The metalworking fluids (MWFs) market undoubtedly was the hardest hit by the global pandemic—and while some of the most acute issues like supply chain disruptions, logistics slowdowns, unavailability of the workforce and reduced demand disappeared along with the pandemic, important structural changes have emerged, as the global market aspires to be better prepared for another unexpected global event.

The market for these fluids—which are used in industries that work with metals and employ processes such as cutting, machining, stamping, bending, grinding and heating of metals, along with lubricating and cooling in different metalworking processes—is governed by several diverse applications. They include transport equipment manufacturing, machinery, primary and fabricated metals and more. Within the transport equipment manufacturing, automotive production is by far the largest end-use MWFs consuming segment, and this will be precisely the battlefield where fundamental changes with repercussions for the MWF market will take place.

The rise of EVs and shifts to new MWFs demand hubs

Electrification of transportation is regarded as a key technology to decarbonize road transport, posting exponential growth over the last years. As reported by Kline

1 in 2017 electric vehicles (EVs)—including battery electric vehicles (BEVs) but also plug-in and full hybrids—represented less than 2% of the total passenger vehicle parc in 14 select country markets; in 2022, they already accounted for 5%, and its share is foreseen to reach nearly 25% in 2032.

With the imminent ban of new car sales

2 based on internal combustion engine (ICE) technologies happening in the next decade in Europe, automotive manufacturers (OEMs) have unveiled significant EV spending plans, allocating billions of dollars to scale up their EV manufacturing capacities, particularly for battery production. EV manufacturing is different from ICE vehicles manufacturing, and the growth of the former will have a significant impact on the demand for MWFs.

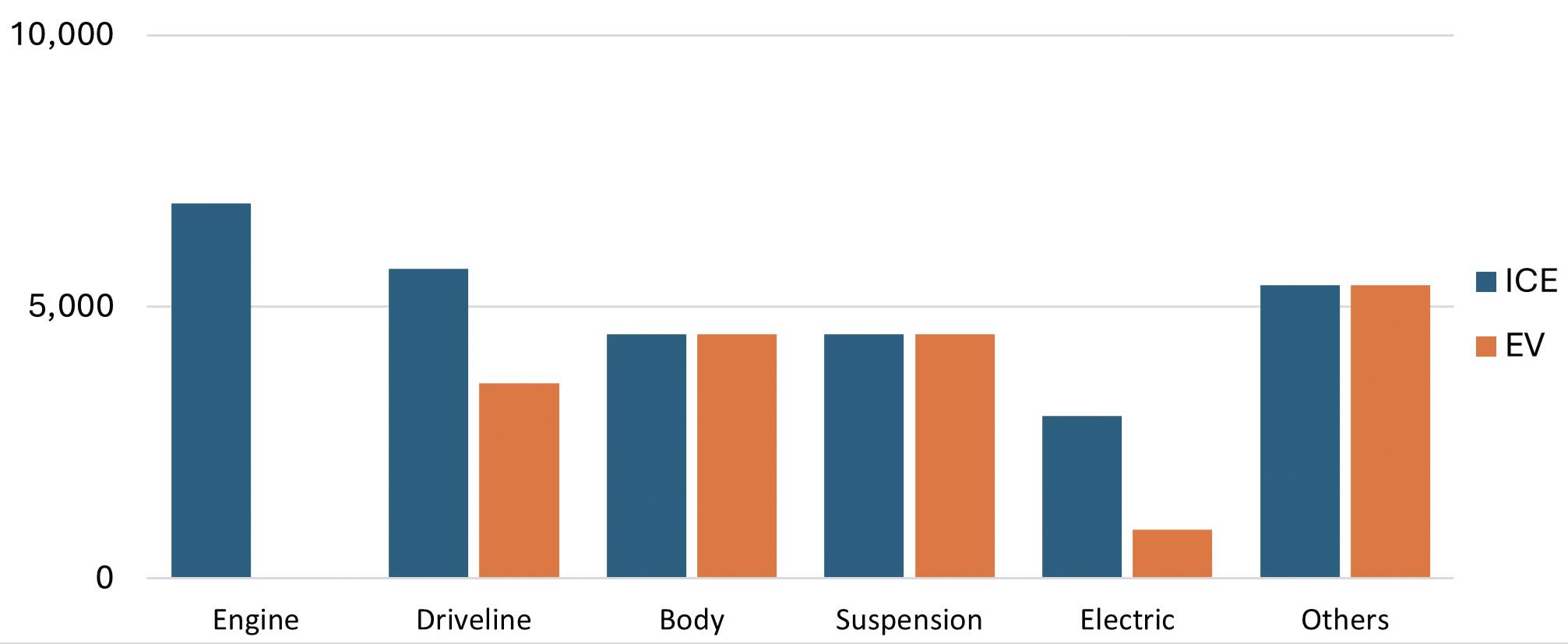

EV manufacturing will lead to a reduction in the number of components, and consequently a decline of MWF demand, especially in processes involved in the manufacturing of power generation and power transmission components. On the other hand, the impact of manufacturing processes involved in the manufacturing of electrical and electronic components including battery and electric motors (e-motors) on MWF demand will be lower

(see Figure 1).

Figure 1. Comparison of number of parts between ICE and EV.3

Figure 1. Comparison of number of parts between ICE and EV.3

Moreover, the key locations generating MWF demand also will undergo significant changes responding to new market fundamentals and evolving geopolitical order.

