KEY CONCEPTS

•

Sustainability means different things to different stakeholders.

•

Carbon emissions are important but not the whole story.

•

Life cycle assessments are key to understanding the impact of a lubricant, its raw materials and use.

Lubricants blenders, grease manufacturers and their distributors are being placed under increasing pressure for evidence that the products on offer are more sustainable than a competitor’s product or previous version, without defining what they mean by sustainable. The importance is such that the STLE Sustainability Committee was formed in November 2023 and the 2024 STLE Annual Meeting & Exhibition is hosting its first-ever Sustainability Forum.

The pressure comes from many sources, some of whom claim to be acting on behalf of the consumer. The pressure may be regulatory, from activist shareholders or from companies—usually downstream— wanting to “do the right thing.” However, the criteria for sustainability are many and varied, sometimes leading to confusion or complaints that complying with some could lead to a worse outcome by other measures.

UN sustainable development goals

In her 1987 report to the United Nations called “Our Common Future,” Gro Harlem Brundtland, former Prime Minister of Norway, described sustainability as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” She wasn’t the first to use such a phrase, but she was the person to bring it to wide attention.

The Brundtland Report led to the United Nation’s 17 Sustainable Development Goals, or UN SDGs

(see Figure 1). The UN SDGs and the 169 individual targets cover the three main areas of sustainable development: economy, society and environment. “Generally, discussion in the industry tends to be narrowed to minimizing environmental repercussions. But the three are not separate topics and overlap in the challenges, solutions and outcomes,” says Valentina Serra-Holm, former president of the European Union of Independent Lubricants Manufacturers (UEIL) and now vice president for engineered fluids at Perstorp, based in Stockholm, Sweden. “Societies and organizations are still not fully appreciating to what extent the targets are interconnected not only with each goal, but also across goals.”

1

Figure 1. The United Nations Sustainable Development Goals.

Figure 1. The United Nations Sustainable Development Goals.

During Serra-Holm’s presidency, the UEIL Board created a Sustainability Task Force in March 2019 under the leadership of Apu Gosalia. Their brief was “to develop and define exactly what sustainability means for the European lubricants industry, in words that are simple and easily communicated within both our industry and to external stakeholders.” They identified SDGs 9, 12, 13 and 17 as the most important. However, the impact is wider, as emissions, resource use, recycling and customer benefits impact almost all SDGs—some upstream, some in-house and some due to the lubricant or grease in use.

Gosalia now works as independent expert for sustainability and strategy and co-chair of the Commission Climate & Sustainability in the Senate of Economy since 2020. He also is a partner of Fokus Zukunft, a sustainability consultancy based in Bavaria, Germany.

“Most of the developments in sustainability in the last five years are based on the European Green Deal, a concept presented in 2019 with the aim of reducing net greenhouse gas (GHG) emissions in the European Union (EU) to zero by 2050,” says Gosalia. “The Green Deal is the central component of the EU’s climate policy since its inauguration and comprises a series of measures in the areas of financial market regulation (sustainable finance), energy supply, transport, trade, industry, agriculture and forestry.”

A year later, the European Climate Law was passed, which legislated that GHG emissions should be 55% lower in 2030 compared to 1990. The Fit for 55 package details how the EU plans to reach this target. “The plan includes potential carbon tariffs for countries that don’t curtail their GHG pollution at the same rate. The mechanism to achieve this is called the Carbon Border Adjustment Mechanism (CBAM). It also includes a circular economy action plan, which requires member states to carry out activities related to changing their economies into circular economies,” Gosalia continues.

Many large companies, including some lubricant manufacturers, are obliged for the first time in 2024 to measure and disclose detailed sustainability information as part of the Corporate Sustainability Reporting Directive (CSRD), although in February some sectors were given two more years. The reporting also includes the calculation of corporate and product carbon footprints (PCFs), according to the GHG protocol standard.

According to Serra-Holm, “In order for the industry to address the impact, there is a need for measurable and comparable data to assess status, progress and develop plans to meet targets. In many cases, measuring targets is not only difficult, but we also lack indicators. The development and implementation of international and industry standards, and the ease of sharing and verifying data, will be key to sustainable development

(see Product Carbon Footprint and Life Cycle Assessment).”

Product Carbon Footprint and Life Cycle Assessment

2023 was a big year for the lubricants industry in developing product carbon footprint (PCF) methodologies. The American Petroleum Institute (API) released “API Technical Report (TR) 1533, Lubricants Life Cycle Assessment and Carbon Footprinting – Methodology and Best Practice,” in May.

A ATIEL and UEIL then published their “Methodology for Product Carbon Footprint Calculations for Lubricants and Other Specialties” in October.

B Andreas Glawar, carbon solutions advisor, based at the Shell Technology Center, Houston, says, “I chaired the API subject matter expert working group and Mark Southby, industry liaison manager and sustainability lead for Shell Lubricants Technology, based in the UK, contributed to the ATIEL/UEIL working group. (ATIEL is the Technical Association of the European Lubricants Industry, representing mostly the international oil companies. UEIL is the Union of the European Lubricants Industry, representing independent lubricants blenders and marketers.) It was important to develop the robust methodologies, but also to ensure that they were complimentary and did not contradict each other.”

