicate balance needed from formulators for both improved fuel economy with strong wear prevention.

Figure 1. Lower viscosities push the lubricants further down the Stribeck curve into the mixed or boundary friction regimes where metal-on-metal contact can occur.

Figure 1. Lower viscosities push the lubricants further down the Stribeck curve into the mixed or boundary friction regimes where metal-on-metal contact can occur.

Improved timing chain wear will drive the need for more dispersants or better performing thermal dispersants as gasoline engines push diesel levels of compression in search of higher miles per gallon. These new efficient engines will generate more soot than traditional engines, which is finding its way into engine oils and driving additional wear on timing chains.

Better hybrid engine protection also is needed as hybrid electric vehicle (HEV) and plug-in hybrid electric vehicle (PHEV) sales have picked up in recent months with consumers preferring the benefits of both ICE freedom and EV fuel economy. These engines often may not run at all or for very long on a typical trip so they may never get fully warmed up. As such, the drive for greater low temperature flow of engine oil is needed to ensure these engines get as much protection as ICEs, which benefit from better flowing hot engine oils. This could drive the need for better pour point depressant performance and potentially better base oils such as Group III+ or PAO.

Overall, despite the EV changeover looming, engine oil formulators will be quite busy formulating new lubricants for GF-7 in 2025, and then PC-12 diesel engine oils in 2028, along with an updated GF-8 in the same year! Kline + Company looks forward to delving into the lubricants additive industry as it prepares new chemistry and new formulations to meet the needs of tomorrow and beyond.

For a more comprehensive analysis on the global lubricant additives market, contact David Tsui or request the latest Kline + Company report, “Global Lubricant Additives: Market Analysis and Opportunities” at

https://klinegroup.com/reports/global_lubricant_additives/.

David Tsui is a Project Manager at Kline + Company in the Energy practice. You can reach him at david.tsui@klinegroup.com.

Kline + Company is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.