The challenges of climate change have drawn global attention among policymakers, prompting them to set goals to reduce the total carbon footprint and eventually become carbon-neutral or carbon- negative. This effort has already been kickstarted in a few heavily polluting segments, one being transportation.

When it comes to the decarbonization of transportation, every government has its own agenda. In the U.S. and many European nations, achieving carbon neutrality and sustainability prevails, while China currently focuses on dominating the market in strategic areas, such as electric vehicles (EVs).

There is an undeniable commonality that emerges from the global market intelligence and insights agency, Kline, and its report on the impact of electrification on the fluids and lubricants market. This is shown in the various subsidies and incentives that are driving EV sales globally.

However, the range and intensity of such incentives broadly differ from country to country. For instance, China primarily prioritizes the development of a local EV industry as part of its broader government agenda to increase competitiveness.

In the early stages, national and regional governments in China have implemented policies with the objective of promoting EV sales, creating the necessary market conditions for mainstream EV adoption. Currently, China’s EV industry has entered the next phase in the EV transition, where the government is redirecting these incentives, from promoting EV sales to offering subsidies focusing on EV manufacturing.

Chinese EV manufacturers were able to largely reduce production costs, thus significantly increasing the cost competitiveness of Chinese EVs against those from the U.S. or European OEMs. For illustration, a few examples are listed in the JATO 2023 Webinar series (by Felipe Munoz):

1

•

Average Chinese EV price in H1 2023 at EUR 31,000 is less than half of the U.S. (EUR 68,000) and Europe (EUR 65,000).

•

In China, EVs are cheaper (by EUR 11,000) than ICE vehicles. In contrast, EVs are more expensive than ICE vehicles in the U.S. (by EUR 17,700) and Europe (by EUR 18,800). In Europe, only Norway has EV prices lower than ICE vehicle prices, because of high ICE taxation.

•

China has 75 models priced at or below EUR 20,000. Europe and the U.S. have none.

The ability of Chinese EVs to optimize production costs can be attributed to several factors intrinsic to the China market, including lower labor costs, high government support and lower safety standards. Lower battery costs in China compared to the rest of the world is another crucial competitive advantage. The country aims to build a battery capacity that will reach 1,500 gigawatt hours this year; this represents more than twice its domestic demand needs.

2

This is the reason why European OEMs (who have more pressure to electrify compared with some North American counterparts) are very jittery as they witness how Chinese EVs are rapidly gaining market footprint in European home markets over the last few years. As a matter of fact, Chinese EV sales reached 8% of the total Europe EV market in 2023, and it is expected to reach a 15% share in 2025. This rapid expansion of Chinese EV players has raised concerns among European institutions. The EU Commission started an investigation in September 2023, and the decision is due to be announced soon. If the EU Commission finds that Chinese EVs sell their vehicles at artificially low prices, the EU Commission may decide to impose tariffs on Chinese EV imports. This could give European OEMs some margin of time to gain competitiveness.

Relatively severe restrictions have been adopted in the U.S. on the components of Chinese provenience, such as batteries and critical metals in EVs, under the Inflation Reduction Act (IRA). Similarly, India is another major market resistant to open doors for Chinese OEMs.

Conversely, the influx of affordable EVs from China could help accelerate EV deployment in developing countries in Asia and Latin America, which are all markets characterized by a low EV diffusion rate, currently. In most of these emerging economies, the purchase of EVs is not financially subsidized, despite the few incentives being offered at the state or local level. Growth in Chinese EV sales in Southeast Asian markets corroborates this trend. For instance, Chinese OEMs have an 82% market share in Thailand and 60% in Mexico for EV sales.

1

The expansion of Chinese EVs can tap considerable opportunities in the EV fluids market. The rise of EVs represents an opportunity to prompt innovation in the next generation of lubricant formulations customized to be used in EVs. The formulation of next-generation fluids will be based on the industry collaboration between OEMs and tier 1 supplier engineers on one side, and lubricant formulators and additives suppliers on the other.

The growing popularity of Chinese EVs could expand the geographical market footprint for Chinese lubricant blenders, which benefit from its strong relationship with domestic automotive OEMs.

Global market incumbents also are entering into several tie-ups with Chinese EV manufacturers. Reportedly, major global players are currently partnering with new EV players to develop three-in-one transmission fluids. This closer cooperation will enable lubricant suppliers to gain and defend market share, especially in fast-growing markets embracing EVs via affordable Chinese EV brands.

Factory-fill applications such as EV-dedicated transmission fluids, immersion cooling fluids and EV greases are expected to exhibit the highest market dynamic since they are high-margin, low-volume market segments, as some of them are marketed as fill-for-life products.

