China has witnessed a significant transformation over recent years due to the post-lockdown economic downturn, the growing trend of vehicle electrification, increasingly stringent emissions regulations, as well as a shift in the heavy-duty motor oil (HDMO) sales channels.

Economic impact

China’s economy has been undergoing significant changes, with a shift from traditional manufacturing to high-tech industries, such as electric vehicles (EVs) and renewable energy. During the COVID-19 pandemic, China witnessed a growing demand for light and mini trucks. Factors such as ease in pandemic lockdowns, expanding domestic demand and government policies on climate change contributed to the growth of this segment. The urban logistics market, in particular, saw significant growth, creating demand for local delivery vehicles.

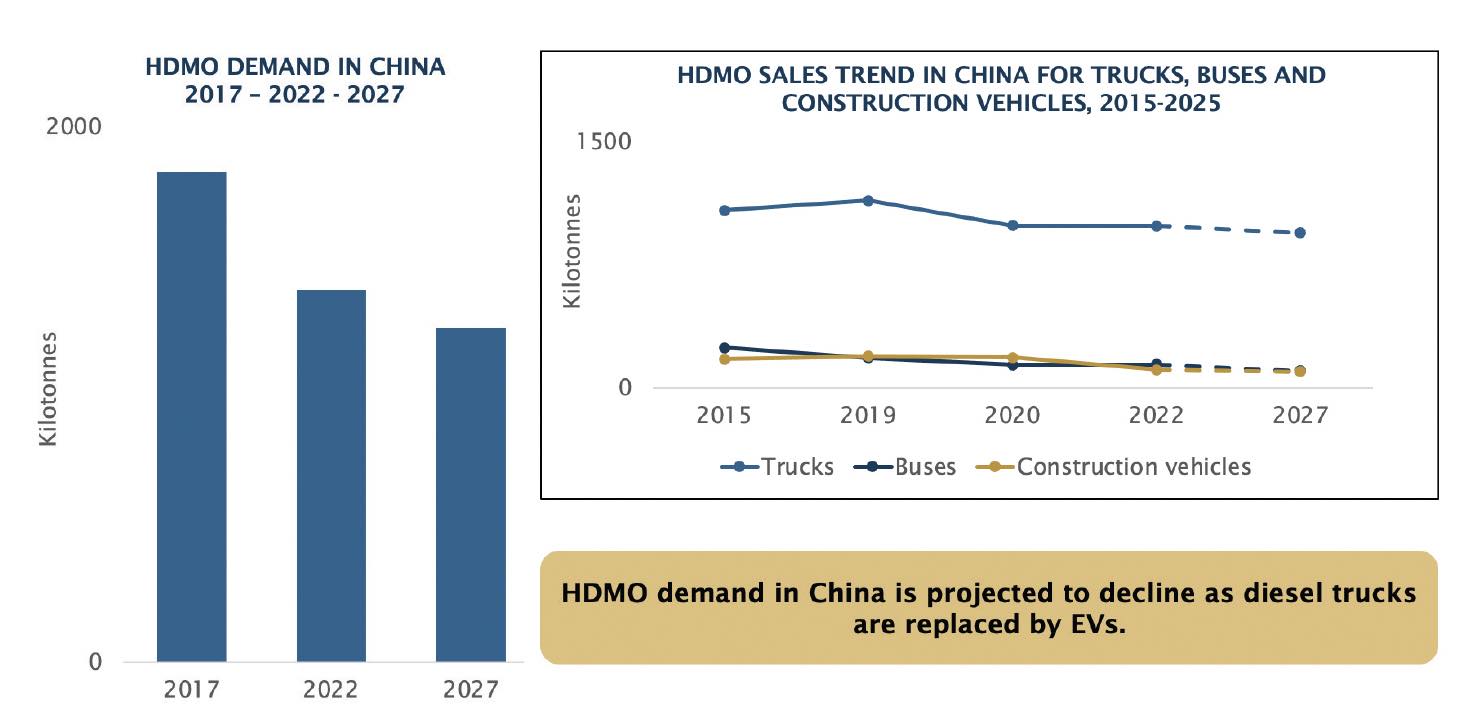

However, the lockdowns also slowed China’s massive economic growth, leading to the continued impact of the COVID-19 pandemic on China’s economy even in the post-lockdown world. The uncertain economy has slowed commercial truck sales from a blistering peak of 4.7 million vehicles in 2020, down to 2.9 million in 2022. While the 2022 figures are closer to pre-pandemic averages, the economic slowdown is expected to continue to drive a decline in new truck sales, with heavy truck demand falling more rapidly. This will negatively impact demand growth for HDMO as the vehicle parc growth slows down and newer trucks consume long drain lubricants.

