TLT: How long have you worked in a lubrication-related field?

Jin: I have been working in the lubricants industry for more than 17 years. I find that the lubricants industry is exciting because of many interdisciplinary sciences and technology contributed to this industry, such as mechanical engineering, physics, chemical engineering, material science, etc. Therefore, I can leverage my knowledge and experience in many fields not only related to my major.

TLT: What project are you most interested in recently and why?

Jin: Recently the most exciting project has been about replacing bright stock. The term “bright stock” is a decades-old industry term that describes its appearance since bright stock is bright orange or reddish-orange in color. Bright stock can be produced from both paraffinic and naphthenic sources; bright stock is a high viscosity lubricant base stock manufactured from the asphaltic residue that remains when lighter fuels and lubricant components are distilled from crude oil. It is produced via a series of separation processes using solvents designed to extract or remove unwanted molecules. However, the conventional process to produce bright stock employs a paraffinic stream. Most of the bright stocks produced globally are by the conventional process (using a paraffinic crude source in a Group I refinery). Another type of bright stock, Group V bright stock, which includes heavy base stocks, is still used in various fields, and its demand is expected to continue in the future, but it is thought that there is an element of uncertainty about the supply. Therefore, an appropriate alternative is needed to replace it, and we think of it as PIB

(see next paragraph). Excluding various performance aspects, considering the production volume and economic feasibility, other alternatives do not seem easy, and experiments are being carried out for technical backup.

Polybutenes are a class of synthetic hydrocarbons that are used in a range of automotive and industrial lubricants. Polybutenes are typically produced as oligomers of isobutylene and are, therefore, commonly referred to as polyisobutylene or polyisobutene (PIB). Since there is often some level of other butene isomers in the feedstock, polybutene is a more accurate description.

There may be many concerns about replacing base stock with PIB—in particular, shearing like polymers or deterioration of base oil properties. In addition, some may be concerned about the difference in solvency, even in the application using the solvency characteristic, but the difference is not significant in reality, and it shows better results in stability and viscosity index (VI). We found that there is not much difference in using a mixture of base oil and PIB, even if 70%-80% is mixed and used. Due to PIB, it is decomposed without making sludge/deposit, so it shows particularly advantageous properties in engine oil and marine applications.

TLT: What is the demand and supply of bright stock for the next five years?

Jin: The supply of Group I conventional bright stock decreased from 2000 to 2020, which also will be exhibited in the future. Dwindling supply of conventional bright stock between 2000 and 2022 happened mainly due to new engine oil demand regulations, which require low viscosity and low sulfur content. The new regulation of base oil moves the demand for base oil from Group I to II/III, which has low viscosity and sulfur. This has forced Group I base stocks out of favor for blending automotive engine oils and an overall decline in Group I demand. Unable to find a market for their products, several Group I plants have shut down in the past. Some of these plants had bright stock-producing facilities, which too shut down along with them, resulting in a net reduction in conventional Group I bright stock capacity.

Due to the global COVID-19 pandemic, conventional Group I bright stock supply declined sharply in 2020. Post-2020, the conventional global Group I bright stock supply will recover slowly as the demand recovery helps operating rates for plants. After the recovery, the supply is anticipated to decline due to a continuous shift toward lower viscosity oils that demand advanced quality base stocks. Also, Group I capacity shutdowns will result in a capacity reduction for bright stock.

Bright stock is most used in applications where lubrication is needed at high temperatures or under heavy stress and load conditions. Lubricants with a high percentage of bright stock in their formulations include monograde engine oils, gear oils for automotive and industrial applications, marine cylinder oils, industrial hydraulic oils, greases and process oils used in the tire and rubber industries.

