Long gone are the days when the electric vehicle (EV) “revolution” in India was considered mere buzz; the moment has clearly arrived. Sales of EVs in India doubled in 2021 compared to 2019. Automotive players have made tremendous investments in setting up dedicated EV capacities, particularly in the two-wheeler segment. Numerous private players also have invested—and are continuing to invest—in infrastructure to support EV charging and/or battery swapping. Further, favorable policies by the central and state governments are creating an environment that will help drive EV sales. Against this backdrop, we provide an update on EV manufacturing, charging infrastructure, battery swapping, government policies and subsidies and acceptance by Indian consumers.

EV sales: Which vehicle categories are growing?

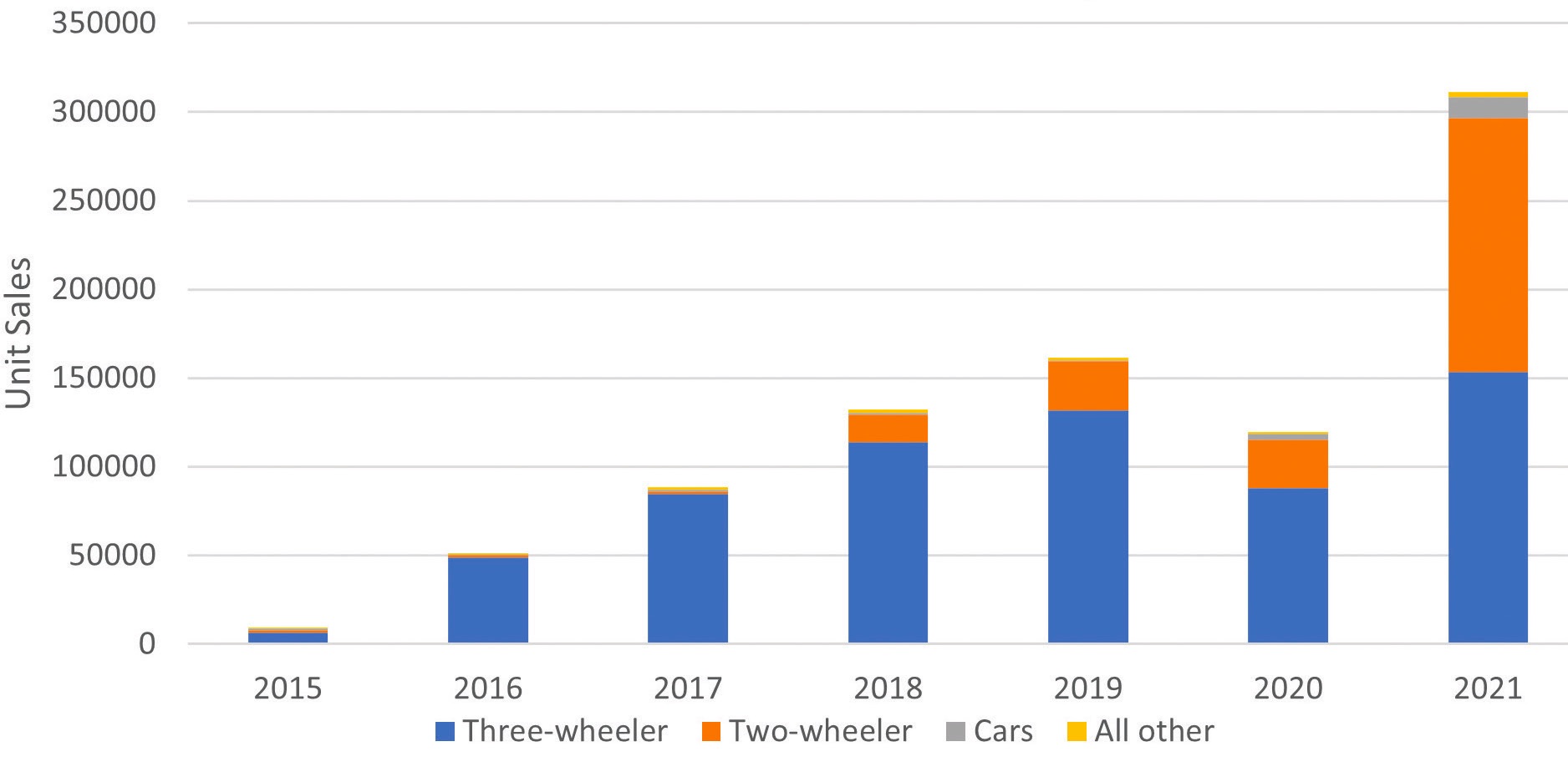

EV sales have surged in India. This is true across all vehicle categories, especially for three-wheelers and two-wheelers. EV sales have increased for three-wheelers (locally referred to as “rickshaws”) for passenger commute, particularly as a means of shared mobility in cities. This shift to electrification has now spread to last-mile delivery, where electric three-wheelers are used primarily by e-commerce firms or their delivery partners. Per the Vahan dashboard (compiled by the Indian government), there are close to 700,000 electric three-wheelers registered in India, accounting for 8% of the overall three-wheeler registered parc.

The two-wheeler segment accounts for most EV sales in the country. India has significant electric two-wheeler manufacturing capacity with several original equipment manufacturers (OEMs). The two-wheeler segment can be sub-divided into low- and high-speed vehicles. Low-speed electric two-wheelers, which have a maximum speed of 25 kilometers per