The shipping industry has faced two major challenges during 2019-2022: the implementation of International Maritime Organization (IMO) norms on the maximum allowed sulfur concentration to be 0.5% in marine fuel, which also are known as IMO 2020 norms, from Jan. 1, 2020, and the COVID-19 pandemic, which disrupted normal operations. The next challenges that the shipping industry is expected to face are the decarbonization 2030 and 2050 norms. This article will focus on the aftermaths of the IMO 2020 norms and the COVID-19 pandemic on the marine lubricants industry and how it is likely to evolve in the future as the shipping industry tries to meet the decarbonization targets.

The implementation of IMO 2020 norms restricted the sulfur concentration in marine fuel to 0.5%. This fuel is known as very low sulfur fuel oil (VLSFO). However, a ship can continue to use 3.5% sulfur fuel if it has installed an exhaust gas scrubber (EGS). About 95% of the ships opted for VLSFO to meet IMO 2020 norms as there was uncertainty regarding the EGS systems to meet future fuel norms from the IMO. Further, many countries banned the wash water discharge from open-loop scrubbers.

The introduction of VLSFO led to significant changes in the marine lubricants industry. It led to the categorization of cylinder oils into categories I and II. Demand was expected to shift from higher base number (BN) cylinder oils to lower BN cylinder oils; however, the shift was smaller than anticipated. This is because deposits in the piston rings and crowns were seen in certain engines with the existing 40 BN cylinder oil at the time in ships that were using VLSFO. As a result, shipping companies were using 40 BN cylinder oil most of the time and used 100 BN cylinder oil for a short period to remove deposits. Thus, the demand decline for higher BN cylinder oils was lower than anticipated. This triggered a need for a cylinder oil with the acid neutralization capability of a 40 BN cylinder oil and the detergency of 100 BN cylinder oil. Such cylinder oils were categorized under category II 40 BN cylinder oils. Category II 40 BN cylinder oils were introduced by major marine lubricant suppliers in 2022.

The introduction of category II cylinder oils also led to a change in how cylinder oils were selected. Earlier, BN was the key criterion to select a cylinder oil as it was used to judge the acid neutralization capability and detergency of the cylinder oil. However, due to VLSFO, the need for a higher BN or higher acid neutralization capability has been reduced, but the need for higher detergency remains. This has led to the decoupling of the BN and detergency for cylinder oils performance. This will have implications for cylinder oil selection in the future as detergency becomes more important than acid neuralization capability.

The second key challenge that the ship ping industry faced was COVID-19, which led to the adoption of digital technologies in the shipping industry. Onboard inspections became difficult or could not be conducted due to restrictions put in place by countries to control the spread of COVID-19. It is estimated that the number of visits by support personnel to vessels reduced by 65%-70% due to COVID-19-related restrictions, resulting in reduced onboard as well as onshore support to the ship. Shipping companies, OEMs and marine lubricant suppliers had to rely on digital technologies to provide support to the vessel as in-person services could not be provided. This also helped reduce operating costs. For example, marine lubricants suppliers did not send experts to different vessels leading to a reduction in travel costs. Such services will continue to gain importance in the future as they help provide wide coverage while also reducing costs.

Another major challenge that the shipping industry is expected to face is the decarbonization targets for 2030 and 2050. These norms aim to reduce the average carbon intensity (CO

2 per ton-mile) by a minimum of 40% by 2030 and 70% by 2050 compared to 2008. Further, greenhouse gas emissions are targeted to be reduced by 50% by 2050 compared to 2008. To meet these targets, the shipping industry will need to use alternative fuels (also known as future fuels) such as methanol, hydrogen, ammonia and biofuels to reduce emissions. These fuels have different characteristics from the high sulfur fuel or VLSFO, requiring engine oils specific for these fuels to be developed. Further, the inclusion of the shipping industry in the European Union Emission Trading Scheme (EU ETS) means that the shipping industry will have to pay for carbon emissions starting in 2024. This is expected to further drive the usage of future fuels in the shipping industry while increasing the cost of those who don’t use these fuels.