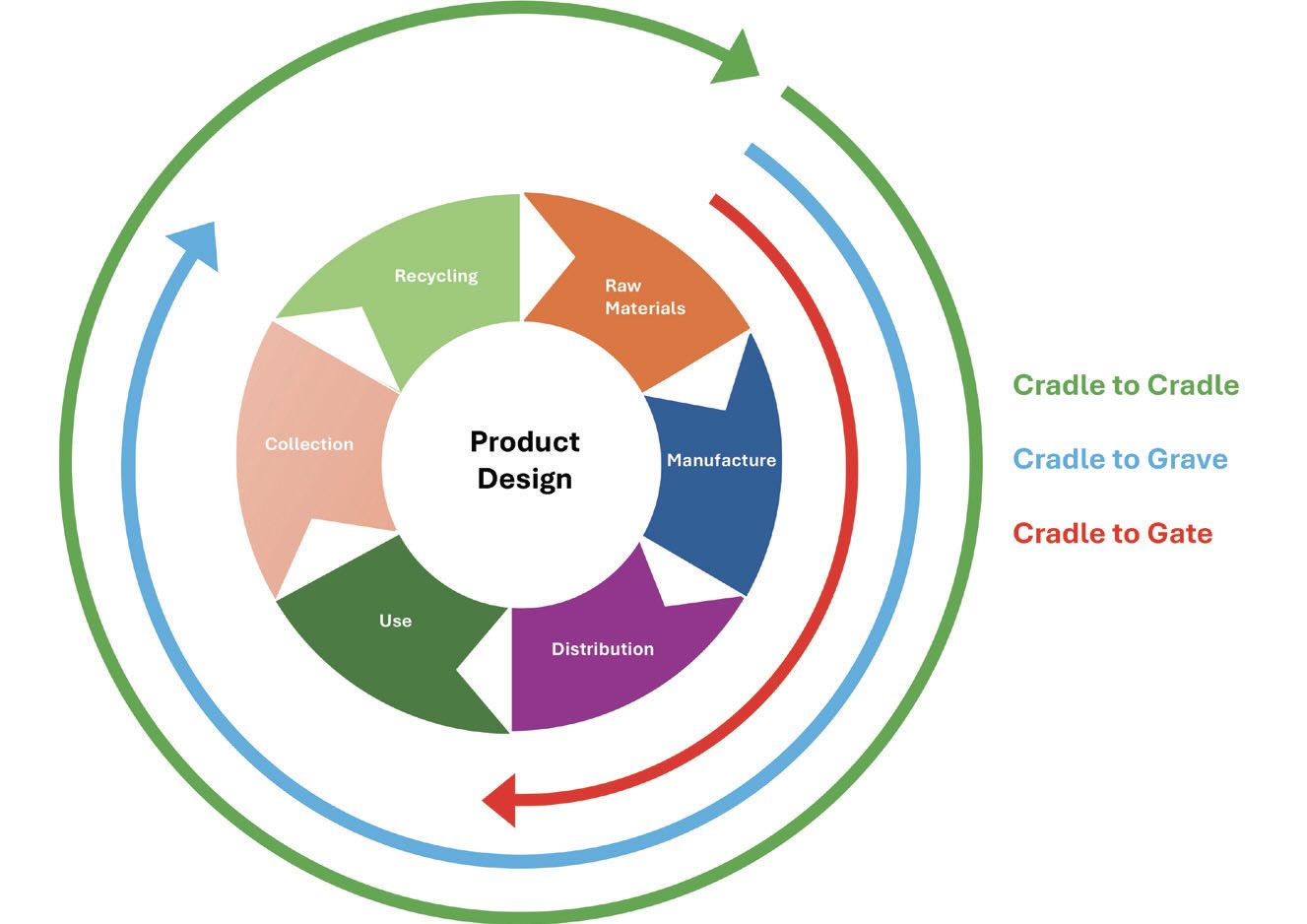

TLT: Can you explain what a carbon footprint of a product (CFP) or product carbon footprint (PCF) is and where it sits with cradle-to-grave, cradle-to-gate and circularity?

Glawar: There is a lot of terminology used in this space, and it’s worth starting with life cycle assessment (LCA), the definition of which is captured in API (TR) 1533 as “the compilation and evaluation of the inputs, outputs and the potential environmental impacts of a product system throughout its life cycle.”

C LCA takes a broader look at different environmental issues organized in impact categories, such as climate change, acidification, etc., which are typically expressed in indicator results like kg CO

2 equivalent (CO

2e, for climate change) or kg H+ equivalent (for acidification).

Southby: Carbon footprint analysis could be seen as a subset of a LCA of a product, activity or process but focused on the single impact category of climate change and expressed in kg CO

2e. Therefore, the carbon footprint of a product (CFP) or PCF, can be defined as: “The sum of GHG emissions and GHG removals in a product system, expressed as CO

2 equivalents and based on a LCA using the single-impact category of climate change.”

