KEY CONCEPTS

•

Oil-free MWFs work well with some, but not all, materials and applications.

•

Operations considering switching to oil-free MWFs must balance their advantages with costs, performance and fluid management factors.

•

Corporate initiatives and regulations on environmental protection, sustainability and health and safety influence choices of MWF formulations.

How far can metalworking fluid (MWF) formulators push the trend toward less mineral oil content—and less oil content of any kind? Over the past couple of decades, newer formulations on the market have trended toward less dependence on nonrenewable resources like petroleum products and fewer ingredients like biocides that pose worker health concerns. Oil-free formulations check these boxes, and they also help with reducing foam, increasing fluid life and eliminating the need to clean oil films from the finished workpieces. However, they don’t work for all applications, they can be expensive and they can present waste disposal problems. Here’s what several industry experts have to say about oil-free MWFs.

Trends and what’s driving them

The drive toward fully oil-free fluids depends on the application and customer needs, including local requirements and policies, says STLE member Bridget Dubbert, technical director at Engineered Lubricants, a company that manufactures MWFs and other products. Corporate initiatives toward more sustainability also can drive a change in the fluids used, although this tends to be more prevalent in larger operations. Smaller companies focus on products that work, that present them with the fewest problems and that keep their costs under control, she adds.

Oil-free MWFs are on the market, being used successfully, but in some instances, users can find the pricing to be a hurdle, Dubbert continues. For faster, light-duty operations, where cooling takes precedence over lubrication, these fluids are ideal. “We’re not quite there yet for many operations that need a high degree of lubrication,” she says. “Heavy-duty stamping and drawing will be the last holdouts, I believe.”

Over the past five to 10 years, there has been a much more focused attempt to bring sustainable chemistries into industries in general, and chemistries from industry sectors at the leading edge of this trend often find their way into other sectors once they have demonstrated their effectiveness. Customers whose operations directly affect the environment or consumer safety—marine lubricants or food industry lubricants, for example—may ease their way into synthetic lubricants, adopting them for some percentage of their operations. As they begin to see increases in fluid lifespan, fewer price fluctuations tied to petroleum prices or other advantages, they might decide to increase that percentage. As synthetic lubricants become established in these market sectors, they could find an easier entry into other sectors as well.

The MWF industry could be one of those sectors, but petroleum-based fluids are still very affordable, and customers tend to stay with what they know works well for the price. Quantifying the overall benefits of “going green” can be difficult because of the many interacting factors that contribute between the time a lubricant enters an operation until the used fluid goes for disposal. However, company initiatives and customer demands can drive efforts toward sustainability, including adopting new chemistries, saving energy by lowering the temperature needed for parts cleaning and using fluids that are easier to clean from the parts.

“The biggest trend I’m seeing has been going on for a long time, toward semisynthetic, emulsion-based products,” says STLE member Marty Brunker, senior sales account manager at Univar Solutions, a specialty chemicals distributor. He adds that semisynthetics are much more versatile than either fully synthetic fluids or mineral oil products. Fluid formulations using oil-soluble additives require an oil component, and an oil film on the workpiece provides a barrier against corrosion

(see What is a “Synthetic” MWF?).

What is a “synthetic” MWF?

MWF terminology varies among vendors and users. Here are the fluid type definitions used in this article.

•

Fully synthetic fluids are water-based with no oil component or oil-soluble additives; additives are dissolved in the water rather than incorporated into oil-in-water emulsions. The term “fully synthetic” also can refer to fluids based on synthetic compounds like esters rather than mineral oils to dissolve water-insoluble components.

•

Semisynthetics are emulsions of mineral, vegetable or synthetic oils in water; the user mixes a concentrate with water before placing the fluid into operation.

•

Soluble oils (also called emulsifiable oils) contain mineral oil and emulsifiers, but no water.

•

“Straight oils” (sometimes called “neat oils”) refer to MWFs that use a mineral oil and additives, with no water dilution.

In the automotive industry, synthetic lubricants are water-free fluids that contain no mineral or biobased oils, so it’s important to specify whether a fluid is an automotive fluid or an MWF.