Opportunities in the service-fill segment are expected to be rather limited in the short/mid-term. However, in the long run, the service fluid demand is expected to gain prominence because the maintenance and service of EVs will be more frequent as they start to age.

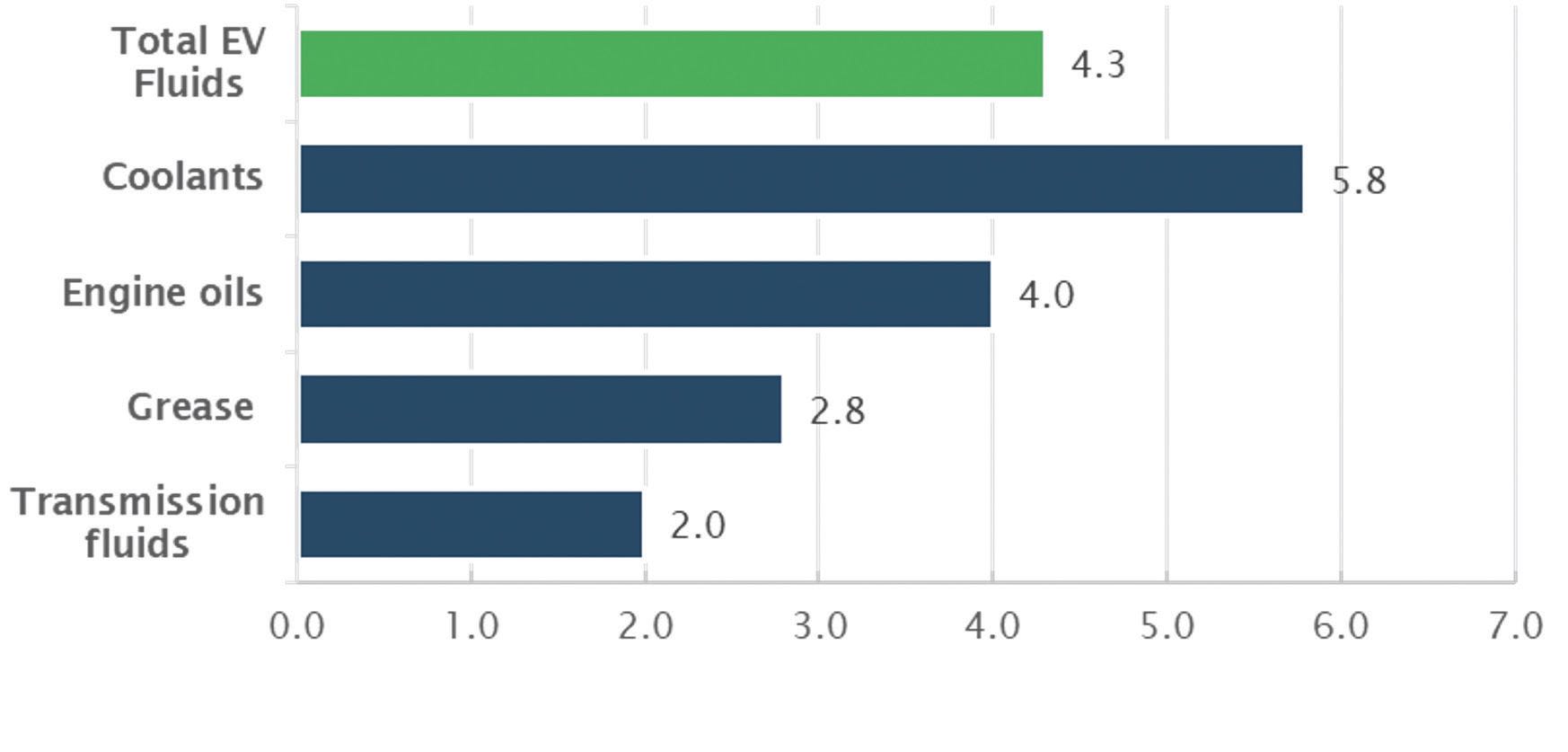

EV fluids are foreseen to experience rapid growth owing to the expansion of the EV population in China

(see Figure 1).

Figure 1. Estimated EV fluids demand growth in China by product category, 2022-2050. Figure courtesy of Kline’s EV Fluids Report.