The demand for bright stock is likely to recover gradually as finished lubricant demand regains its lost ground. The recovery in the market also will vary depending on how quickly the overall macroeconomic environment in the regions stabilizes. The bright stock market is expected to exhibit a total deficit of 5.4 thousand barrels per day (KBD) by 2030. Global bright stock demand (including conventional Group I, Group V and alternate bright stock) is estimated at 44.5 KBD and represented less than 7% of the finished lubricant demand in 2020. Bright stock is under-represented in passenger car motor oil (PCMO), heavy-duty motor oil (HDMO) and other auto fluids relative to their global market shares. Bright stock is over-represented in gear oils (automotive and industrial), marine oils and greases relative to its global market share. These differences reflect the formulation differences between these products and their use of bright stock.

Between 2025 and 2030, demand for bright stock will decline in particular lubricant segments such as automotive engine oils. However, there will be demand growth for bright stock in the automotive gear oil category. Bright stock demand in the industrial segment will grow between 2025 and 2030, mainly due to increased finished lubricant volumes.

By 2030, global bright stock demand is projected to stand at 49.5 KBD. Total bright stock refining capacity (including conventional Group I, Group V and alternate bright stock) in 2020 is estimated at 73.5 KBD, with total bright stock production at 44.4 KBD.

There are already industry-level efforts to develop techno-commercially viable solutions using various substitutes, mostly involving PIBs, to address the shortfall of bright stock.

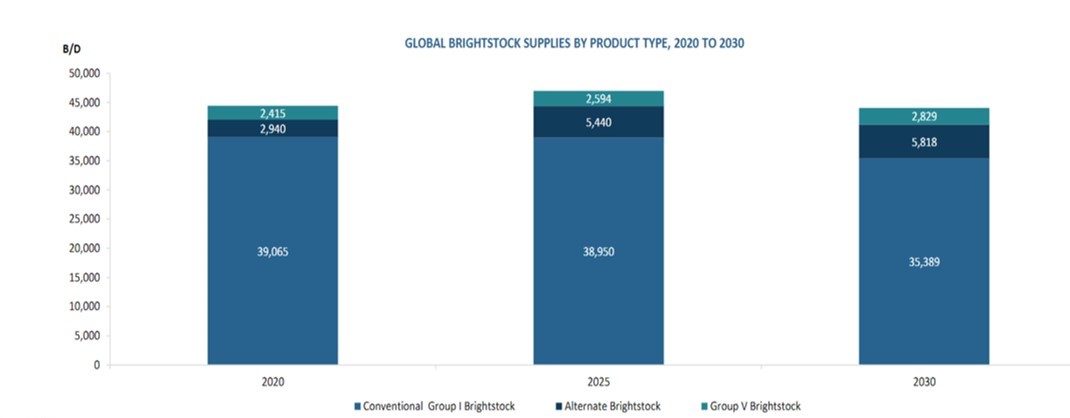

Technology advancement will facilitate bright stock production from non-conventional paths. On an overall level, the bright stock supply (including conventional Group I, Group V and alternate bright stock) will remain flat over the forecast period 2020 to 2030, though there will be an increase in the short term

(see Figure 1). This increase will be driven by plant operating rates as demand for finished lubricants (and hence base stocks) recover in the post-pandemic scenario.

Figure 1. The bright stock supply will remain flat over the forecast period 2020 to 2030, though there will be an increase in the short term. Figure courtesy of Kline & Co.

Figure 1. The bright stock supply will remain flat over the forecast period 2020 to 2030, though there will be an increase in the short term. Figure courtesy of Kline & Co.

The demand forecast is based on finished lubricant demand growth. It does not consider changes in product formulation at an overall level for bright stock share in the total formulation.

The total global bright stock demand is projected to increase from 44,527 barrels per day (b/d) in 2020 to 49,470 b/d in 2030. The market will exhibit a deficit of bright stock supply over the forecast period, encouraging blenders to explore opportunities in the substitute market.

To summarize, over the forecast period, there will be a bright stock shortfall of 5,328 b/d by 2030. This shortfall will be due to a continued decline in Group I demand, an uncertain economic environment, supply reduction triggered by plant rationalizations and shutdowns of Group I refineries. The supply gap in the market will provide varied opportunities for potential alternatives, including substitution by PIBs and other alternatives.