STLE member Chad Crocker, territory sales manager for S&S Chemical, also has seen a long-term trend away from mineral oils and toward semisynthetics with low to medium oil content. Severe operations like deep drawing still require lubricity additives like chlorinated paraffins, especially the longer-chain paraffins, making some amount of oil and emulsifier necessary. However, lubricity additives have gotten better, he says, and there are some good options, including esters and phosphate esters. Castrol went away from chlorinated compounds many years ago, he adds, so it can be done. However, MWFs require a balance of different properties, and pricing is a big factor. “Right now, oil is cheaper than additives,” he says.

Crocker mentions multiple projects over the past 15 years where companies developed MWFs using vegetable-based oils. However, he says, the economic crash in 2008 and the COVID-19 pandemic halted a lot of experimental projects for the next generation of MWFs. Companies are pausing work on new developments as they deal with supply chain challenges, consolidations and cutting some products. Fluctuations in petroleum prices always factor in, he adds, since some MWFs can be as much as 50% mineral oil. “Now, people are just trying to keep their heads above water. All of my customers are just trying to keep raw materials coming in for their current product lines,” he says.

Formulation changes

Fully synthetic (oil-free) fluids have a niche, Brunker says, mostly for clean-running applications that don’t require a great deal of lubricity or long-term corrosion inhibition from the MWF. High speeds and low pressures are ideal for these fluids, he says. For instance, light grinding applications for metals like cast iron or steel can use synthetic fluids. However, the lack of an oil component limits the kinds of fluid additives available for use and the number of applications for a given formulation.

Brunker notes that the technology doesn’t exist yet for lubricity additives and corrosion inhibitors for synthetic fluids to be used with higher-demand applications. On the other hand, fully synthetic fluids are better at drawing heat away from the cutting area because they do not contain the high levels of solids that limit the cooling capacity of oil-containing fluids. Because synthetic fluids don’t often use surfactants or other additives that produce foam, they often don’t require antifoaming agents, and many of the lubricity components in synthetic fluids also help to reduce foaming, he says, which is another factor that makes these fluids attractive.

Indeed, some fluid manufacturers are moving away from certain antifoaming agents, including silicones and siloxanes, which can adhere to the workpiece and cause problems with paint adhesion. “You see their formulations getting very complex, using different raw materials to try and reduce the price and the potential for foam,” Brunker says. Dilution water quality varies from location to location, and even among different shops within a given area, so a water-dilutable formulation that works in one shop might foam excessively in another. Reducing the antifoaming agents in a formulation reduces costs and cuts down on the number of raw materials needed for the formulation, he says.

Lower-oil systems tend to run cleaner, Crocker says. High-oil systems run under higher pressure, making them more likely to generate mist and foam. Even in enclosed systems, mists can settle on machines and workpieces, leaving a residue when the water evaporates. In the U.S., most facilities have mist guards and enclosures, but this isn’t true in some areas of the world, he says, and this can be an issue for worker health.

There is some movement toward biobased oils, but the biodegradability that makes them attractive from a waste disposal standpoint also shortens the service life of the fluid. At present, rapeseed oil, and especially canola oil, is the most common vegetable-based oil for MWFs. However, Crocker says, for heavy-duty operations, mineral oil is still the way to go.

Light- to medium-duty applications can use fully synthetic fluids, but the fact that these formulations rely on water-soluble additives means that they require different extreme pressure (EP) additives than the oil-soluble, emulsifiable additives like chlorinated paraffins. “Almost any type of fluid can provide the same level of lubricity performance, depending on the additive package used,” Crocker says, but price is always a factor. For straight oils and semisynthetics, the oil component is both a carrier for additives and a lubricant. Fully synthetic fluids—several of which are currently on the market—rely on the additives to provide the lubricity and water to act as the coolant.