As a result, the interest in future fuels for the shipping industry is rising. This can be seen from the shift in the new shipbuilding orders toward alternative or future fuels. According to the data on new shipbuilding orders for 2020, 2021 and January to April 2022 published by DNV, the share of methanol in the new shipbuilding orders in terms of gross tonnage jumped from 1% in 2020 to 6% in 2022, while the liquefied natural gas (LNG) share jumped from 21% in 2020 to 46% in 2022. However, LNG is seen as an interim fuel before the shipping industry transitions to future fuels, such as hydrogen, ammonia, methanol and liquefied petroleum gas (LPG). This is because, though LNG is cleaner compared with the current marine fuels, it still has a significant carbon footprint. It should be noted that vessels running on ammonia are not in operation as of now. An ammonia engine for the shipping industry is expected to be supplied toward the end of 2024 with the first ship running on ammonia being commissioned in 2025.

Biofuel demand for the shipping industry also is expected to grow, especially in the backdrop of EU ETS. It also is seen as a strategy to meet the decarbonization targets of 2030 and 2050 as the increasing usage of biofuels will reduce carbon emissions. Currently, various blends of biofuels with marine fuels, such as B10, B20 and B30, can be used in the shipping industry. However, the price of fuel increases as the share of biofuels increases in the marine fuel blend. For example, B30 can cost $1,100-$1,200 per ton compared to B10 costing $800-$900 per ton. The price of VLSFO is around $750 per ton. As a result, shipping companies prefer B10 to ensure that the cost of fuel remains under control.

Hydrogen also is used in the shipping industry, although its usage is limited to ships such as ferries used for short-distance travel. Electric vessels also are expected to be available in the market. Currently, only a few electric vessels are in operation, but their usage is expected to grow. As electric vessels do not need engine oils, the increasing usage of electric vessels is expected to be a negative factor for marine engine oil demand growth. Initially, electric vessels are expected to become popular for tugs and ferries. Vessels operating on inland waterways also may use electric vessels; however, swappable battery solutions will be ideal for them.

