The U.S. Environmental Protection Agency (EPA) has published its most recent report on automotive trends,

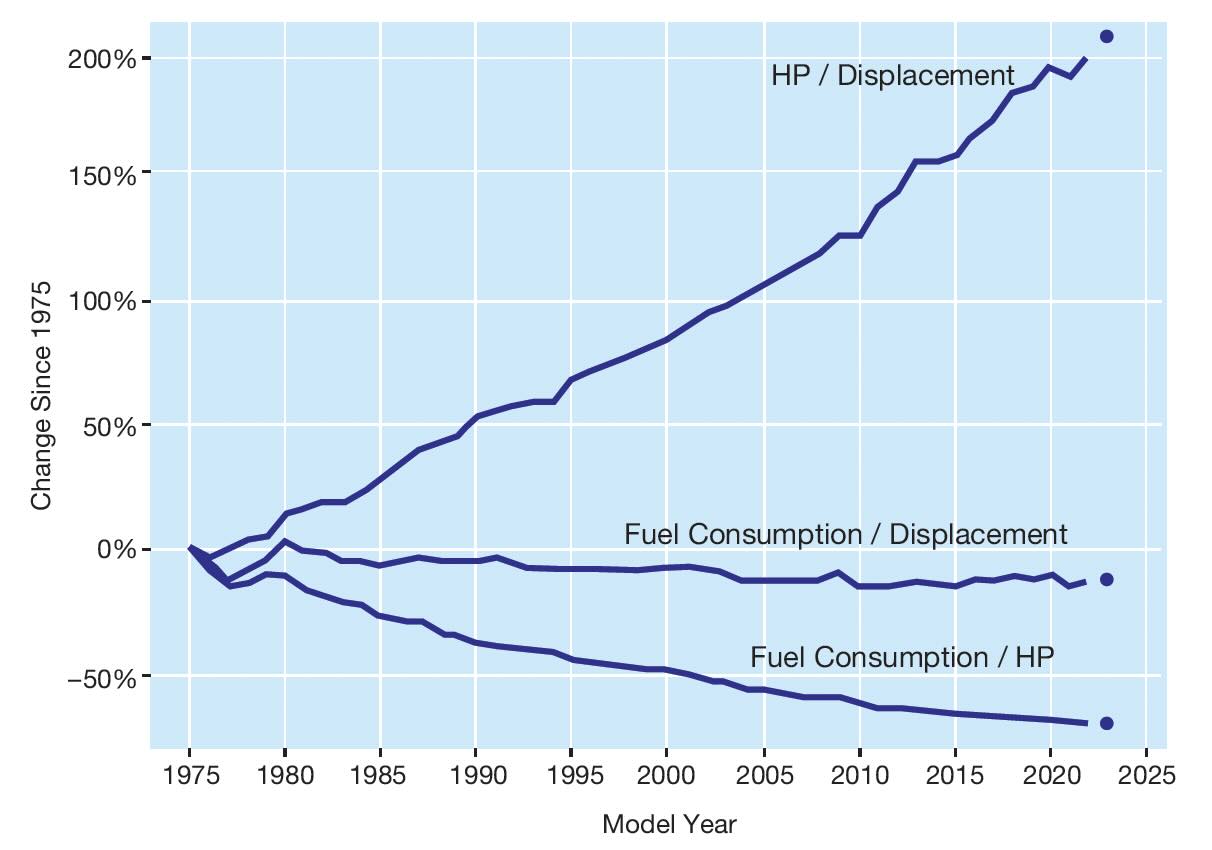

1 and as usual it is filled with interesting data and thought-provoking analysis. Regarding the gasoline engine, Figure 1 presents a milestone of interest to the automotive tribologist.

Specific output of gasoline engines in the U.S. has tripled since 1975

(see Figure 1), while specific fuel consumption actually decreased slightly. The report gives many reasons for this impressive accomplishment, and further states:

“

Considering the numerous and significant changes to engines over this time span, changes in consumer preferences, and the external pressures on vehicle purchases, the long-standing linearity of this trend is noteworthy. The roughly linear increase in specific power does not appear to be slowing.”1

Figure 1. Percent change for specific gasoline engine metrics.1

The report goes on to list a number of improvements that have contributed to these gains, including fuel delivery systems (port fuel injection and, more recently, gasoline direct injection), multi-valves per cylinder, variable valve timing, turbo-downsizing, cylinder deactivation, mild and strong hybrids and the increasing number of gears in transmissions. While automotive tribologists have certainly contributed to many of these developments, they have probably noticed a glaring omission from honor roll, namely, engine oil. The migration to lower viscosities, and the increased use of friction modifiers, certainly deserve recognition for their role in making these improvements.

In fact, the word “oil” appears only once in the entire 172-page document, and in an appendix during a discussion of “alternative fuel relative to gasoline-from-oil,” clearly a

reference to crude oil, not lubricating oil.

The report also shows that carbon dioxide emissions from passenger vehicles in the U.S. have continued to decrease, due almost entirely to the increasing share of electric vehicles (EVs), including plug-in hybrids (PHEVs), which can operate as an EV, at least for a relatively short distance. In 2023, EVs accounted for nearly 9% of total vehicle sales and PHEVs another 3%. This combined 12% market share for EVs is up from about 7% in 2022.

While such an impressive growth rate is unlikely to be sustainable, it seems safe to say that enough consumers are finding EVs that meet their transportation needs at a sufficiently affordable price that the segment will grow significantly for the foreseeable future. While EVs are still more expensive, the prices continue to drop and are now at a point where fuel savings can be expected to make up for the initial cost over a reasonable period of time. Charging infrastructure also is improving rapidly, as has the average range on a single charge. As of 2022, the average range for a new EV in the U.S. is 488 km (about 305 miles), more than four times the average range in 2011.

That just leaves recharging time as the last great barrier to widespread EV adoption. If we ever figure out how to push that much power through wires of finite conductivity, and do it cheaply, internal combustion engines in cars could become a novelty in the not-too-distant future, much like steam locomotives are now!

REFERENCE

1.

EPA-420-R-23-033 2023 (December 2023), “The 2023 EPA Automotive Trends Report: Greenhouse Gas Emissions, Fuel Economy, and Technology since 1975.” Available at

www.epa.gov/automotive-trends.