The move away from chlorinated paraffin lubricants and boron-based corrosion inhibitors is greater outside the U.S., Dubbert says. Several older chemistries, mostly on the lubrication side of the formula, have made their way onto Europe’s list of Substances of Very High Concern (SVHCs). Formulators are faced with trying to predict what fluid components might make their way onto the SVHC list and other regulatory lists within the next few years so that they don’t have to constantly change or update their formulations. “But a lot of the newer synthetic chemistry being used to formulate safer products allows formulators to develop effective products that can replace older, more hazardous chemistries,” she says.

One area where oil-free fluids excel is in resistance to microbial growth, Dubbert says. Additives used in oil-free, synthetic MWFs provide far fewer nutrients than the additives historically used in traditional soluble and semisynthetic fluids. This, in turn, reduces the level of biocides needed to protect the fluids. Reducing biocide usage is a common concern, both for worker safety and for health and environmental considerations. In addition to direct hazards, there is some concern over secondary hazards associated with a class of biocides that release formaldehyde as they break down. However, she says, these concerns are balanced by a need to keep fluids and machines free from microbial contamination, which also can be a hazard for workers.

Using biobased fluids has an impact on fluid management practices, and formulators’ portfolios of additives need to take the special requirements of biobased formulations into consideration. Fluid management extends from formulation development and selection through operations, to fluid disposal. Semisynthetics, especially those with biobased components, require biocides. Vegetable-based fluids break down faster, which is good for disposal, but a disadvantage for operations. Because fully synthetic fluids run cleaner and are more biologically stable, fluid life tends to be longer, which reduces the amount of used fluid that must be disposed of. However, even “green” fluids can present disposal issues because used MWFs contain metal fines, tramp oil and everything else that finds its way into a sump.