hour (kmph), are not required to be registered and are not included in government statistics. Hence, there are no reliable statistics on the low-speed electric two-wheeler parc. The current electric two-wheeler parc is close to one million units (excluding low-speed vehicles). While this number is miniscule compared to the overall two-wheeler parc of 216 million, it shows the tremendous growth potential for EVs in India

(see Figure 1).

Figure 1. Historical EV sales in India, 2015-2021. Note: These figures include registered vehicles. Sales of low-speed EVs are excluded. Figure courtesy of Vahan Dashboard, Government of India.

Figure 1. Historical EV sales in India, 2015-2021. Note: These figures include registered vehicles. Sales of low-speed EVs are excluded. Figure courtesy of Vahan Dashboard, Government of India.

EVs in the passenger car segment have experienced a limited offtake. Approximately one-half of electric car sales in 2021 were generated by only three states—Maharashtra, National Capital Territory of Delhi and Telangana. Currently, OEMs offer a limited variety of electric car models. Unlike the two-wheeler segment, passenger car OEMs have not established dedicated capacities to produce EVs.

Among the other vehicle classes, electric variants are primarily gaining popularity in buses and, to some extent, in light commercial vehicles. Electric buses are typically used for intracity transportation, with most of the buses owned by state transport bodies (government entities). Very high capital expenditures deter private players from purchasing electric buses. Light commercial vehicles are not very popular in electric variants, as most end-users who desire an electric version of a goods carrier prefer electric three-wheelers.

Price: Are EVs competitively priced compared to their ICE counterparts?