D

If we talk about “cradle-to-grave” as a scope, this is an assessment that includes all stages of the lubricant life cycle, typically covering raw materials, production, packaging, logistics, in use and end of life. A CFP is on cradle-to-grave or life cycle basis. For a partial CFP, certain stages of the life cycle could be removed from the assessment. Examples for partial CFPs could include the following scopes: Cradle-to-(factory)-gate includes all upstream stages until the production gate, including raw materials, production and packaging, while the scope of cradle-to-(customer)-gate would in addition include the logistics contribution to the customer gate.

Glawar: Circularity is a term used to express a departing from the traditional linear supply chain thinking of “take-make-dispose” to a more sustainable circular approach. Product circularity and the circular economy is a key concept, where products are reused or recycled at end of life, rather than disposed of and therefore aiming to keep materials and resources in use as long as possible. A good example is re-refined base oil.

TLT: Where did the pressure for a cross-industry PCF come from? Shareholders? Customers? Regulators?

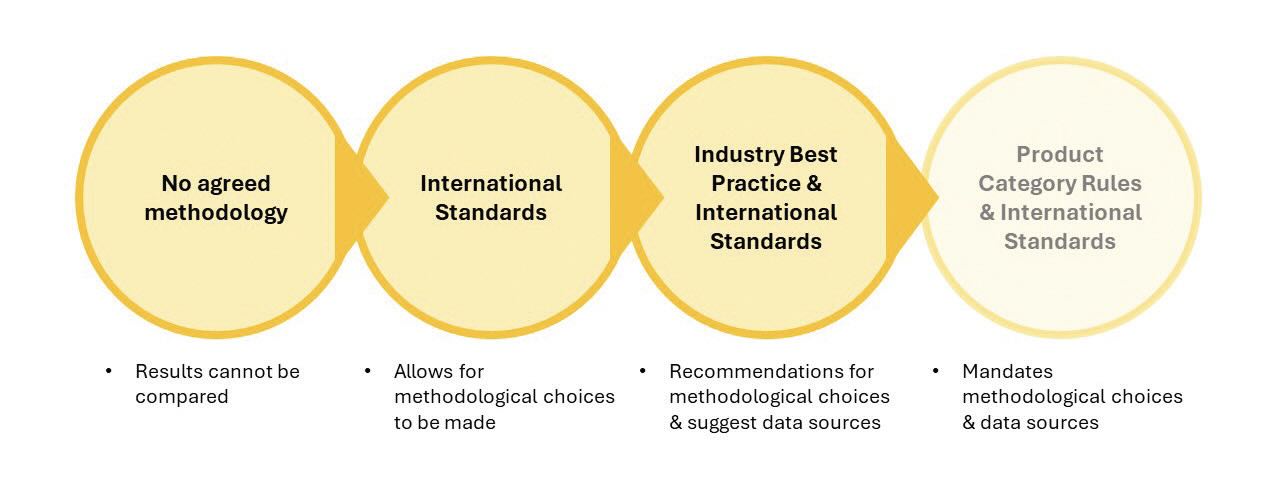

Southby: The industry itself drove the development of PCF methodologies for lubricants, recognizing that international standards alone were not specific enough, leaving too many choices open to practitioners, meaning that like-for-like comparisons of assessment results could not be made

(see Figure A). That is not to say that customers and regulators did not play a part. The lubricants industry is getting increasing numbers of requests for PCFs from customers and regulators also are increasingly interested in this topic. Customer groups such as Catena-X

E and regulators are all considering their own individual methodologies, so having a consistent industry-agreed methodology for lubricants is beneficial when engaging with these stakeholders. These methodologies are a huge step forward, and they can be the foundation to develop product category rules—which are even more detailed—and restraining rules outlining how such assessments should be performed.

Figure A. Moving toward standardized PCF methodologies in the lubricants industry. Figure courtesy of Shell Global Solutions (US) Inc.

Figure A. Moving toward standardized PCF methodologies in the lubricants industry. Figure courtesy of Shell Global Solutions (US) Inc.

TLT: Can you explain the relationship between PCF and Scope 1, 2 and 3 emissions?

Glawar: As mentioned, a PCF covers the life cycle of a product and therefore all the stages from cradle-to-grave

(see Figure B).

Figure B. Product life cycle for lubricants.

Figure B. Product life cycle for lubricants.

Scope 1, 2 and 3 emissions are defined by the Greenhouse Gas Protocol and, in my view, are more useful when considering corporate emissions reporting rather than PCF. Dependent on where a participant sits in the supply chain will lead to a different categorization of the same emissions into Scope 1, 2 or 3. As an example, if you were to apply them to a lubricants marketer’s PCF, then Scope 3 emissions would cover the bulk of the emissions over the life cycle, including raw materials, packaging, distribution, in use and end of life. Scope 1 and 2 would cover the emissions relating to the “production stage,” e.g., caused by the blending activity through electricity used and fuel consumed. It should be noted that those Scope 1 and 2 emissions will have associated upstream Scope 3 emissions—e.g., from extraction of the fuel resources that are burned as Scope 1 emissions. These upstream emissions also would need to be accounted for when determining a PCF.