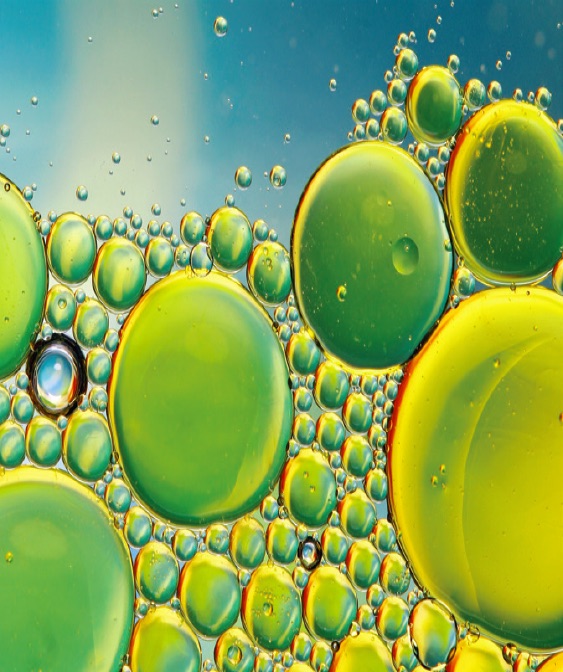

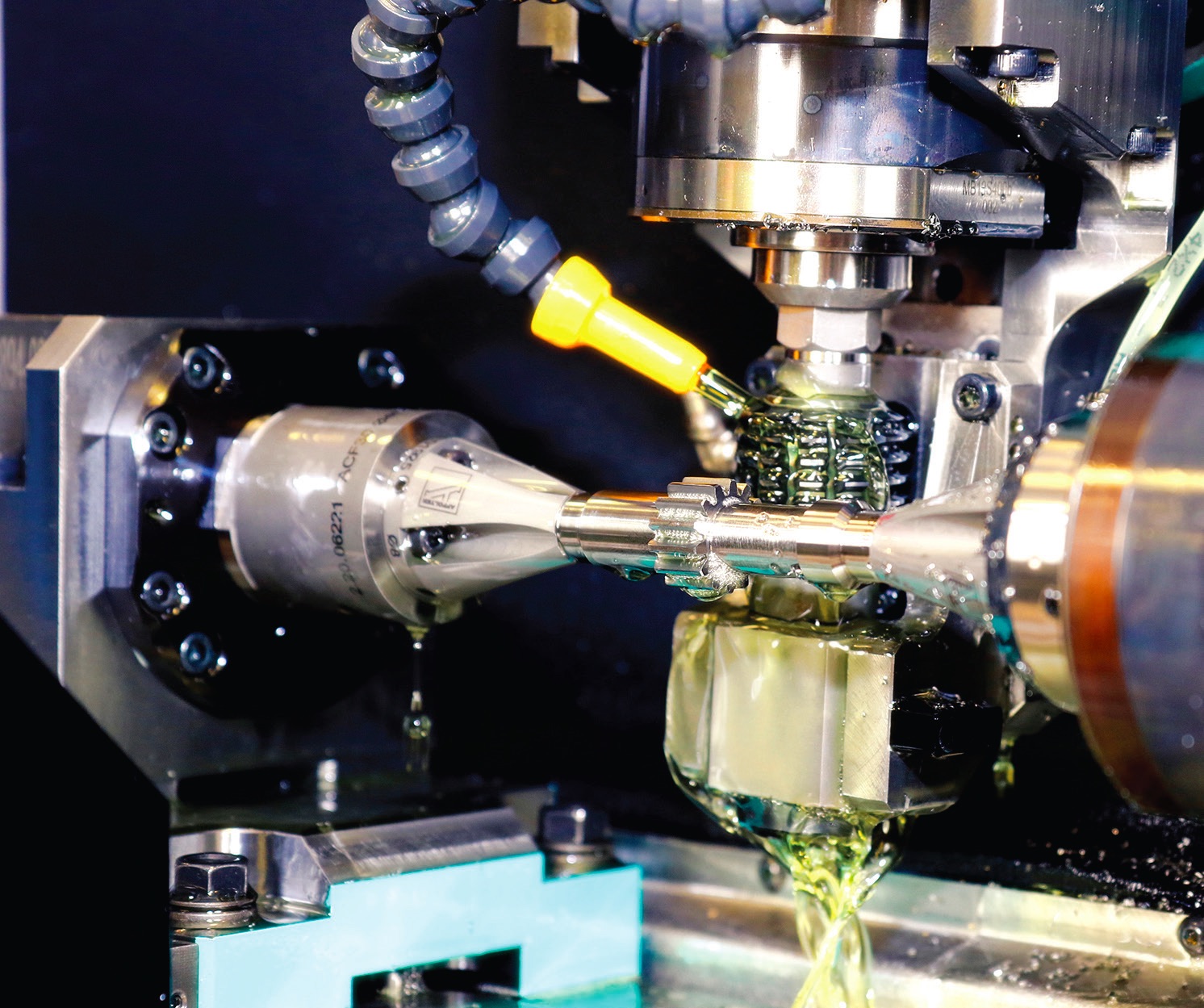

Formulations containing ethoxylated castor oil, sulfated castor oil and fatty esters can be used for applications like drilling, cutting, grinding or reaming or hobbing using cast iron

(see Figure 1), some steels or some grades of aluminum, says STLE Life Member Kook-Wha Koh, founder of Chrysan Industries. A synthetic fluid formulation, she says, might include boric acid, sulfonamido carboxylic acid, yellow metal corrosion inhibitor, amines, biocides and sulfated castor oil as a lubricity additive.

Figure 1. Hobbing. Figure courtesy of Affoltergroup, CC BY-SA 4.0, via Wikimedia Commons.

Figure 1. Hobbing. Figure courtesy of Affoltergroup, CC BY-SA 4.0, via Wikimedia Commons.

Metals and alloys like Inconel, titanium, compacted graphite iron, stainless steel, superalloy steels, 2000- or 7000-series aluminum and magnesium, as well as some composite materials, still need the lubricity of semisynthetics and soluble oils, Koh says. She adds that oils are still needed for difficult machining operations like high-speed machining, deep drawing, broaching, roll tapping, stamping

(see Figure 2) and fine blanking. One particularly tough machining application in the automotive industry is roll tapping aluminum cylinder heads, she says. The electric vehicle industry is presenting new challenges, she adds, noting that some composite materials are difficult to work with, even using oil-based fluids. Heavy-duty operations still require EP agents such as phosphates or chlorinated compounds, in addition to soluble oil lubricants, she says.