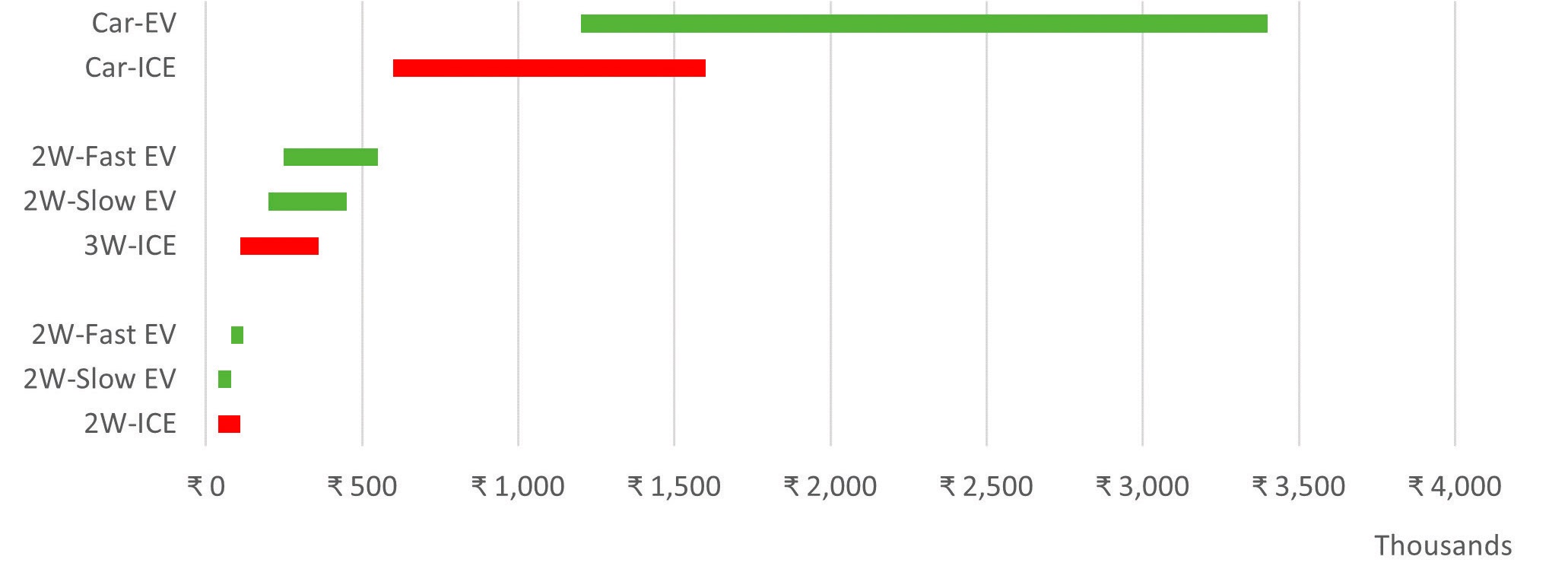

Increasing competition among OEMs, advancing technology and decreasing raw-material costs are some of the reasons why EV costs are declining. Note that the prices shown in Figure 2 do not include road tax, vehicle registration or insurance costs.

Figure 2. Ex-showroom price comparison of ICE and EVs. Note: The figures shown are representative and indicative of only select popular ICE vehicles and their equivalent EV counterparts.

Figure 2. Ex-showroom price comparison of ICE and EVs. Note: The figures shown are representative and indicative of only select popular ICE vehicles and their equivalent EV counterparts.

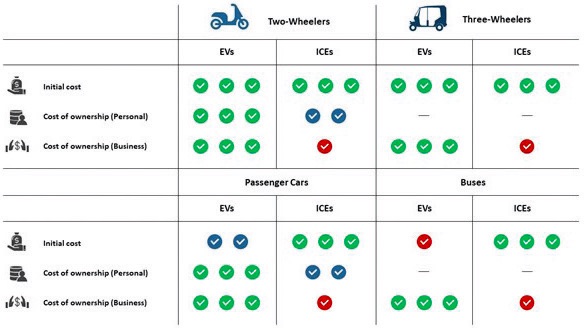

A comparison between internal combustion engine (ICE) and EVs reveals that owning an electric two-wheeler is not very expensive, especially when government subsidies are considered. The initial vehicle costs for ICE and electric two-wheelers are comparable, but the cost to operate an electric two-wheeler is low. The operating cost is even lower for electric two-wheeler owners/operators who use their vehicles for business purposes, such as deliveries, rentals and taxis. This is because ICE two-wheelers used for business purposes have much higher maintenance costs.

It is not possible to compare electric- and ICE-based three-wheelers on a like-to-like basis, primarily because of the speed. Electric three-wheelers are typically available in low-speed variants (approximately 25 kmph), which suffices in most real-life traffic situations. The high-speed variants have a top speed of approximately 55 kmph, which is rarely needed. There are limited-use cases for high-speed electric three-wheelers. Low-speed electric three-wheelers tend to have a lower cost of ownership compared to ICE variants, for the same reasons as electric two-wheelers used for business

(see Figure 3).

Figure 3. Analysis of cost benefits of ICE vehicles and EVs for various vehicle categories. Note: The greater the number of check marks, the greater the favorability.

Figure 3. Analysis of cost benefits of ICE vehicles and EVs for various vehicle categories. Note: The greater the number of check marks, the greater the favorability.

In the passenger car space, there are limited EV options available in the mid-price segment; EVs are almost double the price of their ICE equivalent. However, while the original investment is much higher, the average EV operational costs are half those of a gasoline car, particularly given the increasing fuel prices.

In the bus segment, electric variants are at least 3.5 to 4 times more expensive compared to diesel. The operational costs for electric buses may be 70%-80% lower than diesel buses. The scale of electric bus production in India is currently miniscule, which is one of the reasons for the high cost of electric buses.

Environment: Is it conducive enough to support EV sales?