A.

www.api.org/products-and-services/engine-oil/sustainability-of-lubricants

B.

www.ueil.org/wp-content/uploads/2023/11/UEIL_ATIEL_PCF-Methodology_Rev-1.pdf

C.

ISO 14067:2018, Section 3.1.4.3

D.

ISO 14067:2018, Section 3.1.1.1

E.

https://catena-x.net/en/

Green pressure

Requests for sustainability improvements could encompass increased circularity; use of more biobased products; a lower environmental or health, safety and environmental (HSE) impact in use; or simply better performance through, for example, longer drain intervals or enhanced energy efficiency.

These are not always aligned. For example, biobased components could compete on land use with food crops (SDG 2); some high-performance components could require significant amounts of energy or water during processing; biodegradable products may not be suitable for re-refining alongside hydrocarbon-based lubricants.

And none of this considers cost, the ultimate driver for many customers.

STLE member Bill Downey, senior vice president for business development at bio-sourced synthetic hydrocarbon base oils manufacturer Novvi, explains that, while bio-sourcing and the ability to re-refine is attractive, “showing customers how to improve efficiency or reduce the total cost of an operation is key to driving acceptance.” This reduced cost makes it much easier for customers to implement improved products and systems.

Hans Gerdes of the German additives supplier Metall Chemie warns against seeing the legislators as the enemy. “European industry representatives complain about overburdening due to regulation and red tape,” he says. “However, the source of regulation is often the many lobbyists working for law firms or industry associations.” Gerdes’ mantra is that regulation is not the blocker, but poor administration is. He points to Finland as a highly regulated country, but with a slick administration that facilitates fast-growing businesses.

2

Carbon

For many, sustainability is dominated by climate change and reducing carbon emissions, sometimes to the exclusion of the environmental and social impacts. Then there is the discussion about scope of emissions:

•

Scope 1 covers emissions from sources that an organization owns or controls directly.

•

Scope 2 are indirect emissions by the production of the energy an organization purchases and uses. This also is an issue when discussing “grid carbon,” in locations where electricity is generated by burning gas or coal without carbon capture.

•

Scope 3 emissions are not produced by the organization itself and are not the result of activities from assets owned or controlled by them. This includes all upstream activities, such as extraction, growth, refining and transport of raw materials and downstream use, disposal or recycling.

Reducing their own impact

Lubricants blenders and grease manufacturers can do much to reduce their own environmental impact—not just Scope 1 carbon emissions—and many are doing a lot and saving money in the process.

Many companies mount solar panels on the pitched roofs of their blending facilities and warehouses, which helps to offset a significant proportion of the energy required to heat components, transfer lines and blending vessels, plus regulate temperature in offices and warehouses.

Some have adopted novel technology to reduce their energy consumption. In grease manufacture, microwave heating is ideally suited to greases where the base fluid is polar. Mineral oils are not usually susceptible to microwave heating, so a significant amount of natural fats in the thickener system or as a “susceptor” enhances efficiency.

Contrary to popular belief, microwaves can be used in steel vessels. The microwave grease manufacturing plant replaces hot oil transfer lines with waveguides of approximately the same dimensions. The central oil heater is replaced by a microwave generator. Equipment, which can include mixing paddles for higher viscosity greases, can be designed to ensure that gaps between metal parts are not at distances that could lead to resonance of the microwave and arcing.

Ultrasonic mixing is a novel technology for lubricants blending. “The greenest kilowatt hour is the one you never use,” says Nigel R. Bottom, group managing director of Witham Group, a British blender of lubricants and paints. Ultrasonic blending came from the paint industry. Working the same way as ultrasonic cleaners used in laboratories and sold for domestic tasks, such a jewelry cleaning, the ultrasonic energy generates bubbles in the fluid that cause mixing as they travel through the fluid and collapse.

The ultrasonic cavity is essentially a pipe of around 8 inches external diameter and 5 feet long. Base oils and additives are charged to the tanks, as usual, but the mixing takes place by circulating the blend through the ultrasonic cavity. “The electrical power requirements are of the order of 1.5 KW to 3 KW,” says Bottom. This compares with megawatts that could be consumed when heating the componentry and the vessel for mid-sized batch blends. Trials have shown that the energy requirement for a 10-ton blend can be reduced over 200 times, relative to using gas to heat the vessels and transfer lines. Raw materials are heated only to achieve pumping viscosity.

Both microwave and ultrasound processes claim much shorter residence times in the vessels, another factor in reducing the overall energy requirements, which also improves the utilization of equipment. They also reduce waste, a key sustainability benefit. The small volume of the ultrasonic mixer means that a single drum of specialty material can be routinely blended to within a pint or two of the order.

Microwave grease manufacturing reduces waste in two ways. First, there is a higher yield per unit thickener mass, as the thickener is more uniformly dispersed through the grease. Second, the grease is not oxidized by resting on hot surfaces so doesn’t adhere to the reaction vessel walls. This increases the chemical yield—the amount of usable product relative to that of the reactants.