Figure 2. Metal stamping machines. Figure courtesy of Sam Beebe/Flickr, CC BY 2.0.

Figure 2. Metal stamping machines. Figure courtesy of Sam Beebe/Flickr, CC BY 2.0.

Semisynthetic fluids and soluble oils can have the same formulation components as fluids using mineral oils, Koh says, so if the cost difference is not prohibitive, semisynthetics can be substituted for mineral oil formulations in many applications. Synthetic base oils include low-viscosity polyisobutene (PIB), polyalphaolefins (PAO) or gas-to-liquid (GTL) oils. Koh notes that synthetic soluble oils such as PIB or PAO have low molecular weights and low viscosity, which makes them suitable for applications such as beverage can drawing, but they are not cost effective for machining.

Koh recalls one instance in the 1980s where an automotive manufacturer recommended using coolants with all-synthetic MWFs for every material and every machining operation. The synthetic lubricant it switched to had worked previously for machining transmission cases, 390 aluminum valve body machining and other machining operations using different materials. However, this synthetic lubricant, which had lots of detergency, leaked into a gearbox on its production line and ruined the gears. The company then tried a new formulation that used a PIB base oil instead of mineral oil. The PIB formulation was much more expensive, and the company decided that this approach was not cost effective for its machining operations.

Environmental considerations

Regulations on environmental protection and health and safety influence what goes into an MWF, as do corporate initiatives geared toward sustainability and environmentally friendly practices. Brunker notes that over the past 10-15 years, as the European Union (EU) banned some fluid additives commonly used for semisynthetics—some biocides and chlorinated lubricity additives in particular—it drove some operations back to using straight oils. Although the U.S. has not emphasized environmental drivers as much as the EU, they are moving in that direction, Brunker says. In the U.S., he adds, the focus is more on versatility of applications, which tilts the balance toward semisynthetics.

One driver of “greener” formulations is what happens to an MWF after it is taken out of service. Biodegradability is a plus for fluid disposal, but “biodegradability goes both ways,” Brunker says. A fluid that degrades while it is in service, resulting in a shorter service life, can drive up costs related to defective parts and higher volumes of fluid to be disposed of. Semisynthetic fluids contain soluble oils with anionic emulsifiers, sulfonates and corrosion inhibitors, many, if not all, of which are easy for bacteria to break down. Because fully synthetic fluids contain fewer or none of these ingredients, they are less prone to microbial contamination.

Brunker notes that more of his customers are starting to ask about naturally derived products like bioderived complex esters. About 15 years ago, there was a push to use more vegetable oil-based emulsions, and some of these products still exist, he says. However, vegetable oils are prone to bacterial attack. In addition, vegetable oils oxidize, which degrades the MWF and can produce varnish on metal tools and workpieces in high-temperature applications. “It’s very difficult to formulate a product that is biostable but also biodegradable,” he says.

Despite a trend toward more sustainability and fewer petroleum products in many industries, MWFs containing mineral oils provide performance and cost effectiveness, Dubbert says. When they are used and disposed of properly, they are generally regarded as safe, she adds. With the rise of semisynthetic formulations, oil no longer represents 85% of the formulation. Instead, many concentrates are 10%-20% oil, and these concentrates are diluted about 10:1 to 15:1 with water, she says.

Vegetable oils are not problem-free, Dubbert says. If they are not disposed of properly, they can present their own environmental problems, both on their own and with the additives and processing residuals that they are mixed with. In addition, depending on the type of vegetable base stock, they can biodegrade faster. This is especially true of the lower-viscosity oils (which is an advantage after these oils are disposed of, but not during use). Lower viscosity offers certain advantages, however. “The trend is toward lower viscosity because of access to better additives, reducing the need for heavy oil for lubrication,” she says. Because these newer additives provide better lubrication, a thick layer of viscous oil is not needed. Low-viscosity oils (vegetable and mineral) also are easier to clean off parts before painting them or applying coatings, and they can reduce carry-off, therefore reducing usage.