Government support. Not only is the Indian government promoting the use of EVs, but it’s also encouraging the manufacture of these vehicles within the country. In 2015, the government launched a scheme—“Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India” (FAME India)—which ran for two years. FAME 2 was introduced in April 2019, initially for a three-year period at a budget outlay of INR 10,000 crores ($1.3 billion); the program has now been extended to March 2024. The budget allocated for offering subsidies under FAME has tripled in the financial year (FY) 2022-2023 compared to FY 2021-2022. FAME 2 aims to support sales of the following EVs: 7,000 buses, 55,000 passenger cars, 0.5 million three-wheelers and 1 million two-wheelers.

Several state governments are offering additional subsidies for the purchase of EVs. Several states also are waiving road taxes. In addition, registration charges for EVs have been waived across the country. Further, the electricity used to charge EVs is being offered at subsidized rates at commercial and domestic EV charging stations in several states.

There are efforts underway to make India self-sufficient in lithium-battery production. A production-linked incentive scheme has been launched with a budget outlay of INR 18,100 crores ($2.4 billion).

Charging infrastructure. Under the country’s “Phased Manufacturing Program,” FAME 2 promotes the domestic manufacturing of EV chargers, with INR 1,000 crores ($130 million) reserved for this purpose.

With negligible entry barriers, in addition to support from the Indian government, many private players are establishing charging stations for domestic and commercial use. There are approximately 70,000 fuel retail outlets in India that could offer EV charging station, which could become a huge network of charging stations.

The government, in association with oil marketing companies (OMCs), aims to install EV charging stations at 22,000 fuel retail outlets.

Battery swapping: Battery swapping is a time-efficient way to keep EVs running compared to charging the exhausted battery pack. However, there is one major technical challenge to battery swapping—compatibility. Different OEMs have different-sized batteries, which makes swapping difficult. This challenge is expected to be addressed by the government’s soon-to-be-launched battery-swapping policy.

All three OMCs have forayed into battery swapping with the support of private-sector participants.

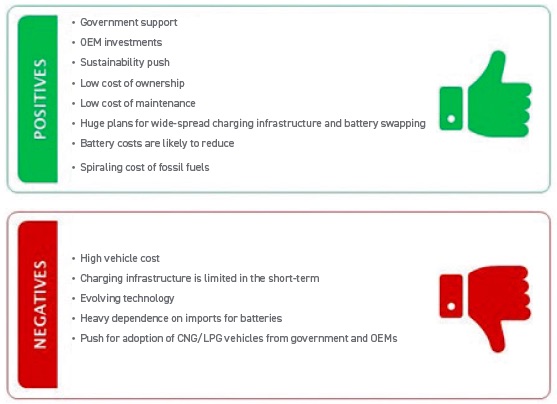

Outlook: What lies on the road ahead for EVs in India?

While adoption of EVs will continue to grow, full-scale adoption would only be possible if the following were to occur:

•

Gasoline/diesel prices become so high that operating costs for conventional ICE vehicles are no longer affordable for the average consumer. This tipping point could be fuel prices reaching INR 125 (USD 1.6) per liter.

•

The government either directly or indirectly bans the sale (or use) of ICE vehicles

(see Figure 4).

Figure 4. Factors driving the penetration of EVs in India.

Figure 4. Factors driving the penetration of EVs in India.

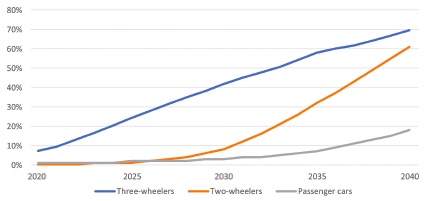

Figure 5 depicts the most-likely scenario for EV penetration in different categories, assuming no additional government regulatory intervention (including bans/restrictions on ICE vehicles).

Figure 5. Penetration of EVs in the overall vehicle parc.

Figure 5. Penetration of EVs in the overall vehicle parc.

The current technological advancements and cost considerations do not favor large penetration of EVs in heavy-duty vehicles, especially buses and trucks. Retrofitting ICE vehicles into EVs could gain traction for two-wheelers and, to some extent, in the passenger car segment. However, the greatest EV penetration would be from new sales.

Lubricants: How will EV penetration affect lubricant demand?

