The global wax industry is experiencing pronounced volatility. Wax supply saw some sudden changes during the volatile global environment of 2020 to 2022, when a number of petroleum wax suppliers exited the market and, on the other hand, synthetic wax suppliers expanded their capacities. Demand for waxes also is seeing uneven growth in different applications, impacted by the uncertain global macroeconomic conditions. Demand for waxes in candle applications, for instance, saw sharp growth during 2020 and 2021, while other applications such as polyvinyl chloride (PVC) and board sizing experienced spurts and slowdowns, influenced by regional macroeconomics.

The upheaval in the wax industry also has spilled over to wax prices. The fluctuations in global energy prices due to the Russo-Ukrainian war and disruptions in the energy supply chain, coupled with sudden changes in wax supply, have sent the wax prices soaring in the last two to three years.

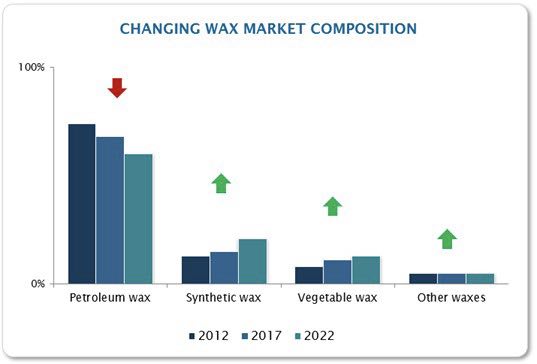

Changing wax supply landscape

During the period from 2020 to mid-2023, wax-producing Group I base stock refineries witnessed weakening financial conditions, uneven demands and an uncertain geopolitical environment, resulting in the closures of several of these refineries. Many Group I plants, especially in Europe, were already struggling to stay afloat even prior to the COVID-19 crisis as a consequence of the technical obsolescence of Group I base oils and increasing focus on Group II and Group III base oils. The economic impact of the 2022 crisis pushed these facilities further to take the plunge. Some of the leading wax-producing refineries ceased wax production between 2020 and 2023

(see Figure 1).

Figure 1. Changing wax market composition.

Figure 1. Changing wax market composition.

The supply of synthetic waxes during the same period witnessed significant capacity additions. In particular, Chinese Fischer-Tropsch (FT) wax suppliers added large production capacities between 2020 and 2022 and have been filling up the gap created by the global petroleum wax deficit. Existing FT wax suppliers in China have creased their supply. Moreover, a new supplier emerged in this market and is now expanding fast. Many of these suppliers plan to continue increasing FT wax supply over the next five-year period. The supply of alphaolefin (AO) wax also is on an uptrend.

Vegetable oil-derived waxes, on the other hand, are facing new challenges. After experiencing sturdy growth in the past decade, these waxes are likely to see a slowdown in the coming years due to concerns about their sustainable production. The tightening regulatory environment for non-sustainably produced vegetable oils and their derivates is negatively impacting the demand for palm and soy waxes. The trend is growing stronger in regions with more stringent regulatory environments, such as Europe. The European Union (EU) has now applied differentiation between those bio-products or oils that generate a high indirect land-use change (iLUC) risk from those that have no or low iLUC risks. Further, bio-products with a high iLUC risk will be capped at 2019 levels and will be phased out from 2023 onward. This is expected to slow down the future growth of vegetable waxes.

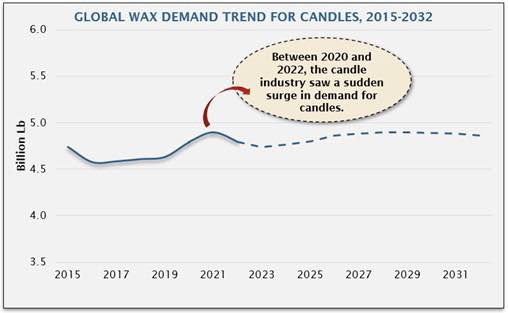

Wax demand is witnessing uneven growth

The economic and social upheaval caused by the COVID-19 crisis has impacted different wax applications differently. Candle applications, for instance, saw a sudden spike in demand for waxes during 2021 and 2022. The continued work-from-home situation resulted in consumers increasingly purchasing home and mental wellness products, including candles, which led to a sudden increase in demand for candles. Additionally, in 2022, geopolitical tensions due to the Russo-Ukrainian war also fueled candle sales in Europe. The fear of reduced natural gas supply and, hence, reduced electricity generation amidst the war caused panic-buying of candles in some European countries. This kept the demand for candles strong in most of 2022, before it began to soften in the last quarter of 2022 and continued to soften in the first half of 2023

(see Figure 2).

Figure 2. Global wax demand trend for candles, 2015-2032.

Figure 2. Global wax demand trend for candles, 2015-2032.

