KEY CONCEPTS

•

Market innovation has arrived for those involved in auto lubrication and tribology.

•

The need for some fluids will change but might not diminish overall as electric vehicles continue gaining market share.

•

Organizations with an innovation mindset are most likely to thrive.

It is no longer a matter of preparing for market innovation in lubricant and tribology-related fields. It’s already here—mainly due to the accelerated transition from internal combustion engines to electric.

Jeff Hemphill, CTO, Schaeffler Group USA Inc., says, “The main thing for people in any field is to watch the trends and spend time thinking about how they could impact your product. For example, electric vehicles are gaining momentum. On an absolute basis, they need a lower quantity of lubricants and additives. But where does the energy get used in an electric vehicle versus a conventional one? Is lubrication more or less important overall? What points of friction exist, and could unconventional approaches work better than simply adopting the equivalent from the conventional vehicle?”

Hemphill, the keynote speaker at STLE’s 2019 Annual Meeting & Exhibition in Nashville, urges colleagues to think about their work as more than just providing a product. Instead of saying “we provide lubricants,” tribologists should re-cast their role as “motion facilitators” who think about where motion is happening in the changing landscape and where they could offer value.

The EV market

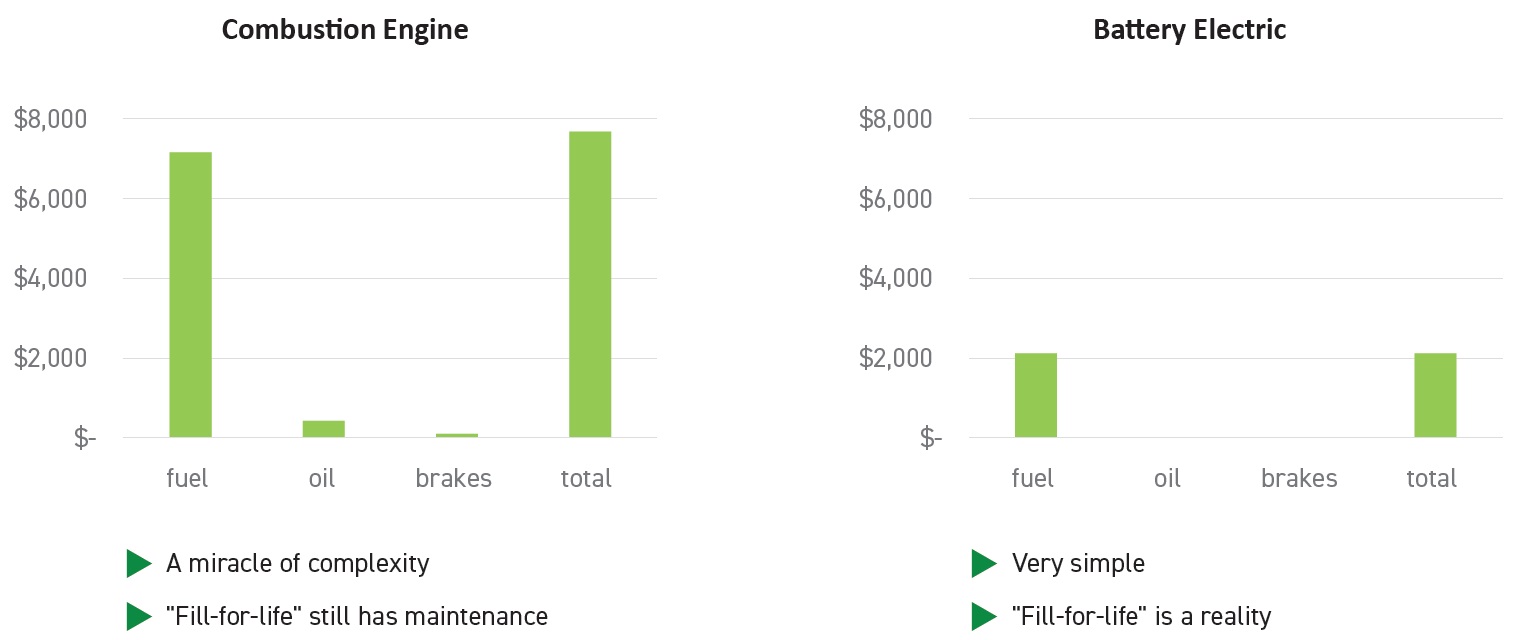

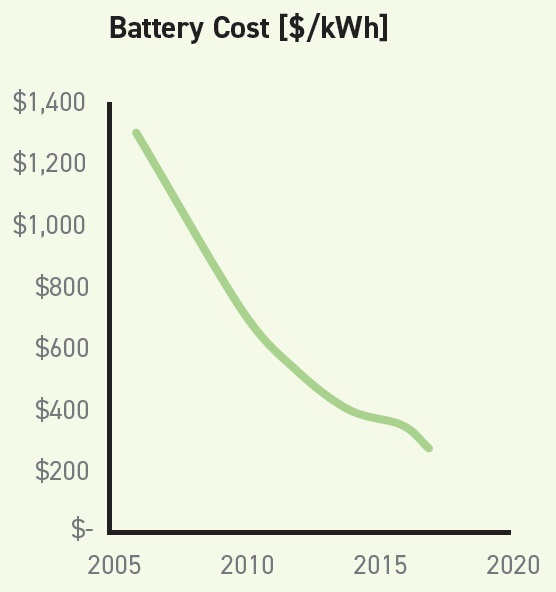

The market for electric vehicles is approaching a tipping point for reasons that center mostly on the battery: longer time between charges, faster charging technology and lower cost of original and replacement batteries (

see charts).

STLE Fellow John Burke, CMFS, and global director of engineering services, Quaker Houghton, says there are five basic market drivers:

1.

The increased distance a battery electric vehicle (BEV) can travel between recharging—allowing for a practical ride option for daily commuters.

2.

Energy cost per mile is now less for the electric car.

3.

The perception of less maintenance.

4.

Near zero onboard emissions.

5.

The cost for electric vehicles has come down, making it affordable for a larger market.