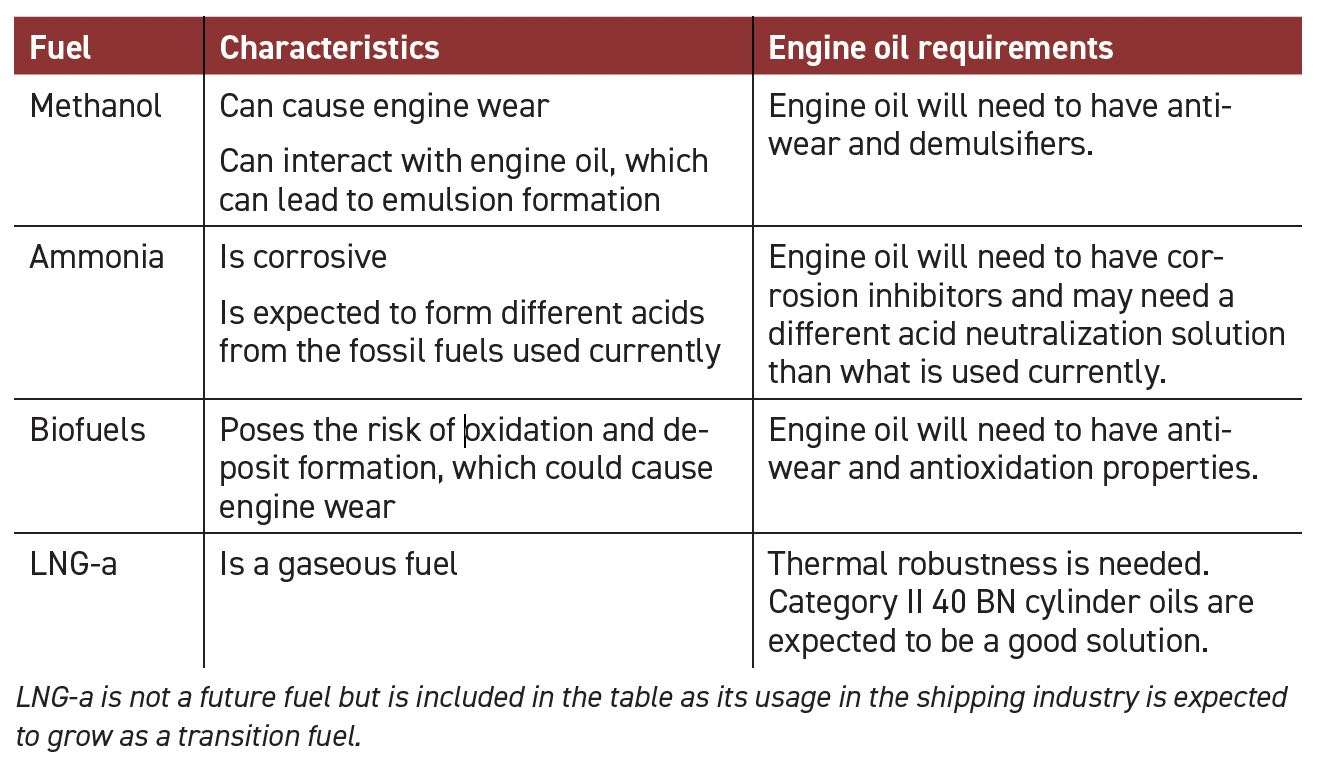

For now, ships running on future fuels are mostly using Category II 40 BN cylinder oils as the number of ships running on these fuels is still small. However, future fuels have different characteristics from the fossil fuels being used today and may need specific solutions to handle any lubrication issues arising from their use. These issues are described in Table 1.

Table 1. Engine oil requirements for future fuels

Table 1. Engine oil requirements for future fuels

As new engine oils specific for future fuels are launched, the shipping industry will transform from a single-engine-oil industry to a multiple-engine-oils (six to seven types) industry. This, in turn, is expected to make supply chain management challenging for engine oil suppliers. Marine lube suppliers are expected to rationalize their product portfolio and phase out engine oils such as Category I 40 BN cylinder oils and other engine oils that make up a small portion of their overall portfolio. Category II 40 BN cylinder oils also are recommended to be used in engine types that use Category I 40 BN cylinder oils. This is expected to provide further incentive to phase out Category I 40 BN cylinder oils.

This situation is further exacerbated due to the spread in the average price of VLSFO and 3.5% sulfur fuel. As per the information available on Ship & Bunker,1 the average price spread for the top 20 bunkering ports hit a high of $420.5 per ton in July 2022. The corresponding figure at the end of 2021 was $153 per ton, leading to growing interest in EGS. At the end of 2021, 30% of the global container capacity had EGS, with 150 container ships adding these systems in 2021. In 2022, this trend has grown. After the implementation of IMO 2020 norms, it is expected that high-BN cylinder oils will continue to decline and eventually have a small share in the overall market or may even phase out. However, as the interest in the EGS systems grows, high-BN cylinder oils are likely to regain some of the market share they lost after the implementation of IMO 2020 norms.

Moreover, the future fuel choices of shipping companies are not clear. The adoption of future fuels will vary from one shipping company to another. A shipping company may even operate on multiple future fuels. However, this will depend upon the ship route and the bunkering infrastructure available at the ports along the route that the ship is expected to take. It is expected that ammonia and methanol may be preferred for deep-sea shipping, while hydrogen might be preferred for domestic marine including inland waterways. However, other options such as electric vessels and biofuels are available. These choices are expected to impact the engine oil requirements of the shipping companies. This will have business implications for marine lubricant and marine lubricant additive suppliers as they need to invest in developing engine oils and their additives for future fuels.

These challenges are expected to increase entry barriers for new marine engine oil suppliers as they lack the know-how and may not have the resources to make the investments needed. However, these challenges also provide opportunities. The existing marine lubricant suppliers will need to increase engagement with shipping companies, engine OEMs and additive suppliers to succeed in this industry, given the increasing uncertainty.

REFERENCE

1.

https://shipandbunker.com

This article is adapted, by permission, from Kline & Company, Inc. To read the original article, visit www.klinegroup.com.

Kunal Mahajan is project manager, Kline Energy, at Kline & Company in the Energy practice. You can reach him at Kunal.Mahajan@klinegroup.com. Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.