Another British small/medium enterprise (SME) blender is tapping into a district heating scheme that utilizes heat from water passed through disused coal mines underground. The Gateshead District Energy Scheme (GDES) was initially connected to nearby civic buildings and local authority-owned housing. Paul Booth, managing director, GB Lubricants, explains, “We connected into the heating network last May and have used it for 99% of all our heating needs, such as blending vessels, bulk storage tanks and office heating. We will see a significant reduction in CO

2 emissions; early estimates indicate 50% reduction.”

There was some cost. “We made a 20-year commitment to underwrite the considerable investment in groundworks, large scale pipework, electrical infrastructure and monitoring systems in order to connect to the GDES. The return on investment is not only measured in the long-term savings on energy costs but also the reduction in carbon emissions over that 20-year period, thereby securing our commercial viability as a responsible manufacturer.”

The GDES is the one of the largest ground source heating projects in the UK and the first full-scale system of its kind in Europe for utilizing heat from disused coal mines. However, there is more to their sustainability activities than the GDES. “Sustainability must extend to more than simple energy saving measures,” says Booth.

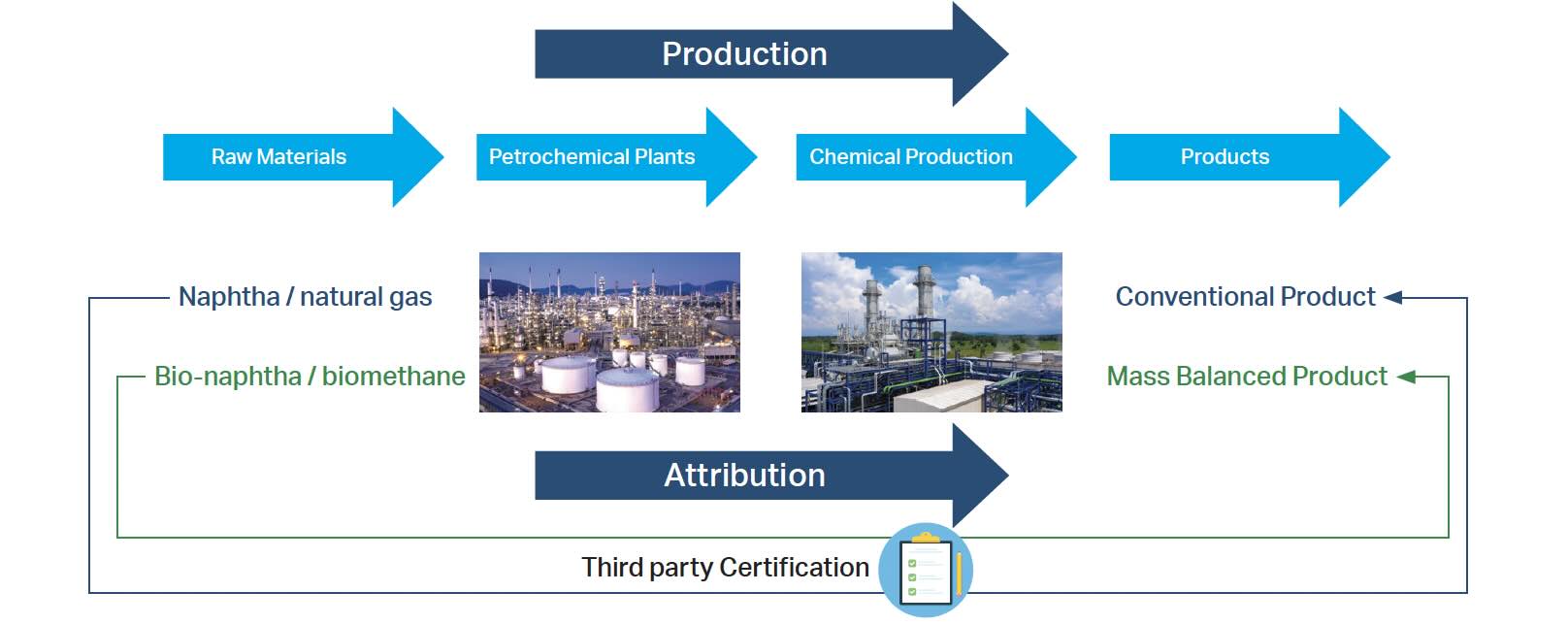

Biorefining

Biorefineries exist that process biobased raw materials to produce bio-naphtha or bio-methane. The products can either be processed directly through conventional petrochemical plants or mixed with naphtha or natural gas from fossil sources. With certification and audit, it is possible for manufacturers to utilize the concept of mass balancing3 to certify that a specific volume of product that they sell is identical to fossil-based materials but originated from a renewable raw material.

The volumes of naphtha and natural gas replaced by renewable feedstocks are calculated through a material flow analysis,4 according to Sabrina Stark of BASF, speaking at the 24th International Colloquium Tribology (ICT) in Ostfildern, Germany, in January. “A chain of custody method … defines the rules for attributing the proportion of renewable raw materials to the end product in a fully transparent and auditable way,” she says

(see Figure 2).