“Investments in information campaigns and general education of the consumers are driving adoption,” Burke says. “The more people learn about electric cars, the more comfortable they become. Also, variety is increasing. There are more options/brands, etc., participating and providing more choices. You can now get an electric SUV and soon will be able to get a pickup truck, whereas before options were limited to small cars.”

EVs, fluids and tribology

“The fluids also have some new jobs to do,” Hemphill says. “For example, automatic transmission fluid today has to facilitate controlled friction in the wet clutch packs, remove the heat from the clutches and do both for more than 100,000 miles. In an electric axle gearbox, the heat might need to be removed from the electric motor, and there are likely no clutch packs. This might make viscosity and specific heat more important than friction modification.”

So which fluids will have diminished needs in an electric vehicle?

Burke says four fluids come to mind: antifreeze, motor oil, automatic transmission fluid and rear differential gear oil. He explains, “These affected fluids will not be needed except for a possible small amount of heat transfer fluid for the battery pack and electric motor. Also, with electric vehicle regenerative braking, the strain on the brake fluid will be less (admittedly, this is a small volume for each vehicle). Overall the fluid volume in the electric car for lubricants will decline.”

Regarding metalworking fluids for production, Burke says the need for those, too, will decrease. Electric cars do not need radiators, exhaust pipes, catalytic converters, engine blocks, pistons, camshafts, connecting rods, crankshafts, drive shafts, transmissions and associated gear sets, clutches and associated components and rear differentials (assuming an electric motor is used at each drive wheel).

“Therefore, there will be a reduction in stamping/forming fluids, straight cutting oils, water-dilutable cutting fluids, heat treat quenchants, in-process and interim corrosion preventive fluids and cleaning fluids to make these components,” he says. “The burden to dispose of such fluids also will decline.”

STLE Past President Dr. Ali Erdemir, Argonne Distinguished Fellow, Argonne National Laboratory Applied Materials Division, agrees, “There are fewer moving components in an electric vehicle, and, hence, the diversity or type of lubricants also is fewer: gear oils, greases, etc. These might differ from those used in internal combustion engines mainly because of the differences in contact load, speed and heat, which may require better antiwear, anti-scuff capabilities.”