Wax demand in PVC applications, which experienced strong growth in the past decade, has slowed down due to a sluggish PVC market. After seeing a good run in early 2022, the production of PVC decelerated in the second half of 2022. PVC demand in North America experienced a decline of as much as 11% from October to November 2022, caused by weak demand from construction activities amid rising interest rates, high inflation and increased housing prices. During the same period, the Europe PVC market encountered difficulties such as huge inventories and oversupply, high manufacturing costs, imports with competitive prices and low demand. As a result of such conditions, PVC producers resorted to cutting back operating rates during the last quarter of 2022 and in the first half of 2023.

Another high-growth market for wax demand, hot-melt adhesives (HMA), is currently experiencing slackening demand. Demand for HMA is driven by three key applications—automotive, packaging and construction industries. The automotive industry has remained slow over the past couple of years, impacted by both semiconductor shortages and COVID-19 lockdowns. The packaging industry experienced a spike during the lockdown periods driven by the increased consumer purchases of packaged goods, particularly those shipped via e-commerce. However, in 2023, demand for packing has slowed down due to a slowdown in key economies around the world, as well as a significant rise in the prices of raw materials. High inflation rates and high housing prices also have impacted growth in construction activity.

Demand for waxes in most of the other applications has remained weak to moderate over the last quarter of 2022 and the first half of 2023. High inflation rates and the looming fear of recession during this period have kept consumers from demanding high quantities of waxes in their operations.

Wax prices are going through the roof

Wax prices are typically influenced by the price of its raw materials. For example, petroleum wax prices are influenced by the price of crude oil, polyethylene wax prices are influenced by the price of ethylene, and soy wax prices are influenced by the price of soy oil. Wax prices have witnessed high levels of volatility in the past two to three years driven by various factors such as the opening up of the pent-up demand, high logistics costs, high raw material costs and constrained supply of petroleum waxes. Wax prices began to strengthen in 2021 as the lockdown measures were eased and economies started to revert to “business as usual.” Later, during the second half of 2021, waxes, especially petroleum waxes, saw sharp price increases driven by a steep rise in crude oil prices; the average price for low-melt fully refined pe troleum (FRP) wax reached as high as USD 0.85/lb in October 2021.

The trend continued in 2022, during which the average low-melt FRP wax prices remained more than 50% higher compared to the 2019 levels. During the first half of 2022, end-users scrambled to procure wax supplies, which were tightened due to the sudden rise in demand post COVID-19 lockdowns. Market participants were still learning to cope with the persisting supply chain and logistical issues with skyrocketing transportation tanker prices (four to five times higher), which resulted in extremely high delivered prices for waxes. However, during the fourth quarter of 2022, the demand compression for waxes began to ease. High inflation rates and inventory levels also played their part in keeping the demand soft. This resulted in the softening of wax prices toward the end of 2022. In 2023 as well, seemingly slow economic growth is keeping the wax prices from returning back to their high levels of 2022, though the average low-melt FRP price still remains about 20%-25% higher compared to the pre-COVID-19 levels.

Way forward

The global base stock industry is undergoing significant rationalization of Group I facilities, resulting in tightness in the supply of petroleum waxes. In the next five to 10 years, several wax-producing Group I refineries are estimated to undergo this change, particularly in Europe, Africa, the Middle East, Latin America and Asia. The huge deficits that these rationalizations will cause are anticipated to result in a rise in the price of petroleum wax in the future. At the same time, the global wax market is seeing an influx of non-petroleum waxes that are expected to fill the demand gap created by the loss of petroleum waxes. The next five to 10 years are expected to see AO wax supply increases by large suppliers and that of FT waxes by Chinese suppliers. Incremental supplies of these waxes are anticipated to abate the wax market of the substantial loss in petroleum waxes that the global wax market is destined to see over the next five to 10 years. Additionally, natural gas-derived FT waxes are perceived as relatively cleaner than petroleum waxes on the sustainability front. This is likely to also provide some tailwinds to FT waxes in terms of volumetric growth in the future.

Vegetable waxes, which have emerged as the next best option for soft petroleum waxes, such as slack wax and low-melting-point FRP, also will continue slow-to-moderate growth. Despite the slowdown, these waxes will remain buoyant due to the growing demand for softer waxes in candles, personal care and cosmetic applications.

Stiffening market competition among various wax types is likely to drive innovation and customization among wax suppliers. Physically modified offerings such as micronized and powdered waxes, and chemically modified offerings such as oxidized waxes, are increasingly being preferred in high-growth rheological and surface applications. Additionally, the industry will see a growing focus on waxes that are sustainable and circular and have low carbon footprint. Many industry players are already evaluating technologies and market potential for sustainable waxes, driven by the net zero carbon targets announced by market players for their end-users. For example, budding technologies for producing ethanol-based polyethylene wax are being envisaged in Latin America. Moreover, end-users have introduced circular PVC products produced from ethylene that is derived from waste biomass and may use a low carbon footprint wax. Thus, key future success drivers for wax suppliers in this industry will include their ability to provide customized solutions to end-consumers, meet their sustainability requirements and provide a continued reliable supply.

This article is adapted, by permission, from Kline & Company, Inc. To read the original article, visit www.klinegroup.com.

Pooja Sharma is a Project Manager at Kline & Company in the Energy practice. You can reach her at pooja.sharma@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.