Figure 2. The principles of mass balancing.

Figure 2. The principles of mass balancing.

“This solution enables the use of renewable feedstocks to produce products with the same properties as the conventional equivalent while reducing the use of fossil resources and lowering the carbon footprint of the biomass balanced product. This methodology enables a portfolio of hundreds of biomass balanced products, globally, across various industries, including components for the lubricants industry,” she continues.

Stark and colleagues also sought to quantify the benefits by developing a method to calculate the PCF of such a product. “A third-party certification confirms that the calculation procedure for PCF of biomass balanced products, and the associated PCF reduction, follow conventional life cycle analysis [or assessment] (LCA) procedures as described in ISO standard 14067:2018 and Together for Sustainability (TfS) guideline.”

5

There also are direct routes from bio-sources to many basic building blocks, such as ethylene, which finds use in lubricants in ethylene-propylene copolymers (viscosity modifiers) or when oligomerized into linear alpha olefins (LAOs), which are the feedstocks for PAO and provide the alkyl chains that allow certain detergents to be oil soluble. LAOs also can be produced directly from natural fats and oils.

Bioethylene is usually produced by the dehydration of bioethanol, which sounds like a strong start for sustainability. However, ethanol and ethylene prices trade in roughly the same range, so there is little financial incentive to invest in converting bioethanol to bioethylene.

This raises the financial sustainability conundrum: if you can’t turn a profit, you don’t stay in business.

In assessing sustainability, intending users of bioethylene should look one step further upstream. Many sources of bioethanol are food crops, which is counter to SDG 2. So, non-food sources or products previously thought of as wastes are preferred. One such is “cellulosic” ethanol; this indicates that the source is the non-food part of a plant—the cane of sugar cane, corn stover, grasses or wood—or algae.

Similar considerations apply to other bio-sourced chemicals, showing both the value of the LCA in considering the whole life of a product and the potential complexity. For bio-sourced materials a separate LCA could be required for different sources of what is otherwise the same raw material

(see Multiple LCAs).

Certification

Many companies seek external certification to support the credentials of their products, and there are several opportunities for bio-sourced and circular products. These include the International Sustainability and Carbon Certification scheme (ISCC Plus)

5 and REDcert2.

6

“ISCC Plus is a voluntary, globally recognized sustainability certif ication scheme, which allows companies to demonstrate the sustainability credentials of their biobased, bio-circular and circular materials,” says Marika Rangstedt, sustainability manager at Nynas, based in Stockholm, Sweden. “The certification scheme provides traceability across the value chain by securing verifiable bookkeeping. Annual audits conducted by ISCC-accredited independent certification bodies verify compliance to the scheme.”

Other schemes that include either self- or external certification include the EU Ecolabel,

7 Environmentally Acceptable Lubricants8 or the German “Blue Angel” scheme.

9 Many companies in the lubricants supply chain have brief reviews of the different schemes.

10

For Booth, accreditation against ISO 50001 (Energy Management) “helps us to make the business case for changes that would otherwise go under the radar—simple energy saving measures, such as high-speed roller doors for the warehouse.”

Multiple LCAs

Can a product be defined by a single life cycle? Not in most cases, according to Downey. “We have done two LCAs for our products so far, and we can use differently sourced raw materials to begin our process. Some palm oil is farmed under the conventions of the Roundtable on Sustainable Palm Oil (RSPO). We need to take into consideration differences in the life cycle data from the suppliers upstream.”

Speaking at the 24th ICT in January, Matthew Kriech, CEO of Biosynthetic Technologies (BT), explained that while the general methodological framework of an LCA is defined by the standards, there are still many choices to make when finalizing the goal or scope of the project. These include impact categories (e.g., climate change, acidification, eutrophication, land use and many others) and the scope types, such as cradle-to-gate (raw materials and manufacturing) or cradle-to-grave, which adds distribution, use and disposal. A climate change assessment might consider GHG sources or sinks from fossil and biogenic emissions, CO

2 uptake and land transformation. Evaluations usually cover multiple raw materials or raw material sources, refined raw materials or products, and processing data over several months of production.