STLE Past President Dr. Edward P. Becker, P.E., president and founder of Friction & Wear Solutions, LLC, adds, “An electric vehicle has no combustion process to deal with, so there is no engine oil in the conventional sense; this is the biggest change. However, electric vehicles are still using many of the same lubricants. For example, greases for wheel bearings, suspension components and body closures are essentially unchanged. To date, all electric vehicles are using conventional transmission fluids to lubricate the motor and gears. A new lubricant optimized for the high loads at low speeds will be required for future electric vehicles.”

One major difference, according to Hemphill, is that with electric vehicles, friction losses are a bigger percentage of the on-board energy of the vehicle than in a conventional car—making drag reduction even more important.

“The electric car can accelerate faster than a conventional internal combustion engine, therefore there may be more stress on the lubricant within these components,” Burke says. “Although not a lubricant issue, tire wear is expected to increase due to increased acceleration ability of the electric car (

see Figure 1).”

Figure 1. Tires wear out faster on electric vehicles due to their increased acceleration ability.

EV issues

Figure 1. Tires wear out faster on electric vehicles due to their increased acceleration ability.

EV issues

The permanent magnet motor currently offers the highest output for a given size and is the preferred design for automotive motors, Becker says. “The best permanent magnets are currently made from some combination of rare earth elements (neodymium, dysprosium and terbium) with iron and boron. These rare earth elements are primarily supplied by China, and the price is subject to great uncertainty. The induction motor, while heavier, is mainly made of iron and copper and is therefore less expensive. Both types of motors are currently in use in electric automobiles.”

Hemphill points to new issues arising due to the high speed in electric axle gearboxes—for example, bearing creep where the outer race rotates in the housing. This may need surface coatings or tribological solutions. Another new challenge is the presence of high voltages in the gearbox. Due to power switching, which is used to control electric motors, static charges build up and sometimes discharge through the bearings or gears. “In this case, the lubricant becomes the dielectric in a capacitor. A variety of solutions are being explored which may involve insulation, lubricant modification or shunts.”

Becker advises that electric motors themselves are extremely reliable and seldom experience wear-related failures. However, the reduction gears used in electric vehicles to date are subject to very high loads at low speed, much higher than gears in conventional transmissions; thus, these gear loads are the most likely cause of failure in an electric vehicle.

Hemphill points out that the trend toward ride-sharing creates another issue. “Durability is even more important,” he says. “As shared mobility concepts enter the market, vehicles will be used up to 50% or 60% of the time, as opposed to today’s 4% or 5%. Durability is a key part of making the shared mobility ecosystem work.”

Autonomous vehicles and tribology

Now that electric vehicles are becoming more mainstream, the next challenge is the design of autonomous vehicles. Schaeffler Group’s Schaeffler Mover robo-taxi has four 90-degree steerable wheels, each with a planetary gearbox. The vehicle goes from one gearbox to eight—creating a significant demand for lubrication.

In addition, the company has recently formed a joint venture with Paravan, which makes drive-by-wire systems (originally to allow handicapped people to drive). “This solution was quickly adopted by several automotive and industrial OEMs as they created autonomous vehicles because it offers ‘fail functional’ reliability in both electro-mechanical and electrical components,” Hemphill explains. “We are now developing a high-volume version of this that we call SpaceDrive III. This will include actuators and also our own custom eMotors. Since these motors are built into the gearbox, they have the same tribological challenges as electric axles.”

Although Erdemir doesn’t have much involvement with autonomous vehicles, he postulates that quick responses to stop/start commands, noise/vibration control (use of good/better lubricants) and temperature extremes might present challenges (

see The Forecast for Autonomous Vehicles).

The forecast for autonomous vehicles

Levels of automation are classified in the following way:

•

L0: Driver (all responsibility to the individual)

•

L1: Feet off (transfer of responsibility)

•

L2: Hands off (transfer of responsibility)

•

L3: Eyes off (transfer of responsibility)

•

L4: Attention off (transfer of responsibility)

•

L5: Passenger (all responsibility to the machine).

