Executive Summary

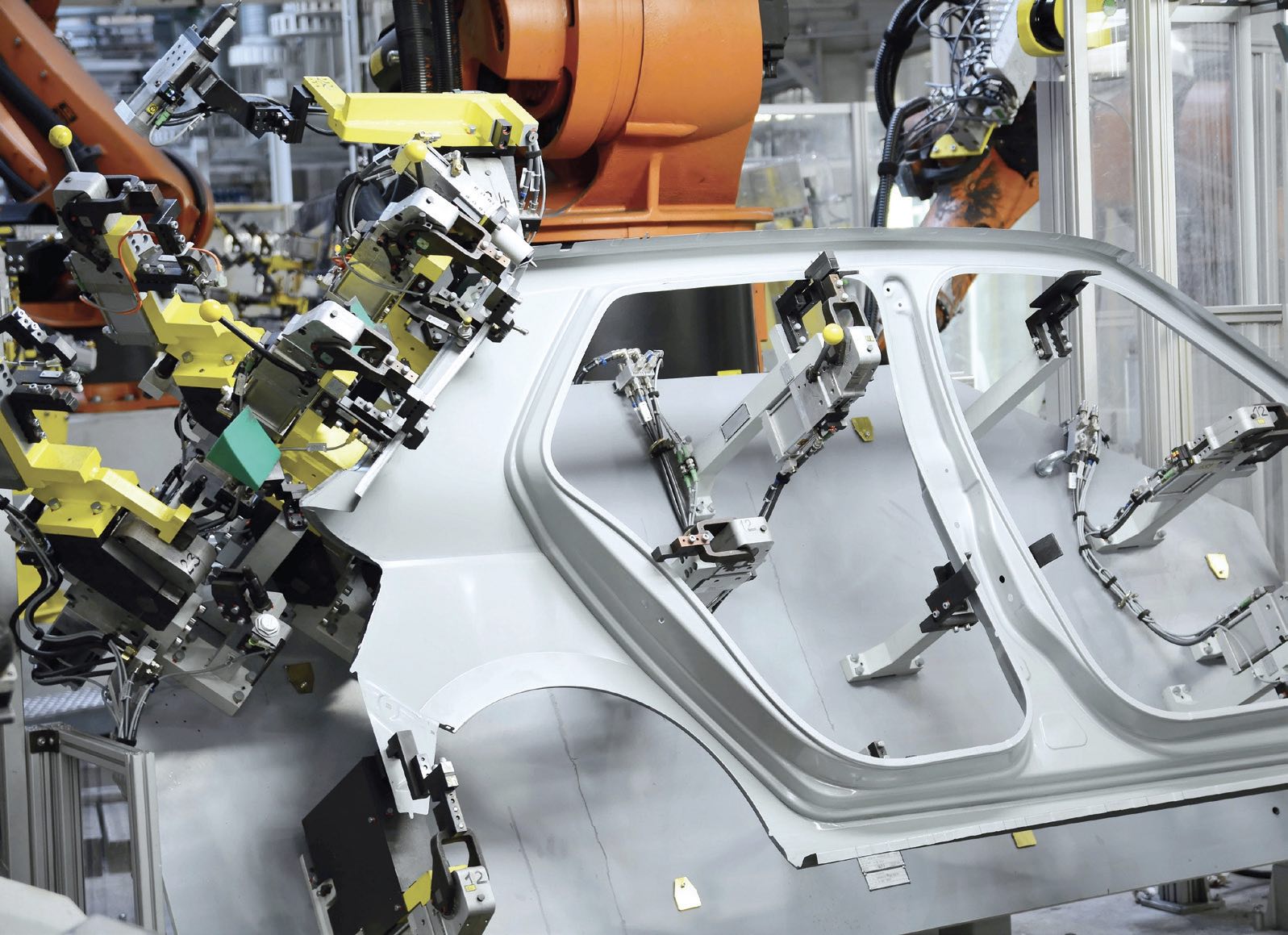

There have been discussions and articles about a possible decline in metalworking fluid usage, but most TLT readers say their companies have not seen a decline in usage in the metalworking industry as of now. In the future, most say the automotive industry will eventually see a decline, along with the machinery and gear industries. Many readers share that they have a diverse portfolio of products to help compensate for this. One reader says, “Our company is putting the efforts on the aluminum die casting process, which needs different kinds of lubricants to complete the process, and it is almost like a processing fluid.” While most agree that 3D printing is the biggest threat to the metalworking industry, opinions are mixed on what factors have the most impact on the reduced consumption of metalworking fluids.