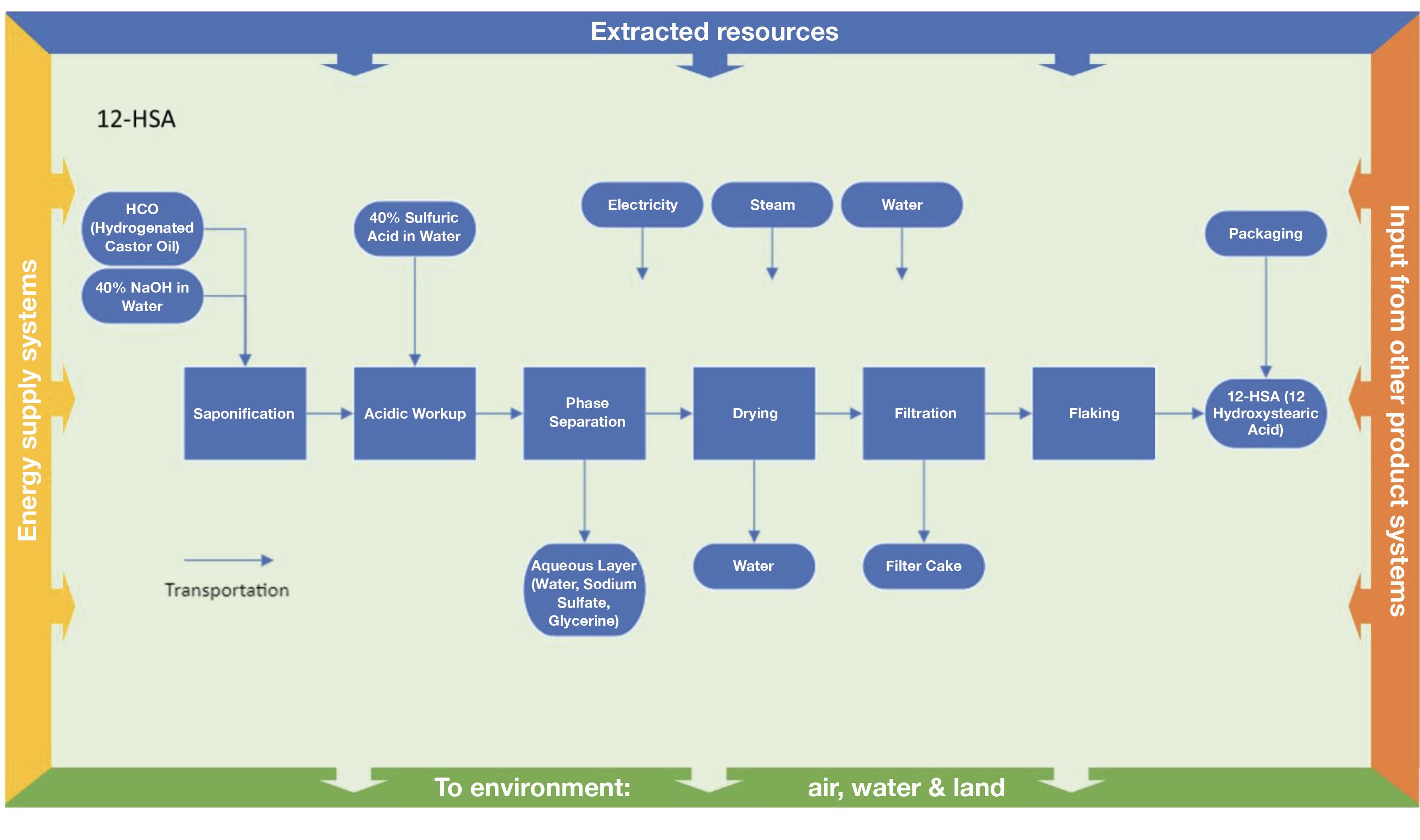

The considerations for the processing of hydrogenated castor oil to 12-hydroxystearic acid are shown in Figure 3. In the six processing stages, there are two chemical inputs, three byproducts and utility use, illustrating how much data are required for a relatively simple chemical process. With such data requirements, Downey points out that “it is likely to be easier for [small companies with a simple product line] to do the LCA work vis-a-vis a fully integrated, [API] Group IV base oil supplier. Many [base oil suppliers] are still working on their first [LCA].”

Figure 3. Process flow for conversion of hydrogenated castor oil (HCO) to 12-hydroxystearic acid. Figure courtesy of Biosynthetic Technologies.

Figure 3. Process flow for conversion of hydrogenated castor oil (HCO) to 12-hydroxystearic acid. Figure courtesy of Biosynthetic Technologies.

One significant finding for BT was that estolides partially derived from coconut/soy oil had around three times higher net cradle-to-gate emissions measured in CO

2e per metric ton of product, mainly driven by the negative effects of coconut agriculture on ecosystems. “Feedstock choice can heavily influence emissions,” Kriech told his audience. Economies of scale in manufacture also clearly reduced the CO

2 intensity of the products.

Two upstream factors could reduce the CO

2 intensity significantly. Improved efficiencies in castor farming requiring lower fertilization would reduce the base castor oil fossil emission, which is over half of the impact of an estolide. Some castor oil users are encouraging suppliers to follow a sustainable castor initiative.

11 The second factor is grid carbon. For example, India is currently heavily dependent on coal for electricity generation.

Scopes 2 and 3

According to Serra-Holm, “The latest UEIL methodology development in PCF calculation

(see Product Carbon Footprint and Life Cycle Assessment) is a step in the right direction. However, it is important to take into account the use of lubricants as well, and therefore our goal in the short term should be to develop robust LCA methodologies, so that we as an industry can both contribute to and take the right course of action to reach the 2050 goals.”