Electrification

China has emerged as a global leader in the production and adoption of EVs. As the government promotes EVs through subsidies, incentives and supportive policies, the HDMO market faces reduced demand. This is driven by the Chinese government’s desire to make China the leader in EV manufacturing, for which it has secured vast amounts of raw materials required to produce EVs and their massive batteries.

EVs do not require traditional engine oil but consume other lubricants in their transmissions, bearings and cooling systems. However, these applications typically have very long drain intervals, which reduce their service-fill volumes. As EVs increasingly displace diesel trucks in the Chinese commercial vehicle parc, the decline in HDMO demand will visibly start to intensify. In Kline’s study of the China HDMO market, profiled are three scenarios of EV adoption rates and their impact on HDMO demand as EVs, in the longer run, will drive a much greater decline in HDMO demand, especially in the light duty segment.

CO2 emissions

To combat pollution and reduce carbon emissions, China has implemented stringent regulations and standards for vehicle emissions. These regulations aim to improve air quality and encourage the adoption of cleaner technologies. China has already implemented National VI emissions standards, which are similar to Euro 6 emissions regulations. In addition, parts of the country have already started to ban the registration of Nation III and IV emissions vehicles. These changes will drive a step change in demand for more advanced API service category engine oils, such as API CK-4 or CJ-4 lubricants, as OEMs have adopted exhaust gas recirculation (EGR) systems in their National VI-compliant heavy-duty vehicles. These systems require cleaner, dispersant and corrosion-resistant lubricants.

In addition to stricter vehicle emissions, China also has continued to build more electric rail lines to help move people and cargo in a cleaner, faster mode of transportation. However, growing rail use will mean decreased demand for long haul heavy truck transport, which will hurt HDMO demand.

E-commerce and other channels

Online sales of HDMO are relatively nascent in China, accounting for an estimated 2% of sales. Yet, this channel is expected to witness rapid growth at a 14% compound annual growth rate (CAGR) out to 2027. The growth in e-commerce sales will be driven by several factors such as lubricant marketer participation and government regulations to help combat counterfeiting.

Currently, independent workshops (IWS) are the largest channel, followed by franchised workshops (FWS) and retail. However, the China market is experiencing some channel shifts as the market is witnessing more consolidation in the IWS space and a growing number of chain stores with larger purchasing power and better consumer reputation, as well as growing e-commerce.

China’s economy is transitioning from traditional manufacturing to high-tech industries, including EVs and renewable energy. This shift has resulted in a decline in diesel vehicle sales and a growing demand for advanced lubricants that offer improved fuel efficiency and reduced emissions. Lubricant manufacturers have been proactively developing innovative formulations to cater to these changing market needs.

The rise of EVs in China has brought new challenges and opportunities to the HDMO market. While demand for lubricants used in internal combustion engines is declining, there is a growing need for specialized lubricants for EV components. Additionally, the surge in battery production for EVs has expanded the market for lubricants in the battery manufacturing sector.

Stringent regulations and standards for vehicle emissions have prompted the development of high-performance lubricants that improve fuel economy and comply with emissions standards. Lower viscosity grades, synthetic lubricants and cleaner formulations are becoming increasingly important in meeting these requirements.

Market dynamics of the HDMO industry in China revolve around various channels. The IWS channel holds the largest market share, while demand for light and mini trucks is growing due to urban logistics expansion and government policies on climate change.

Looking ahead, the HDMO market in China will continue to evolve. Lubricant manufacturers will need to adapt to the changing landscape, investing in research and development to meet the demands of EVs, improve fuel efficiency and comply with stringent emissions regulations. As China progresses toward a greener and more sustainable transportation sector, the HDMO market will play a critical role in supporting the transition. While HDMO is forecast to decline in demand, it will continue to remain one of the top volume markets globally.

The HDMO market in China is at a crossroads, driven by the interplay of the economy and electrification of vehicles. As the country strives for sustainable development and reduced carbon emissions, lubricant manufacturers must navigate these changes, seize new opportunities and innovate to meet the evolving needs of the market.

In conclusion, China’s HDMO market is undergoing significant transformations as the economy evolves and vehicle electrification takes hold

(see Figure 1).

Figure 1. HDMO market for trucks, buses and construction vehicles in China.

Figure 1. HDMO market for trucks, buses and construction vehicles in China.

More information can be found in Kline’s just published study titled “Heavy-Duty Motor Oil: China Channel Dynamics and Opportunities for Trucks, Buses, and Construction Vehicles.”

David Tsui is a Project Manager at Kline & Company in the Energy practice. You can reach him at david.tsui@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.