Shift of MWF demand from West to East, and North to South

So far, the EV manufacturing installed capacity was predominantly localized in the largest EV sales markets, notably in China, the U.S. and in Western European countries. But the new challenges including high inflation, geopolitical tension, more active governmental intervention and the return to protectionism will inevitably lead to a realignment of the global supply chain, and consequently a shift in MWFs demand hubs.

•

Chinese EV players disembarking in overseas markets. In early stages, the overwhelming expansion of production sites was initially addressed for the domestic market. However, with the saturation of the Chinese EV market, combined with the urban Chinese consumer shifting from car ownership to ride sharing options and resulting rationalization, Chinese EV manufacturers are likely to target overseas markets more aggressively, especially high-value ones such as Europe, but also South Asian markets for price-conscious customers. This external consumer demand would drive the construction of new EV projects in China.

•

Back to protectionism. The EV market is not only characterized by a fierce competition, but the EV market also has a strong geopolitical subtext, with the European Union (EU) launching an anti-dumping investigation into the Chinese EV industry, following complaints from EU manufacturers that vast subsidies and bank lending from Beijing underpinned the expansion of Chinese manufacturers.

•

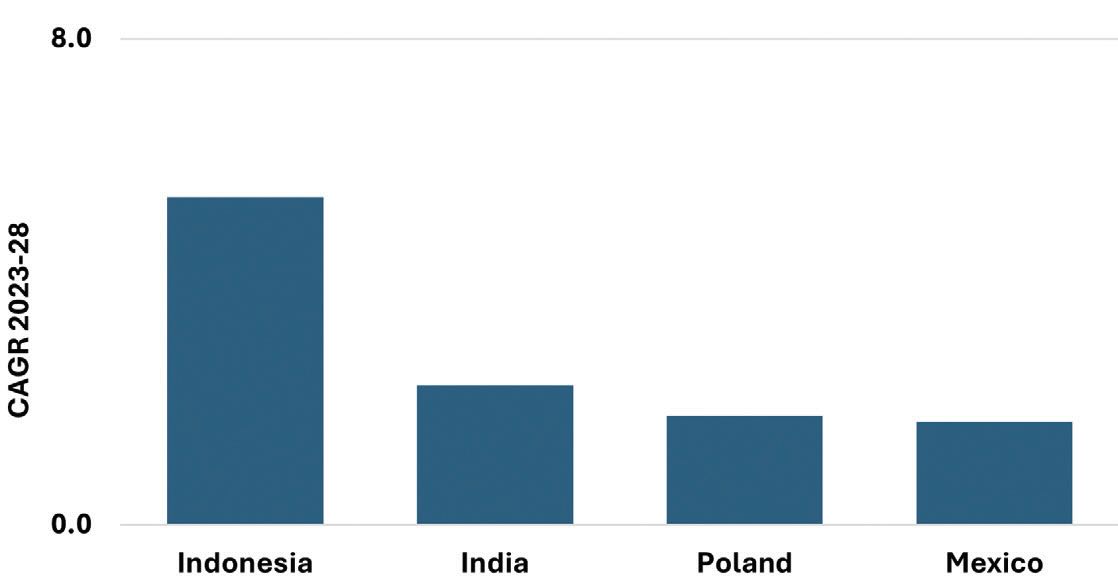

Ongoing U.S.–China tensions. Amid the incurring decline of Chinese exports to the U.S., Mexico has been a clear winner. In 2023 Mexico surpassed China as the biggest exporter of goods as per the Bureau of Economic analysis, indicating the beneficial effect of the U.S. Inflation Reduction Act (IRA) on the Mexican industry. Under the IRA initiative EV manufacturers in the North American Free Trade Agreement are entitled to receive tax breaks offered by that program. Mexico has been a clear winner, but there are other countries that could also benefit like India, Indonesia, Vietnam, even Poland, all countries which could take advantage of waning U.S.–China trade flows.

•

Global nearshoring and intra-regional offshoring. The various global crises happening recently also have revealed sensitive structural vulnerabilities in the automotive global supply chain, and as a result more companies are proactively relocating their manufacturing of essential components back to their home markets from other regions, mainly from Asia. Contrarily, offshoring of manufacturing activities within the same region has remained unaltered, especially within a common market (EU), which is evidenced by ongoing investment plans made by German OEMs opening manufacturing to Eastern Europe, namely Poland

(see Figure 2).4

Figure 2. Estimated metalworking fluids demand growth forecast for select countries.

As new EV production sites will become operative, higher competition is anticipated in the MWF market, with a multitude of MWFs catering to this increased demand. However, it is expected that this upward pattern in MWF consumption will have an inflection point, when it will eventually start to decline as the EV transition progresses, along with improvements in housekeeping and maintenance practices. Kline’s recently published “EV Manufacturing Impact on Metalworking Fluids”

5 report addresses these and other pressing questions affecting the MWF market. This report provides a view on the timeline of the expected market contraction, and what volume would be potentially lost in the forecast period under various scenarios.

Most importantly this research is highlighting markets where a substantial MWF market growth can be expected in terms of countries and applications, but also where the performance requirements and the product offers are differentiating in responding to emerging or specialized processes and applications specific to EV manufacturing, especially BEVs.

REFERENCES

1.

The PCMO Market in 2050: A Long-term Outlook.

2.

Fit for 55 legislation. Available

here.

3.

Osan University Survey.

4.

Click here.

5.

Click here.

Sharbel Luzuriaga is Industry Manager at Kline. You can reach him at Sharbel.Luzuriaga@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.