STLE Fellow professor Ian Taylor of the University of Central Lancashire is among several who have pointed out

12 that, for many applications, GHG emissions during the use phase are far greater than those due to production and disposal. For example, lubricants with synthetic base stocks are often perceived as carrying a significant CO

2e deficit relative to mineral oils, due to higher manufacturing CO

2 emissions. “But the difference is small, maybe an extra 0.5 kg of CO

2 emitted per liter of synthetic lubricant manufactured, compared to mineral lubricants,” he says. “The use of synthetic, low viscosity lubricants can lead to substantial fuel economy savings compared to mineral oil alternatives, and the CO

2 savings [in use] outweigh any slight differences in CO

2 generated during the lubricant manufacturing process.

13 Even greater CO

2 benefits can be realized if the used lubricants are re-refined and re-used at the end of the oil drain interval.”

Circularity

Re-refining transformer oils or to produce new base oils are good examples of circularity, or cradle-to-cradle. Nowadays, re-refining technologies are capable of producing highly paraffinic products with properties closer to those of API Group III.

14

In most G20 countries, used oil re-refining is now a significant activity, but in many developing countries used oil has a higher or more consistent value if it is used as a fuel source. Extended Producer Responsibility (EPR) legislation for used oils—introduced in Vietnam and India in 2024, for example—aims to improve the management of used oils, by mandating that lubricants producers must ensure a minimum quantity of their product is collected after use by licensed collectors and delivered to licensed re-refiners.

Another EPR area is recycling packaging. Steel drums and other larger containers can be cleaned and reused, but plastic packaging also must be melted down before reuse. Contamination—either by incomplete cleaning or mixing plastic types—can degrade the resultant product, reducing the number of applications in which it can be used, and therefore its financial value.

Contamination of lubricants also is an issue. Re-refining processes are designed to remove additives and in-use contaminants, such as water, wear and oxidation products, glycol-based coolants, dust, grit and grease. However, unintended contamination with an incompatible fluid can have dramatic effects. Contamination is much higher where individual consumers are concerned.

Why do it?

“It’s said that ours is the first generation to understand the impact of climate change, and the last which has time to do something about it. I don’t want us to be remembered as the generation that was too comfortable to change,” says Peter Vickers, fifth generation managing director of the lubricants and greases company Vickers Oils, based in Leeds, UK. Vickers also is a member of the UEIL Sustainability Committee, which succeeded the Task Force, and is co-chair of the Downstream Working Group, which is developing practical advice on lubricants use and end of life.

“Leadership does not depend on size,” says Vickers, refuting that sustainability initiatives can only be led by regulators or the majors. In the 1990s, the first biodegradable stern tube oil was developed many years before the U.S. Environmental Protection Agency (EPA) issued in 2013 the Vessel General Permit (VGP), which was the first regulation to mandate the use of environmentally acceptable lubricants (EALs).

“We are a UK-based SME, with seemingly little leverage in the U.S.,” says Vickers. “But when we heard that the U.S. EPA was seeking input on the feasibility of a regulation for marine EALs, we approached the EPA and offered detailed, evidence-based input, which they took seriously.”

For the VGP, eco-toxicological aspects of lubricants were given priority: biodegradability, toxicity and bioaccumulation are the key criteria, as the VGP addresses water quality. Many EALs are based on renewable feedstocks.

Other pressures are apparent in the textile industry, where pressure for greater sustainability is cascaded from major brands through their global supply chains. “Some of these requirements can mitigate against some low-carbon or biobased products,” says Vickers.

Sustainability matters, but what does it mean?

“Sustainability is a much broader, wider concept than just carbon emissions. And it means different things to different people,” says Vickers. “As a company we have learnt to ask customers, ‘What does sustainability mean to you?’”

For Booth, “Good sustainability should equal good business, if you have the correct mindset.”

REFERENCES

1.

Gapminder,

www.gapminder.org/sdg/

2.

Amoroso, S., Herrmann, B. and Kritikos, A. (October 2023), “The role of regulation and regional government quality for high growth firms: The good, the bad, and the ugly,”

DIW Berlin, Discussion Paper No. 2053,

http://dx.doi.org/10.2139/ssrn.4619861.

3.

Click

here.

4.

Krüger, C., Kicherer, A., Kormann, C. and Raupp, N. (2018), “Biomass balance: An innovative and complementary method for using biomass as feedstock in the chemical industry,” in: Benetto, E., Gericke, K. and Guiton, M. (eds), “Designing sustainable technologies, products and policies,” Springer, Cham,

https://doi.org/10.1007/978-3-319-66981-6_12.

5.

Together for Sustainability PCF Guideline,

https://tfs-initiative.com

6.

Click

here.

7.

Click

here.

8.

Click

here.

9.

Click

here.

10.

Click

here.

11.

Sustainable castor initiative eyes the future and encourages the participation of women - Solidaridad Network, click

here.

12.

Taylor, R. I. (2023), “A closer look at sustainable lubricants,”

Tribology Online, 18 (6), pp. 268-274. Available

here.

13.

Ishizaki, K. and Nakano, M. (2018), “Reduction of CO2 emissions and cost analysis of ultra-low viscosity engine oil,”

Lubricants, 6 (4), 102. Available

here.

14.

Click

here.

STLE member Trevor Gauntlett is a freelance writer and consultant on lubricants based in Wirral, UK. You can contact him at trevor@gauntlettconsulting.co.uk.