More work needs to be done on waste treatment for oil-free fluids, Dubbert says. The fluids work well, and they are long-lasting, but the very components that make them so stable also make them hard to break down in a waste treatment facility. Traditional waste treatment methods (splitting or separating the MWF into water, oil and solids) do not effectively treat synthetic MWF solutions to be disposed through most municipal waste systems. (Semisynthetics present similar problems, since the newer emulsions are hard to split.) In addition, used MWF contains metal fines, machine oil and anything else that entered the system during operations, which means dumping used fluid down the sewer is not an option without treatment, no matter what a supplier implies, she says.

MQL and dry machining

Some operations are going in a different direction. Dry machining does away with MWFs entirely, using specially coated tools. Minimum quantity lubrication (MQL) uses very small amounts of vegetable oil-based MWF sprayed onto the cutting area or applied as small droplets onto the tip of a tool.

MQL uses a high-velocity, low-volume stream of cutting fluid mixed with compressed air cooling and lubrication. The cutting fluid flow rate is about 0.05-0.5 liters per hour, compared with typical flood cooling rates of about 30-600 L/hr. MQL decreases the rate at which machine tools corrode compared with flood cooling, and it gives workers a clearer view of the work zone, so they can stop the machining operation if they see a problem.

1

“Small is beautiful,” Koh says. She explains that MQL allows companies to use smaller fluid storage containers; it reduces the need for large central filtration, fluid maintenance and waste disposal systems. MQL produces less misting, which is better for worker health. The chips produced by MQL operations are almost dry, making them easier to recover and recycle. MQL also reduces or eliminates the need to clean oil films off of the finished parts. She cites the example of one automotive transmission plant that uses MQL for more than 90% of its milling, drilling, sawing and other machining operations.

Because of the low volume of cutting fluid involved in MQL and the difficulty in collecting used fluid, the cutting fluid is usually not reused. Despite not reusing the fluid, the low volume reduces the amount of fluid waste, and there is no need to filter the used fluid, thus reducing overall machining costs. MQL reduces the volume of fluid needed in a machine reservoir to ensure uninterrupted fluid delivery during machining. The method also reduces fluid disposal volumes, costs and environmental impacts.

1

Koh cautions that technological improvements are needed before MQL or dry machining can be used for more demanding applications such as stamping, deep drawing and fine blanking with stainless steel. MWFs containing oil are still required for these applications, with the associated fluid storage, maintenance and disposal procedures. In addition, the oil film must be cleaned off of the finished parts. However, she says, even in conventional operations, newer tool coatings containing antiwear agents reduce the amount of MWF needed for certain applications.

Are oil-based fluids ever going away? In theory, water-soluble additives could allow oil-free fluids to be used for the most demanding applications, but at what price? For many applications, you could get away from using oil-containing MWFs, says Dubbert, but formulators would need to find and use the right additives. Additive suppliers are inventing more additives to help us get there, she says, adding, “Are we there yet? Yes, for many applications we are. A lot depends on how much people want to pay for it and what sacrifices they are willing to make.”

The consensus among experts in the MWF industry is that the technology for making fully synthetic fluids for the entire range of applications does not yet exist. Brunker predicts that oil-based fluids will not go out of use entirely unless something really radical comes out that is completely soluble in water and can perform the diverse, new tasks that other MWF products can. “I don’t see synthetics taking the whole market, there’s just no way,” he says. When choosing an MWF, “It becomes a question of what works best for you and what are the applications where you want to use it.” Not only are mineral oils needed for high-demand applications, Crocker says, but many of the products that contain them have been around for years, and customers rely on them because they know how these products perform in their operations. “Mineral oil is here to stay,” he adds.

REFERENCE

1.

Difference Between Flood Cooling and Minimum Quantity Lubrication (MQL), Minaprem blog post, click

here.

Nancy McGuire is a freelance writer based in Albuquerque, N.M. You can contact her at nmcguire@wordchemist.com.