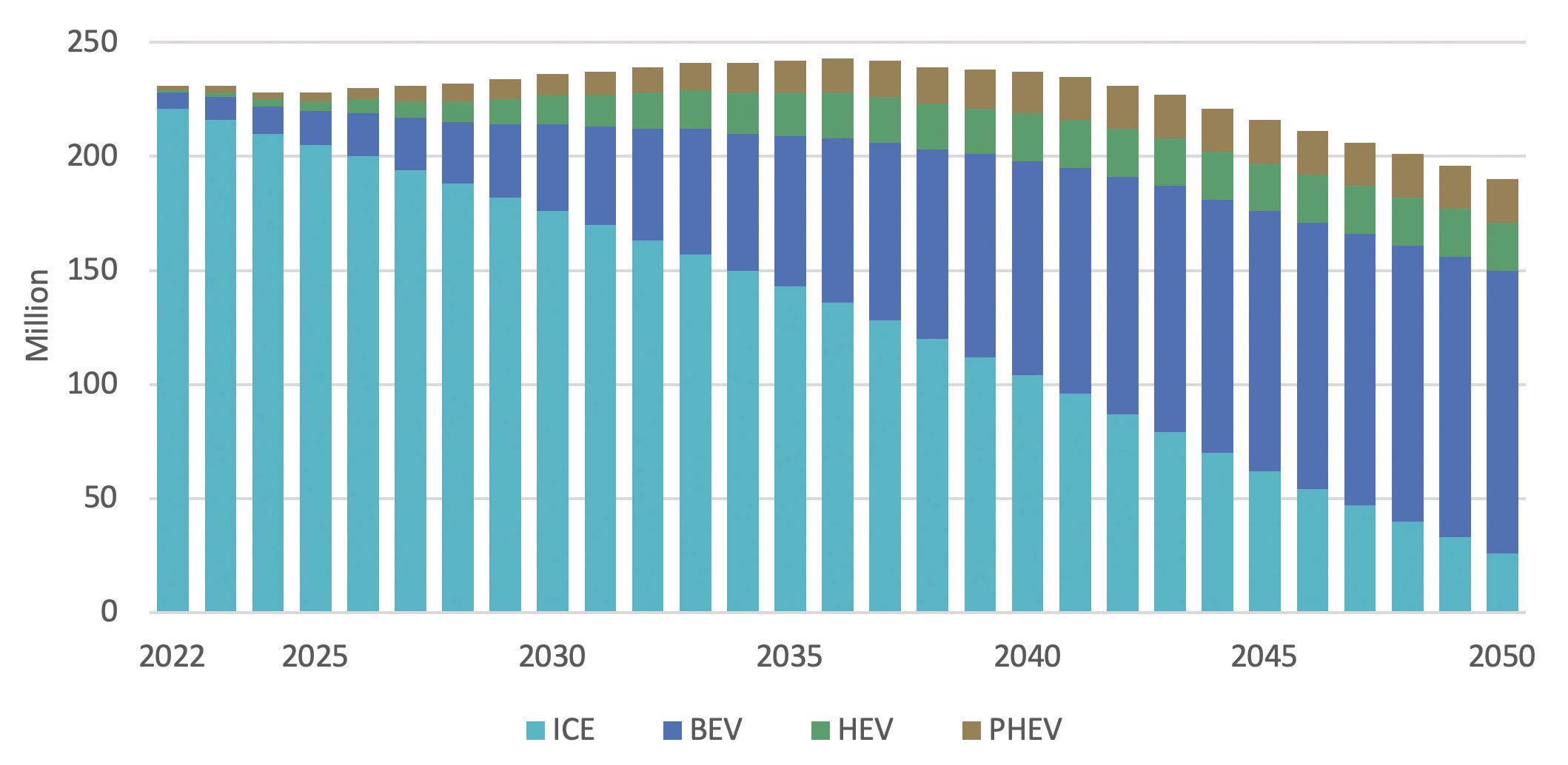

However, Kline’s projections indicate that the population of personal vehicles in China will decline since drivers in China will increasingly opt for car sharing, instead of owning a new vehicle. Therefore, leading Chinese EV manufacturers will increasingly be turning their sights to overseas markets, despite the policy roadblocks present in the EU and the U.S. The market trends for EVs are set to continue shifting for the foreseeable future

(see Figure 2).

Figure 2. Baseline EV passenger vehicle park penetration China, 2022-2050. Figure courtesy of Kline’s “The PCMO Market in 2050: A Long-Term Outlook.”

REFERENCES

1.

www.jato.com/newsroom/resources/webinar-recording/

2.

www.crugroup.com/

Sharbel Luzuriaga is Industry Manager at Kline. You can reach him at Sharbel.Luzuriaga@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.