Lubricants with a high percentage of bright stock in their formulations include monograde engine oils, gear oils for automotive and industrial applications, marine cylinder oils, industrial hydraulic oils, greases and process oils used in the tire and rubber industries.

TLT: Are they any specific characteristics of fluid/oil to interchange bright stock?

Lubricants with a high percentage of bright stock in their formulations include monograde engine oils, gear oils for automotive and industrial applications, marine cylinder oils, industrial hydraulic oils, greases and process oils used in the tire and rubber industries.

TLT: Are they any specific characteristics of fluid/oil to interchange bright stock?

Jin: Various fluids were considered substitute products for bright stock, considering price points, supply availability, technical substitution, compatibility issues and consumer preferences. We have already evaluated the nearest possible substitutes to bright stock: PIB.

Bright stock pricing follows Group I neutral base stocks pricing, with a premium above light- and mid-grade neutrals. The rationale behind the premium includes recovery of fixed, variable and capital costs for the additional process of solvent deasphalting, incremental variable cost for processing base stocks by extraction and dewaxing and a capacity factor for lost time versus lighter stocks because bright stock limits the throughput on solvent extraction and dewaxing units.

The premium also reflects the increased scarcity of this grade compared to light- and mid-grade neutrals. As Europe is the major exporter of Group I, the supply from this region sets pricing for all regions except North America.

Pricing for a synthetic substitute, such as PIB, is linked with crude oil prices, manufacturing and distribution costs and the regional supply-demand balance for these chemicals. These prices also are determined by the supply tightness of other chemical products that compete with the basic chemical building blocks used for PIB. This includes isobutylene for PIB. There is no correlation between the pricing of these products and historical lubricant base stocks pricing. The price for each chemical product varies based on its molecular weight/viscosity. Bright stock is expected to maintain its price premium over light neutrals over the forecast period (2020 to 2030). In 2020, the European market’s average premium remained at around $145-$150 per ton. Over the next 10 years, this price premium will gradually strengthen as the market becomes a deficit. When price premium increases, blenders will have a growing interest in evaluating other options, such as PIBs.

Every new product that enters a market faces hindrance, and it is the same with the case of bright stock substitutes. Substitute products will face some firm and soft barriers to entry. Firm barriers, such as government regulations, patent coverage, base oil interchange guidelines, OEM approvals and availability, would pose some challenges to the entry of the substitute products. Soft barriers involving customer acceptance, logistics and supply reliability would not be of great concern to the industry. For most applications that use bright stock today, the price of the substitute product is overwhelmingly the primary barrier to entry. The ability to reformulate with an acceptable substitute, plus logistical/tankage constraints at blend plants, will be the real issues for substitute products. These barriers would lose significance once the pricing of these substitute products becomes acceptable in comparison with bright stock.

TLT: What are the advantages of using PIB oils for application?

Jin: Most PIBs are used as a blend stock for blending and manufacturing lubricant additives, fuel additives and adhesives. Other applications include sealants, roofing membranes, cable insulation, filling and pipeline wrapping. PIB, being nontoxic, also finds application in chewing gums, lipsticks, eyeshadows, sunscreens and other personal care products. Moreover, unlike mineral oils, which support microbial growth, PIBs do not, which is an essential property for metalworking fluids and other food-grade lubricants. PIB’s excellent flash point properties also help in manufacturing electronic circuit chips.

A thickening agent is needed to achieve the exact viscosity for specific automotive and industrial lubricants. Traditionally, bright stock has been used as a thickening agent. With declining supplies of bright stock, PIB is being evaluated as one of the possible substitutes for bright stock. PIBs are commercially available in a wide range of viscosities, depending on their molecular weight. The higher the molecular weight, the higher the viscosity for any given PIB. Often, PIB has a viscosity several times higher than that of bright stock. Hence, one part of PIB can potentially replace up to four to five parts of bright stock in any given formulation. The extent to which bright stock is substituted by PIB in any given formulation is a function of the technical suitability of the new formulation and its economic viability.

