Executive Summary

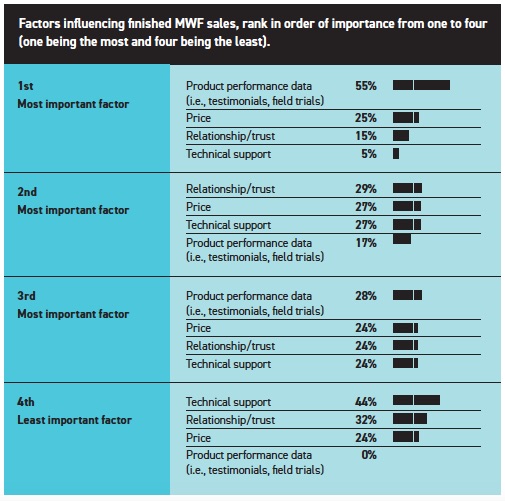

The metalworking fluids industry is continuously evolving to meet the demand for growing and changing applications. Readers predict a wide range of growth opportunities, particularly in the aerospace and automotive industries. Environmental concerns also play a key role as regulations push for more efficient, biobased and environmentally friendly products. Most readers agree that performance remains the most important factor in metalworking fluid sales.

Q.1 What industries provide the greatest opportunity for growth (five- to 10-year outlook) in finished metalworking fluid (MWF) sales?

Automotive, aerospace.

Aerospace, automotive, appliances.

Semisynthetic water soluble MWFs for machining aluminum.

Forming fluids.

Original equipment manufacturer (OEM).

Aerospace and medical.

It seems the same industries that have been prominent in recent history. Automotive, aerospace and appliances are all unique in their ever-increasing demands. Each of these have been bringing in new alloys and processes and have required formulation reviews and responses to specific applications. Process improvement is an ever-demanding challenge.

New generation infrastructure engineering.

Improvement in water-based products.

Machining, founding.

Aluminum processing.

Gas transportation companies.

Machinery, metal fabrication.

Automotive.

Aerospace industries and medical device manufacturers.

General machining.

Aerospace. Wind turbine components, gas turbines, turbocharger machinery.

Automotive, construction.

Automotive continues to be the big driver for MWF.

Transport industry.

Lubricants, nanolubricants industries.

Automotive sector.

Processing of steel and aluminum probably will still offer an opportunity for growth. The development of new lighter metal alloys to be used in the automobile industry might be a new opportunity to be considered in the next years.

Electric vehicle manufacture.

Metal fabrication, transportation equipment, machinery.

Industrial.

This will be more diverging per continent, but automotive will be No. 1 for the next 10 years.

All types of manufacturing seem to be growing quickly at the moment due to pandemic-related pent-up demand. Long-term though, anything related to green energy and energy efficiency seem likely to be the best markets for growth for MWFs. Battery manufacturing probably is the single biggest growth market, if I had to pick just one.

In light of certain issues (trade tariffs, COVID-19, etc.), how has your company’s strategy on raw material supply changed?

We are reducing the number of suppliers

8%

It’s about the same

38%

We are bringing on more secondary suppliers

38%

We now entertain multiple (more than two) suppliers for the same product

16%

Based on responses sent to 15,000 TLT readers.

Screw machine and wire drawing.

HVAC technologies, compressors, turbines, etc.

Transportation.

Automotive, renewable energies.

Q.2 How will increasing environmental concerns change the way MWF manufacturers formulate their products?

Continue to find effective substitutes for chlorinated paraffins and other items on global watch lists.

The increased use of green chemistry additives. Plant or animal based/derived.

Products will be formulated to leave much less of an environmental footprint behind.

Not much it seems. Many users are still somewhat reluctant to pay more for a finished fluid containing more sustainable ingredients unless the regulations compel them.

More restrictions on ingredients.

Unfortunately, this is very unpredictable. In the early 2010s, chlorinated lubricants were under attack. Government regulators’ activities will dictate how finished fluid formulators change (or not) their formulas to comply with new regulations.

Cleaning and consideration for successive manufacturing processes, recycling and longevity of service are going to become more critical. As the availability of common items like base oils and petrochemicals will be a challenge in the future, as the recent disruptions in the spring have revealed, one can only expect MWF costs to increase significantly. Past reluctance to consider renewable sourced products may give way now that anticipated costs for conventional base oil and additive chemistries will increase. End-users will probably place more emphasis on filtration, recovery and continued use where possible, maximizing return on an investment in MWFs.

Everything associated with the Green New Deal will be more complicated and more expensive with questionable net value.

Less effective raw materials, costly raw materials, unknown human side effect of the new raw materials in the long run.

Increasing the share of bioderived ingredients in base liquids.

A big change.

Friendly and responsible with the environment.

Use more biobased oils, such as soybean oil.

It will become more stringent, and manufacturers will have to comply with regulations—but as regulations change, so do additives and new advancements in technology.

They will need to reformulate based on the current additives that are proposed to be banned.

Driven to vegetable-based fluids.

Less available biocides.

Lower vapor pressure, “natural” products.

They will probably have to make MWFs more environmentally friendly, which could cause them to be more expensive and of a lesser quality.

More green materials will be required.

China has an increasing concern about environmental impact—and especially looking at phosphorus contaminating the big lakes from waste disposal of MWFs. However, still no uniform regulations. Local governments are taking a precautionary approach now without much understanding about the topic.

MWFs should be formulated more to an environmental regulation compliance.

By taking into consideration the environmental conditions.

Based on responses sent to 15,000 TLT readers.

Based on responses sent to 15,000 TLT readers.

Just to give concentration on certain environmental concerning factors, such as toxicity and inflammation.

The technology is there; it just costs a lot more but not as much as the cost of repairing the environment.

It will become more challenging for the industry professionals to formulate MWFs as we move toward environmentally friendly products while still keeping performance. Not only are the environmental concerns changing the fluids but also worker-related health issues. Water miscible coolants will keep their share on the market, but the issue is the use of biocides, which are a main concern regarding carcinogenic properties. We also probably will see the increase of environmentally friendly oils (ester based) with high biodegradability or oils, such as high quality that impose almost no risk to the environment. And last but not least, the increased use of fluids with reduced concerns for human health.

Formulations will have to change away from mineral base oils toward renewable base fluids.

Requiring their suppliers to provide sustainable raw materials to produce eco-friendly and environmentally safe MWFs.

Regulations will only become more stringent.

Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) in Europe limits import of new additives/products, and this will extend with exclusion of elements—especially for emulsions and the additives for antibacterial properties.

I think metalworking formulators will have to become more cognizant of how their formulas are processed for wastewater treatment. I do not foresee major formulary changes on the horizon, though. Issues such as chlorinated paraffins and phosphorus restrictions do not seem to be pressing issues at the moment, though that can always change.

Continuing search for non-chlorinated and non-staining high-performance additives.

The search for biodegradable and less harmful products (raw materials, bases).

Liquids need to be more degradable so as to limit waste and, therefore, cleanup.

It will be a continuing effort.