The Indian automotive market is witnessing high growth in production and sales of ICE and EVs across the vehicle categories—personal mobility, goods carriers and public transport. While these rates might not be sustained over the very long term, the country has tremendous potential for the addition of new vehicles.

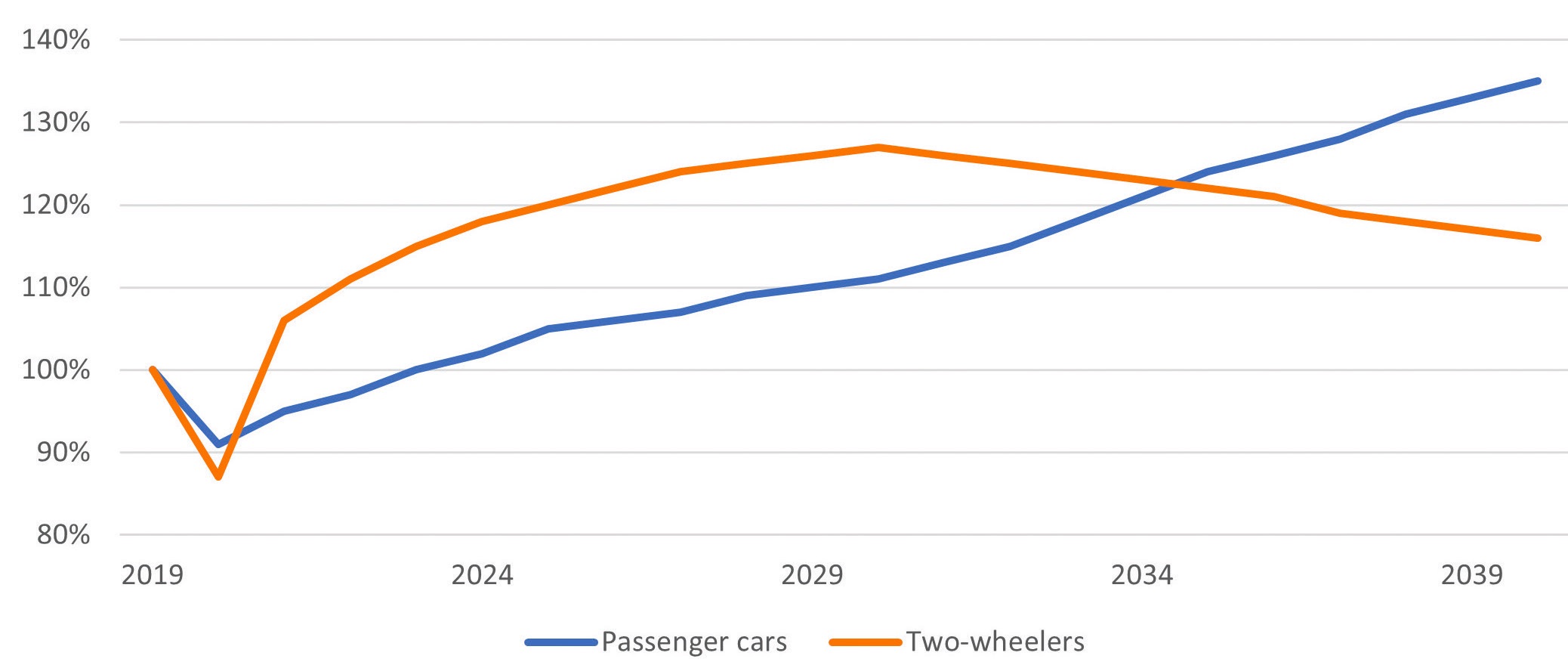

Figure 6. Engine oil demand forecast as a reference to demand in 2019 by vehicle type.

Figure 6. Engine oil demand forecast as a reference to demand in 2019 by vehicle type.

With the EV revolution, demand for lubricants, especially engine oils, is unlikely to grow at a similar rate as the vehicle parc (see Figure 6). Widening oil-drain intervals also will negatively affect growth of lubricant demand. Two-wheeler engine oil is likely to be impacted more than passenger car motor oil. In the commercial automotive segment, a significant impact on lubricants used in the three-wheeler segment is likely, followed by light commercial vehicles. The penetration of medium- and heavy-duty EV commercial vehicles is unlikely to have a severe impact on lubricant demand.

Hareesh Nalam is Project Manager (Energy) for Kline & Company. You can reach him at Hareesh.Nalam@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.