PIBs are cleaner while burning as compared to mineral oils. This property is important for applications where the lubricant burns, such as in two-stroke motorcycle oils (2T) and marine cylinder oils.

PIBs are cleaner while burning as compared to mineral oils. This property is important for applications where the lubricant burns, such as in two-stroke motorcycle oils (2T) and marine cylinder oils.

As a lubricant oil blend component, PIBs offer various advantages compared to bright stock. PIBs have better VI properties, which makes them suitable in applications where high VI is a key requirement. More importantly, PIBs are cleaner while burning as compared to mineral oils. This property is important for applications where the lubricant burns, such as in two-stroke motorcycle oils (2T) and marine cylinder oils. At present, PIBs are the preferred base stocks for blending 2T oils as they do not have associated smoke-related issues. PIBs are typically used in the range of 25%-35% for a 1,000-molecular weight PIB in these oils. This share would be less when consuming a 2,000-molecular weight PIB.

These are the main PIB molecular weights for making ashless dispersants. Usually both would come with reactive olefin end groups, irrespective of whether they are low reactive or high reactive PIB. However, as global demand for 2T oils is declining, the market for PIB will decrease in this application. On the other hand, PIBs have inferior solvency compared to conventional Group I bright stock, which could limit their use in applications where additive solvency is desired. However, the lack of additive solvency can be addressed by introducing other blend components, such as naphthenic oils or alkylates.

As a lubricating oil blend component, PIB is cheaper when compared to other synthetic substitutes. PIBs can be used in applications where low toxicity, non-staining properties, oil thickening, shear stability and low deposit formation are important. In addition to its supply advantages relative to polyalphaolefin (PAO) and polyalkylene glycol (PAG), PIB is cheaper to manufacture than other synthetic substitutes. The starting material for PIB production is C4 streams (like n-butane). It is dehydrogenated in chemical plants to make polymer-grade isobutene. Isobutene is not a widely traded commodity, and neither is it expensive. Tied to crude oil price, isobutene historically trades at one-third to one-half of the cost of 1-decene, the starting molecule for PAO manufacturing. PIB manufacturing also has the advantage of lower operating costs due to its lower manufacturing complexity relative to PAOs. The fundamental cost structure for PIB is well below what PAO or other synthetics can achieve.

PIB is already used in heavy industrial and automotive applications. It also has established itself in grease formulations. Blenders in some regions switch between bright stock and PIB, depending on the availability and price difference between the two base stocks. This switch is more common in applications where OEM approvals are not an important requirement for a formulation. PIB also is used to make dispersants and detergents for fuel and lubricant additives, as a thickener and as a substitute for base stock in lubricant formulations. It can potentially be used in all significant bright stock applications, including two-cycle and monograde engine oils, marine cylinder oil, grease and gear oils. PIB also is used in cutting and rolling oils; however, these applications require low molecular weight PIBs. With a global capacity of 22,430 b/d in 2020, PIB is more readily available than any other chemical used as a synthetic lubricant.

TLT: What is the No. 1 piece of advice you would give to a person who might be interested in starting a career in the lubricants industry?

Jin: Here is some advice for becoming an expert in the lubricants industry from an R&D point of view:

•

Be ready to learn new things all the time and also work as a team.

•

R&D is essential in this industry. Therefore, it is necessary to organize what you experience over time so that you can become a true expert.

•

In particular, I think there will be an opportunity to contribute more quickly if we learn in advance and pay attention to the improvement of value through interaction/synergy/antagonism between materials and the characteristics of each chemistry of materials.

•

Be active in lubricant organizations like STLE.

You can reach Lee Hyeung Jin at hjleev1@dlchemical.co.kr.