According to Frost & Sullivan’s 2018 Global Autonomous Driving Outlook (

1), the five top trends to watch are:

1.

Rise of virtual voice assistants. The widespread introduction of voice-assisted technology in vehicles, most of which would not require a consistent internet connection.

2.

Centralized domain architectures. The introduction of centralized architectures that enable true L3 and L4 autonomous driving.

3.

Improved vision and depth-sensing solutions. The advent of vision sensors including 4D cameras, far IR sensors, 360-degree radars and trifocal cameras for better object detection and classification.

4.

Shared mobility platforms. OEMs realize the introduction of Level 4 tech is most certainly going to be a ride-hailing service, prompting them to collaborate with or acquire start-ups with fleet management software and cybersecurity capabilities.

5.

Artificial intelligence powering development, testing and validation. With increasing amounts of data being captured and processed and with better learning capabilities, AI in cars should grow exponentially.

Following is the rate of adoption major OEMs plan for autonomous vehicles.

•

Volkswagen: L2 autonomous vehicles by 2019

•

Mazda: Autonomous driving technology on Mazda vehicles by 2025

•

Hyundai: L4 autonomous vehicles by 2021-2022

•

Nissan: L2 autonomous vehicles by 2019

•

Renault: L4 autonomous vehicles by 2022

•

Porsche: Optional autonomous drive mode operational on driver’s demand.

The report explained that mass-market-vehicle OEMs lean toward improving and increasing active safety and driver assistance features more than introducing any form of autonomous driving features in their existing models.

Sustainability and reliability

There’s no doubt there is going to be a permanent shift toward renewable sources of energy to support the electricity needs of these new vehicles, but that comes with its own issues.

“There will be a strain on electrical generating capacity and the electric grid,” Burke predicts. “The grid will be strained on both a macro and micro scale. The energy source to make electricity in power plants will have to increase. That will be from sources such as nuclear, coal, natural gas, wind, solar or even oil. Is there enough electric-generating capacity to make a conversion from oil (as used to make gasoline and diesel fuel) to these other electric energy sources?”

He continues, “Right now, in certain cities, the macro grid is strained on very hot summer days. It will only get worse as the number of electric cars on the road increases. The micro grid (your neighborhood and home) also will be strained. Imagine if in a neighborhood of 50 homes all having electric cars and all are charging at 6 p.m. Local electrical transformers might not have the capacity to handle that surge. For rapid charging, some homes may need an upgrade from traditional 60-100 AMP panels to 200-AMP panels, plus larger wires from the utility source into the house.”

Experts predict a permanent shift toward renewable energy sources to compensate for the increased strain on the electric grid.

Experts predict a permanent shift toward renewable energy sources to compensate for the increased strain on the electric grid.

Hemphill envisions a protracted transition. “We face a long change process toward pure renewables, and the variety of energy sources is likely to increase,” he says. “For example, natural gas emits less CO

2 than coal but is not CO

2 neutral. Therefore, the falling costs of wind and solar energy will allow them to play a larger role in the future. As more of the grid becomes renewable, grid energy storage will be needed for reliability. This is a great area for engineers to focus on. Our own company has invested in CMBlu, a start-up using natural lignin in large-scale batteries. Eventually we will establish a mix that works for the different conditions in the different regions of the world.”

One of the most environmentally friendly and sustainable source of electricity is solar. However, no one source will be able to meet all future requirements, and a balance of all these and more will be necessary to manage the ever-increasing demand, Becker predicts. “Fuel oil and natural gas are probably the best sources for peak load management, as they can be brought online and offline fairly quickly. Coal has likely peaked and will see a decreasing share of electricity production over a period of decades. Hydropower also is a mature form and will contribute a major share, but sites for new dams are relatively few. Wind turbines will increase for the foreseeable future. Nuclear power will probably remain near current levels, as high-profile incidents have effectively dampened public support for new projects.”