Q.1 What industries will see a decline in metalworking fluid usage?

Traditional automotive.

General machining with imports coming in.

Automotive engine factories.

Mineral oil-based metalworking fluids.

Probably cutting. Our industry (metal rolling) does not see any other decline than improved fluid management (leaks fixing, etc.).

Automotive parts.

Automotive.

Precision nonferrous metalworking, which can be replaced by 3D printing. Also those employing a heavy dose of metalworking additives that are not environment friendly.

Automobile industry.

Automotive.

Certainly automotive. However, as the economics of additive manufacturing improve, metalworking fluid usage is likely to decline across sectors.

Has your company seen a decline in usage in the metalworking industry?

Yes

22%

No

78%

Based on an informal poll sent to 15,000 TLT readers.

Automotive engine manufacturing plants, cylinder blocks, cylinder heads, pistons, crankshafts, connecting rods, water pumps, spark plugs, engine valves, etc.

Automotive, primarily due to the decline in parts that go into electric vehicles relative to internal combustion engine-powered vehicles. I think a lot of this in the American market will be offset by the reshoring that’s being seen in a lot of other industries.

Optical.

The metal-mechanical industry and manufacture of tools and spare parts.

Machining of gear, belt and chain transmission elements.

Due to government regulation and potential liabilities associated with their customers, the medical device industry may see a decline in metalworking fluid usage. Of course, they still have to make parts.

Healthcare and other industries impacting the environment.

I haven’t seen such a decline.

I’m estimating that the automotive industry will see a decline for all parts related to crankcase and the internal combustion engine.

Auto, machine shops, aircraft industries, agricultural manufacturers and many others.

Typical automotive suppliers.

Machinery, auto.

Conventional automotive market, manufacturing of engines, standard machining.

Only in industry branches that are declining, i.e., gear manufacturing.

Automotives, aerospace.

Companies with less load maintaining at low temperatures.

Automotive industry.

Milling due to the development of dry machining.

The industries where 3D printing will grow.

Automotive—anywhere a part can be made by additive manufacturing instead of metal cutting.

Q.2 What portfolio diversification is your company pursuing to compensate for the decline in metalworking fluid usage?

Higher value products are more expensive but longer lasting.

Adding grease manufacturing.

Biolubricants.

What factor has had the most impact on the reduced consumption of metalworking fluids?

Improved condition monitoring

49%

Precision manufacturing

43%

More robust formulations

54%

Minimum quantity lubrication (MQL)

51%

Sump-side additives

26%

Based on an informal poll sent to 15,000 TLT readers. Total exceeds 100% because respondents were allowed to choose more than one answer.

Leaning into renewables, food grade, water-based cleaners and maintenance lubes.

Cleaners.

Solar.

Adding greener products such as water-based oil free cutting fluids.

Provide wastewater treatment service and online monitoring system.

Grow industrial applications for our products.

Our company is putting the efforts on the aluminum die casting process, which needs different kinds of lubricants to complete the process, and it is almost like a processing fluid.

Our company has a diverse portfolio of products both inside and outside of the traditional lubricant market.

It has been leaning toward products that generate more account control, so it has leaned toward products that generate a lower carbon footprint and greater sustainability in the environment.

We are already very diversified, so there is no one area we are pursuing.

There are no industry standards yet, but there appears to be a need for cooling fluids for the battery and systems in electric vehicles.

What is the biggest threat to the metalworking industry?

3D printing

67%

Plasma cutting

33%

Waterjet cutting

52%

Gas cooling technology

18%

Based on an informal poll sent to 15,000 TLT readers. Total exceeds 100% because respondents were allowed to choose more than one answer.

Making sure that the correct mixture of water-soluble fluids are properly mixed so that too much metalworking fluid is used and using antibacterial additives.

Deformation fluids, die casting, forging drawing.

Oil and grease-based lubricants.

Thermal management, batteries.

Support from new strategies in right directions.

Environmental protection equipment.

No changes so far.

Electric vehicle fluids, immersion cooling fluids, new generation products, etc.

Editor’s Note: Sounding Board is based on an informal poll sent to 15,000 TLT readers. Views expressed are those of the respondents and do not reflect the opinions of the Society of Tribologists and Lubrication Engineers. STLE does not vouch for the technical accuracy of opinions expressed in Sounding Board, nor does inclusion of a comment represent an endorsement of the technology by STLE.