Erdemir also thinks solar will grow but likes wind as a long-range option. “Wind turbines can be considered nearly mature segments of the energy sector,” he says. But he cautions, “Classic or traditional problems with micropitting, white-etching cracks in bearings and gear teeth remain as major challenges, and these are still mostly materials related.”

Becker thinks longer lubricant life requiring fewer changes will improve the adoption of wind turbine energy. “Longer maintenance intervals will be the primary enabler of wind turbines. In particular, offshore turbines are extremely expensive to service, so long lubricant life, probably seven to 10 years between changes, will be required.”

In addition to alternative energy markets, other industries will benefit from electric vehicles as well. “As BEV and other electric car volumes increase, there will be an increase in the demand for electric conducting wire,” Burke says. “That increase will be for the macro and micro grid distribution wiring and the wires in the vehicle itself. The electric wire industry will benefit, however there could be a strain on their ability to produce, as demand for conducting wire increases.”

Innovation imperative

The experts who contributed to this article agree that companies today need to innovate to thrive.

“History shows many examples of companies that fail to take changes in their market seriously,” Hemphill says. “This is not usually caused by a lack of awareness of the coming change but an underestimation of how well the new technology could work.”

He cites Kodak and its failure to take the rate of change into account as an example. “They were far ahead of their competitors in digital photography but eventually abandoned the effort because it was always too slow and expensive. They failed to account for Moore’s Law, which showed that in a few years digital would be orders of magnitude cheaper. Therefore, one has to watch not only new technology but the rate of change of that technology.”

Hemphill continues, “Most companies concentrate on ideation and brainstorming, but a lack of ideas is rarely the problem. Quickly reducing them to practice and keeping them aligned with customer needs is the bigger challenge. In this respect, at Schaeffler we are finding some practices from Agile Software Development to be useful; basically, they work in manageable chunks, get feedback from your customers at each step and then adjust from the feedback and take the next step (

see The Agile Software Strategy). Our company exists because of innovation, so it is deep in our DNA. However, with such a broad product portfolio, we are always moving our innovation focus to follow our customer and market needs.”

The Agile software strategy

Agile software development is a broad term for a set of frameworks and practices based on the values and principles expressed in the Manifesto for Agile Software Development (

2) and the following 12 principles behind it (

3).

1.

Our highest priority is to satisfy the customer through early and continuous delivery of valuable product.

2.

Welcome changing requirements, even late in development. Agile processes harness change for the customer’s competitive advantage.

3.

Deliver working products frequently, from a couple of weeks to a couple of months, with a preference to the shorter timescale.

4.

Business people and developers must work together daily throughout the project.

5.

Build projects around motivated individuals. Give them the environment and support they need, and trust them to get the job done.

6.

The most efficient and effective method of conveying information to and within a development team is face-to-face conversation.

7.

Working product is the primary measure of progress.

8.

Agile processes promote sustainable development. The sponsors, developers, and users should be able to maintain a constant pace indefinitely.

9.

Continuous attention to technical excellence and good design enhances agility.

10.

Simplicity—the art of maximizing the amount of work not done—is essential.

11.

The best architectures, requirements, and designs emerge from self-organizing teams.

12.

At regular intervals, the team reflects on how to become more effective, then tunes and adjusts its behavior accordingly.

Becker believes that both first-to-market and wait-and-see attitudes can be successful. “There is room for both approaches,” he says. “First to market gets headlines; fast followers often get the most profit. My organization’s attitude toward innovation is mainly wait and see.”

Erdemir concludes, “An innovative mindset is extremely important. It is what drives progress, productivity and reliability. Tribology will remain relevant/important regardless of an increase in electric vehicles on the road; since these too rely on many moving parts (bearings, gears, etc.) for reliable and efficient functioning.”

REFERENCES

1.

From 2018

Frost & Sullivan – “Global Autonomous Driving Outlook.” Available

here.

2.

From

Agile 101, “What is Agile?” by the Agile Alliance. Available

here and 12 Principals available

here.

3.

Note: the word “product” is substituted for “software” in the original where it occurs.

Jeanna Van Rensselar heads her own communications/public relations firm, Smart PR Communications in Naperville, Ill. You can reach her at jeanna@smartprcomunications.com.